Pharma Supplier Network Optimisation Trends: New Research into External Manufacturing

Fuliginous Management Consulting regularly tracks the outsourcing activity of 320 pharma companies operating in Europe.

In this new research, Kyriakos Kansos reveals some of the key trends in external manufacturing and advises how companies can optimise their pharmaceutical manufacturing network.

38% of Pharma companies have no in-house manufacturing

From the sample of 320 pharma companies analysed by Fuliginous, more than 120 (38%) do not have own-manufacturing activity, focusing mainly on commercializing products.

The vast majority of these Commercial Pharma Companies (CPCs) market traditional technology products that face increased competition in the market. Not having manufacturing capabilities, CPCs rely exclusively on their External Manufacturing Network to have their products ready for sale.

Common models of External Manufacturing in CPCs

The products that CPCs market, come from three models: in-licensing, product acquisitions or own product development.

In-licensing seems to be preferred to the other two models since it allows:

- Fast market entry,

- Limited initial investment,

- Manageable risk for the first years of product commercialization.

However in-licensing lags behind the other two models in:

- Product Gross Profit (GP),

- Flexibility in future product changes

- Manufacturer selection

- Company’s valuation for the future.

For all three models, at the time of the deal/decision, the Gross Profit of the product supports the business case, and this is usually the case for a number of years. As time passes, product commercialization cost as well as product supply cost increase (supplier price increase requests, additional requirements from authorities etc.)

On the contrary prices stay flat or decrease resulting, after a period of time, to product Gross Profit shrinkage well below the product category market average. This is the time when stockholders question themselves:

“…do we work for our company’s benefit or just for the benefit of all other parts of the supply chain industry…?”

The drop in Gross Profit, at a point in time, raises question marks if it really makes financial sense to keep commercializing the product and also creates unpleasant thoughts about the survival of the company in the future. These concerns oblige CPCs to escape forward by introducing new products with better Gross Profit (than the existing ones) in order to keep an acceptable EBITDA for the company. This is a non-ending cycle since the new products Gross Profit will again shrink after a period of time. Obviously, this leads to an increasing tail of low or negative margin products, even if the CPC’s overall EBITDA could be satisfactory.

Unavoidably, the increase in the number of products of a CPCs leads to adding new suppliers in the list that subsequently increases complexity and administration cost. As supplier numbers grow, Risk Management becomes more and more an important parameter.

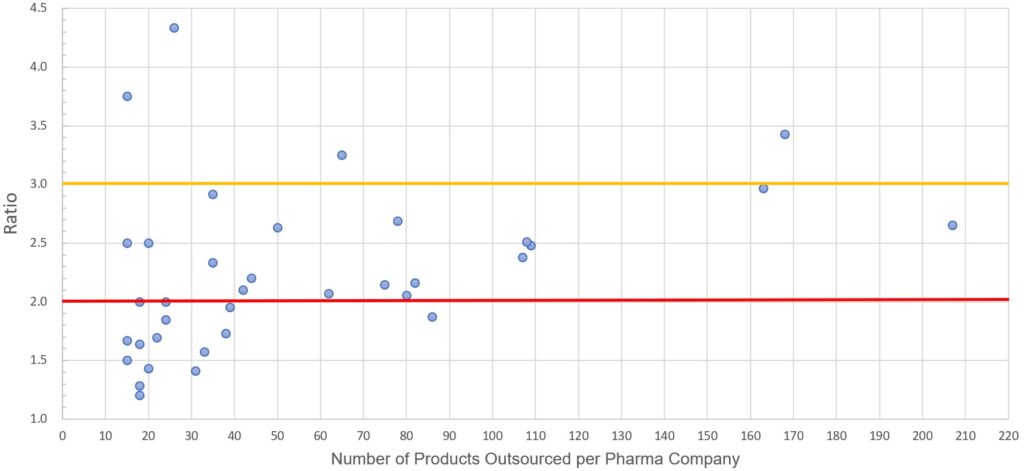

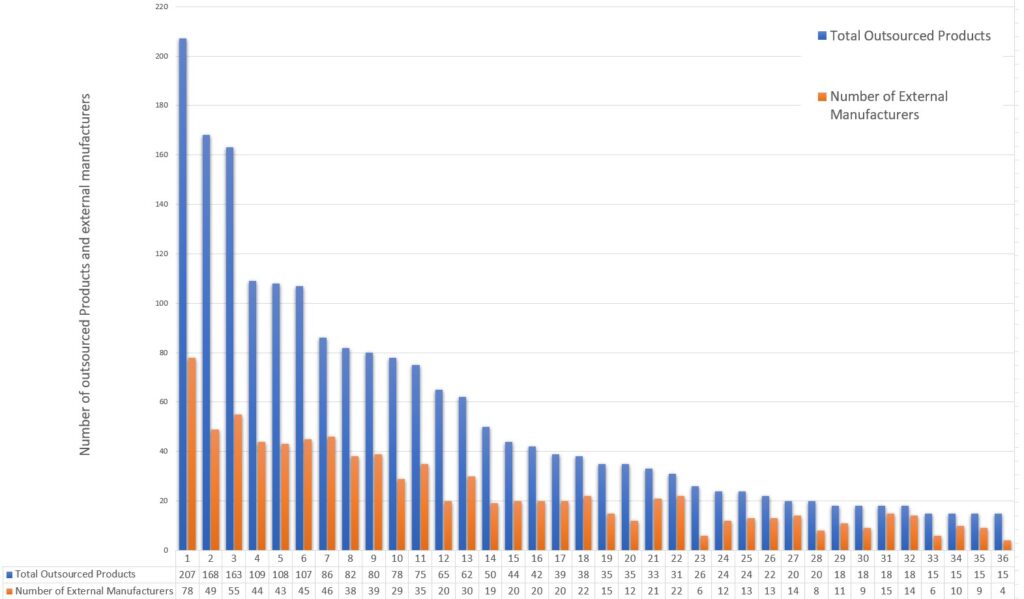

After examining more than 2,500 products of a relatively small sample of 36 CPCs, we concluded that

2.2 is the average ratio of products that CPCs allocate per manufacturer

Ratio of Products : Pharma Company

This means that a CPC with 100 products in its portfolio, uses 45 different external manufacturers for the production of its products. The higher the ratio, the lower the number is of external manufacturers that a CPC uses.

Outsourced products and External manufacturers per pharmaceutical company

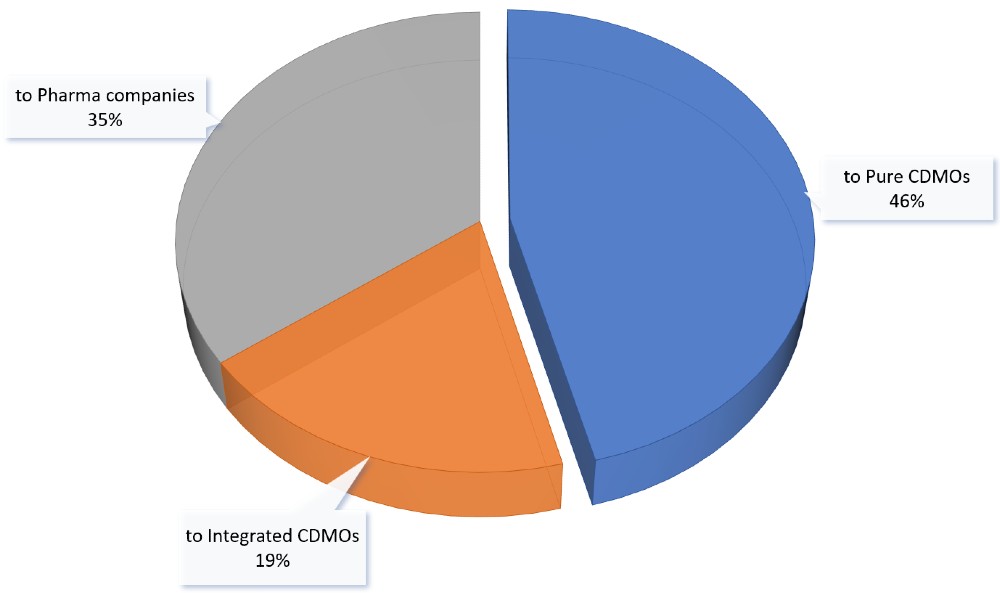

Types of outsourcing partner

- 46% to Pure CDMOs

- 19% to Integrated CDMOs

- 35% to Pharma Cos (due to in-licensing agreements)

In the sample of the CPCs and products examined, the allocation of the products follow the pattern below

Outsourced Product Allocation for Mid and Small-Sized Pharma Companies

What this means for Supplier Network Optimisation

There are three conclusions we can draw from this research:

- Diffusing a given business to a large number of suppliers deteriorates CPC’s weight per supplier. This may lead to limited attention from supplier’s side towards the CPC

- Having a big number of suppliers for products of the same product technology could make the loss of opportunity more intensive since potential synergies are also not obtained.

- Using suppliers for which contract manufacturing is not a core business may lead to limited flexibility, less competitiveness for the product and higher risk for being in a position to find a new home urgently at a point in time.

The External Manufacturing Network situation, as described above, seems to be mainly a result of the combination of three factors:

- All attention of the CPCs is given to increase the top line without really managing the cost

- In-licensing model is preferred

- No organized effort in optimizing existing suppliers network

Does this mean that CPCs should stop focusing on top line growth and on in-licensing? Definitely not! This should continue according to the company’s strategy. At the same time though network optimization should take place and an Outsourcing strategy must be established to support a sustainable growth.

Is External Manufacturing Network optimisation worth the effort and investment?

So, if there is important value to be gained in suppliers’ network evaluation and subsequent optimization, why such a project is not one of the top priorities in the CPCs?

The main reasons are:

- The potential benefit is not clear due to lack of benchmarking information (what market charges for such a product). A business case cannot easily be created based on cost / benefit analysis. This creates hesitation in occupying resources and initiate a project with unknown outcome.

- There are uncertainties related to potential product transfer difficulties that could not be foreseen from the beginning. This is true with old product files with vague process descriptions and for which a transfer process could trigger additional requirements by the authorities.

- Fear to spoil the relationship with current suppliers is involved. Good relationship with suppliers is of high importance and there is a fear that “difficult” discussions would harm the relationship especially if some other products remain with the suppliers.

- Contracts include obligations or clauses that limit CPC freedom to select supplier of choice. This is usually the case with in-licensed products.

- Supply portfolio risk evaluation is not performed and thus related risk is not realized.

Suppliers’ network evaluation and optimization program, addressing the uncertainties mentioned above, could deliver a number of important benefits:

- External manufacturing annual spend reduction indicatively, between 10% and 15%

- External manufacturing network risk management and risk mitigation

- Lower internal cost for efficiently managing suppliers

- Increase company’s weight on fewer preferred suppliers

The answer to the question in the title of the paragraph is YES if it is based on solid business cases that take into consideration real market assumptions.

How to optimise your network

The most decisive step is the thorough evaluation of products and suppliers.

- Understanding market pricing would allow focusing on specific products.

- Analysis of product category Gross Profit and comparison to market average would indicate areas of attention.

- Product restrictions due to contract clauses should be taken into consideration.

- Supplier evaluation based on criteria according to company’s strategy would define preferred or high-risk suppliers.

Combining the outcome of the above analysis, a number of product bundles would be identified as business cases either due to high price / low Gross Profit or because of high-risk suppliers.

Cost / benefit evaluation of the business cases, based on clear assumptions according to market standards, will rank them according to expected overall benefit and define the action plan and priorities going forward.

In the implementation phase, assumptions should be tested and, if necessary, modifications of the business case should be done before proceeding with the change implementation.

As companies grow it is inevitable that new products and suppliers will be added to the list. Having a clear outsourcing strategy and running a product and network review, within specified intervals, is the recipe for achieving and keeping a well-optimised External Manufacturing Network.