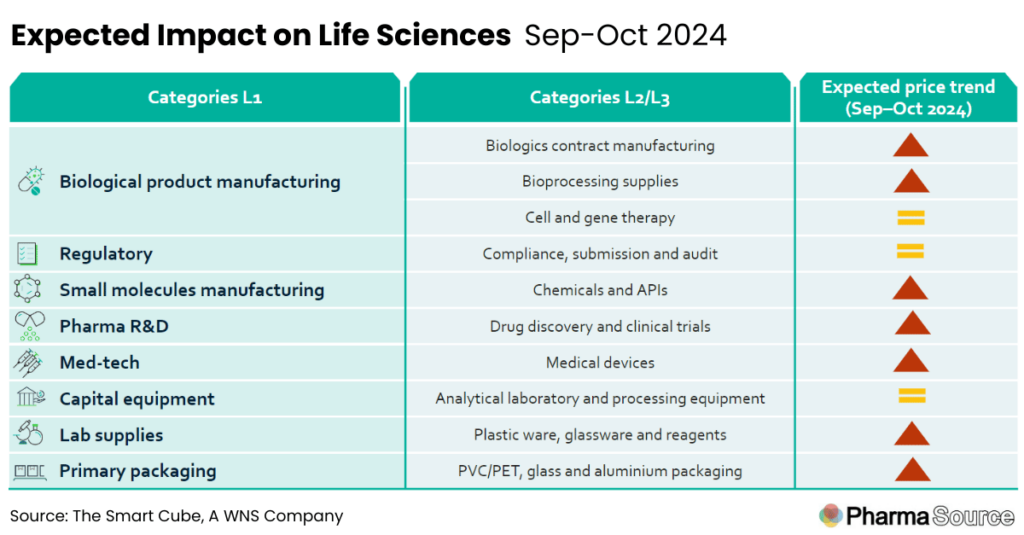

This report summarises key supply chain events and their expected impact on life science prices over the period September-October 2024.

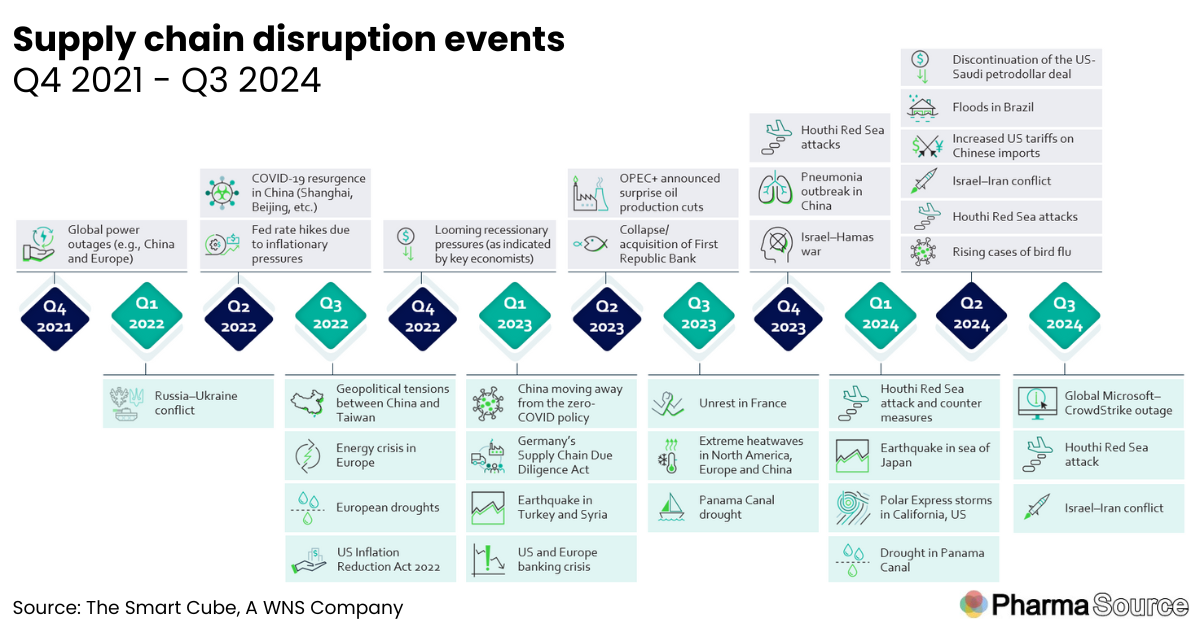

Existing geopolitical tensions and fluctuating commodity stocks are expected to drive global market volatility and supply chain disruptions

- The global API market is experiencing a surge in prices, largely due increased freight rates, driven by the ongoing geopolitical issues in the Middle East.

- The aftermath of Hurricane Francine in the US and Storm Boris in Europe may temporarily increase the cost of crude oil and downstream materials, such as polyethylene (PE), polyvinyl chloride (PVC), high-density polyethylene (HDPE) and polypropylene (PP), which are essential for manufacturing single-use supplies, medical devices and lab supplies.

- Advancement of the BIOSECURE Act to the US Senate has created uncertainty regarding the future of China-based CDMOs and medical device manufacturers in the United States.

Contract Development & Manufacturing

- The global biologics contract manufacturing (biopharma CMO) market is expected to record a CAGR of 9% over 2024–2033, prompting increasing cost of services, driven by rising demand and the scaling of operations.

- Pharma CDMOs are concentrating on increasing their capacity to broaden their service offerings and keep up with rising demand; pharma companies are also entering the CDMO space to fill demand

- In September 2024, Celtrion, South Korea’s largest biosimilars company, announced that it’ll venture into the CDMO space through the establishment of a wholly owned subsidiary in charge of the CDMO business.

- Also, in September 2024, Lonza, a Switzerland-based CDMO, completed the expansion of its mid-scale microbial manufacturing facility at Visp, Switzerland; the site also received a GMP license following a successful audit by Swissmedic.

- As of 9 September 2024, the BIOSECURE Act was passed in the US House of Representatives by a bipartisan vote of 306–81 in favour of the bill.

- The bill, which was introduced in January 2024, aims to restrict US companies and federal agencies from contracting with biotechnology firms associated with certain foreign adversaries (notably China) over alleged concerns of national security.

- As of September 2024, the bill mentions 5 Chinese life sciences companies – WuXi AppTec, WuXi Biologics, BGI Group, MGI and Complete Genomics.

- If passed through the US Senate, the bill will become a legislation and impact the pharma and life sciences industry directly.

- Since, Chinese CDMOs and other raw material manufacturers are a key source of relatively cheap contract manufacturing, the BIOSECURE Act holds the potential to increase the overall cost of biologics contract manufacturing in the US, while potentially boosting the pharma contract manufacturing industry in other low-cost countries, such as India, which is forecast to double in size over the next five years.

Bioprocessing supplies

- The single-use system (SUS) market is expected to witness a slight uptick in prices due to anticipated fluctuation in feedstock prices and a steady demand; the cost is heavily dependent on the price of crude oil

- In August 2024, high-density polyethylene (HDPE) prices in the US remained constant at $ 0.6/lb M-o-M as compared to July 2024, while in Europe, the prices increased 1.8% M-o-M to $1,861.8 /ton.

- Prices in both the US and Europe are expected to increase in September 2024, driven by Hurricane Francine in the US and the floods in central Europe caused by Storm Boris.

- Hurricane Francine hit the Northern Gulf Coast of the US in mid-September 2024, causing severe flooding and power outages in the region.

- The hurricane forced ~12% of crude oil production and ~16% of natural gas output in the US Gulf of Mexico to go offline; it further caused offshore oil and gas producers to lose 2.4 million barrels of oil and 4.9 billion cubic feet of gas.

- The cost of crude oil, downstream HDPE and other petrochemical products in the US are expected to rise significantly in the short term as a direct result to this phenomenon

- In September 2024, Storm Boris caused severe flooding on Austria, the Czech Republic, Poland and Hungary, causing businesses and factories to shut down temporarily.

- Key chemical manufacturers in Ostrava, such as BorsodChem, are forced to stop production temporarily.

- The relief efforts are expected to drive demand for petrochemical products, such as HDPE and LDPE, creating a temporary rise in prices

- Ongoing escalations in Middle East are causing disruption to the bioprocessing supplies’ supply chain.

- The ongoing Israel–Iran conflict has caused temporary disruptions in the supply of crude oil and materials such as polyethylene (PE), polyvinyl chloride (PVC) and polypropylene (PP), which are essential for manufacturing single-use supplies in biological product and medical supply production.

Cell and gene therapy (CGT)

- The CGT market experienced hindered growth in Q2 2024 despite experiencing considerable expansion in recent years.

- A total of 100 CGT deals were done in Q2 2024, witnessing a 20% Q-o-Q and 15% Y-o-Y decrease.

- The number of financings in the CGT space also declined 39% Q-o-Q to 52 transactions in Q2 2024.

- Q2 2024 also did not see any new gene therapy or cell therapy approvals.

- Despite a relatively slow pace in Q2 2024, 2024 is poised to be a pivotal year for CGTs, with atleast 7 CGT products expected to receive approval in 2024; 3 CGT products were approved in Q1 2024

- A consistent demand for CGT outsourcing is prompting suppliers to expand their capacity and capabilities through partnerships and capacity expansion projects.

- In September 2024, Cellular Origins, a UK-based cell therapy automation manufacturing solution, partnered with 3P, a UK-based fill–finish equipment manufacturer, to advance cell and gene therapy (CGT) manufacturing.

- In August 2024, AGC Biologics, a US-based biotech company, completed the expansion of a 2,500 sq. m facility at its Milan Cell and Gene Therapy Center of Excellence production site.

Regulatory compliance, submission and audit

- Global pharma companies, especially the companies located in low-cost countries, might need to dedicate additional resources to meet the strict regulatory standards set by international authorities, especially by the US FDA; this increased regulatory scrutiny could lead to higher compliance costs, potentially affecting their pricing strategies.

- In August 2024, Dr Reddy’s Laboratories, an India-based pharma company, recalled 13,752 bottles of Eszopiclone tablets; the affected lot was produced at Dr Reddy’s Bachupally plant in Telangana.

- In July 2024, Alembic, an India-based pharma company, recalled 82,400 bottles of the bacterial eye infection treatment tobramycin, while Aurobindo, another India-based pharma company, recalled a total of 96 bottles of rufinamide tablets for treating seizure disorders.

Small Molecule manufacturing – Chemicals and APIs

- The global API manufacturing sector is anticipated to register a CAGR of 5.8% between 2024 and 2033, owing to the increasing prevalence of chronic diseases and the escalating need for pharma outsourcing.

- In July 2024, the US government agencies, including the Commerce Department’s Bureau of Industry and Security (BIS), announced that they are conducting a comprehensive assessment of the US API industrial base to gain an understanding of the supply chain network.

- The resulting information will allow the federal government to accurately plan and develop funding strategies to help ensure the availability and security of the API supply chain.

- The global API prices are experiencing hikes, largely due to the following reasons:

- Increased freight prices driven by supply chain disruptions in the Red Sea coupled with multiple port congestions have created a bottleneck situation.

- This has led to significant increase in freight rates from APAC to the US and Europe (since January 2024) due to which API prices have increased multiple folds

- The cost of chemicals are also expected to increase in Q4 2024 as an aftermath of Hurricane Francine in the US and the floods in central Europe caused by Storm Boris.

- Hurricane Francine caused the US offshore oil and gas producers to lose 2.4 million barrels of oil and 4.9 billion cubic feet of gas.

- The loss is expected to increase the cost of crude oil and various downstream chemicals used in the pharma industry.

- The passing of the BIOSECURE Act in the House of Representatives intensifies the future uncertainty of Chinese chemical and API manufacturers in the US, increasing the overall cost.

Drug discovery and clinical trials

- Wages account for >40% of the total cost involved in discovery and clinical research; due to the ongoing shortage of qualified and experienced researchers, the operational costs will be high.

- The inflation rate witnessed slight slowdown in August 2024, providing temporary cost reduction

- The inflation rate in the US decreased to 2.5% in August 2024 from 2.9% in July 2024

- Euro area annual inflation is expected to be 2.2% in August 2024, down from 2.6% in July 2024.

Medical Devices

- In the past few months, the EU and US governments have tightened due diligence on China-based products, impacting medical device production and potentially increasing costs.

- The US FDA has issued import bans on 4 Chinese manufacturers – Jiangsu Shenli Medical Production, Jiangsu Caina Medical, Zhejiang Longde Pharmaceutical and Shanghai Kindly Enterprise Development Group – due to quality concerns.

- In July 2024, the USFDA sent 2 more warning letters to Jiangsu Shenli Medical and Jiangsu Caina related to plastic syringes made in China after the inspection of manufacturing facilities in China.

- The advance of the BIOSECURE Act to the US Senate may cause further bans on other China-based medical device manufacturers.

- Several med-tech companies, including Philips and GE Healthcare, reported challenges in their Q2 2024 financial results, largely due to a slowdown in orders from China, influenced by the country’s anti-corruption efforts in the healthcare sector

- The cost of medical devices are also expected to increase as the price of HDPE, LDPE and other key materials used in medical devices are witnessing inflation.

- In August 2024, HDPE prices in the US remained constant at $ 0.6/lb M-o-M as compared to July 2024, while in Europe, the prices increased 1.8% M-o-M to $1,861.8 /ton.

- The medical device market is highly regulated, and regulations govern every aspect of design, production and distribution.

- Non-compliance leads to frequent product recalls to ensure patient safety, and the companies need to spend more time and resources to ensure compliance, which can increase the input cost.

Analytical laboratory and processing equipment

- The US PPI for analytical lab instrument manufacturing decreased marginally by 0.4%, while that of HVAC and commercial refrigeration equipment rose 1.4% M-o-M in August 2024.

- In analytical laboratories, skilled labour is required to operate sophisticated equipment such as chromatographs, spectrophotometers and mass spectrometers.

- According to the Q3 2024 ManpowerGroup Employment Outlook Survey, 77% of healthcare and life sciences employers reported difficulty in finding the skilled talent they need; this shortage may prompt companies to raise wages to attract skilled workers or invest in training programmes.

Lab supplies and services

- Up to 65% cost of manufacturing lab supplies is attributed to raw materials, which include HDPE, glass and polypropylene; Q3 2024 is expected to witness inflation of >2% within the category

- In August 2024, HDPE prices in the US remained constant at $ 0.6/lb M-o-M as compared to July 2024, while in Europe, the prices increased 1.8% M-o-M to $1,861.8 /ton.

- The prices in both the US and Europe are expected to increase in September 2024 driven by Hurricane Francine in the US and the floods in central Europe caused by Storm Boris.

- Further, the US PPI for chemicals and allied products (wholesale) increased 0.4% M-o-M in August 2024 and is expected to increase further in September 2024.

- The manufacturing cost of chemical reagents is experiencing high input costs due to the ongoing crisis in the Middle East affecting logistics routes through the Suez Canal, leading to extended delivery lead times and influencing prices in the US.

- According to Descartes’ Global Shipping Report (August 2024), the top 10 US ports experienced transit delays in the range of 3–8 days in July 2024 due to port congestions resulted by the Red Sea crisis.

- Additionally, the International Longshoremen Association (ILA) has called for an East coast-wide strike beginning 1 October, potentially impacting 55.5% of US container import volumes.

Primary packaging

- Blister packaging for pharma products typically involves raw materials, such as aluminium, PET and PVC, while HDPE is used for bulk drums.

- PVC suspension prices in the US remained unchanged M-o-M in August 2024 at $0.42/lb as compared to July 2024; PET prices in the US increased 1.5% M-o-M at $0.67/lb in August 2024 while the same in Europe (Italy) remained unchanged at $12,893.6/tonne in August 2024

- Due to escalations in the Israel–Iran conflict, the increased price outlook for crude oil in H2 2024 are expected to have an upward impact on plastic packaging.

- The global aluminium prices decreased 1.4% M-o-M in August 2024 to $2,334.3 /tonne; however, prices are expected to rise during September–October on account of tight supply and rising demand from China’s automotive sector.

- Biologics and injectable drugs are typically packed in glass or plastic vials and ampoules

- The US PPI for flat glass manufacturing increased 1.3% in August 2024 as compared with July 2024, which may contribute to the potential price increase in the overall category.

This category update is powered by The Smart Cube, a WNS Company. For more procurement intelligence, visit Amplifi PRO

Stay ahead of trends and best practices

Stay ahead of trends and best practices