GLP-1 drugs have become a game-changer in treating obesity and type 2 diabetes, forecast to reach a $100 billion market value by 2030.

However, their rapid rise raises important questions about resource allocation in pharmaceutical development and manufacturing, as well as affecting the dynamics between patients, healthcare providers, and the pharmaceutical industry.

In the latest episode of the PharmaSource podcast, Ben Locwin, Chief Scientist at Black Diamond Networks, explains that GLP-1 drugs represent a significant breakthrough in the treatment of obesity and diabetes and the unintended consequences they are bringing to the industry.

The Science Behind GLP-1 Drugs

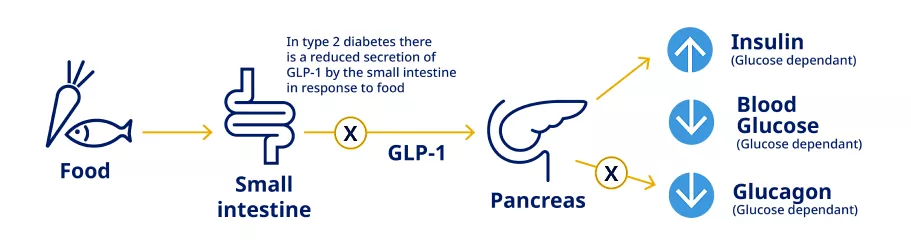

Glucagon-like peptide-1 (GLP-1) is a natural hormone that plays a role in influencing blood sugar control, digestion, and appetite in humans.

Ben explains, “GLP-1 drugs inhibit gastric emptying, acid secretion, and motility in the stomach, which collectively decrease appetite for the user. By decreasing gastric emptying, they also reduce post-meal glucose spikes, which is attractive for diabetes and weight management treatment.”

These drugs work differently from traditional weight loss medications:

- They modulate appetite and hunger suppression rather than stimulating the nervous system to increase calorie burn.

- They influence insulin and glucagon levels, providing better blood sugar control.

- The slower digestive process leads to feeling full longer and consuming fewer calories overall.

GLP-1 drugs have effects on insulin production as well as glucagon production.

“When you take a GLP-1, it’s influencing your insulin level and also down-regulating the amount of glucagon you have. This dual mechanism acts as a kind of safety switch, making it more difficult for blood sugar to drop too low or insulin to be too high.” says Ben.

The Rise to Prominence

Despite being discovered in the 1970s, GLP-1 drugs have only recently gained widespread attention. Ben attributes this to several factors:

- Proven effectiveness in clinical trials and real-world use

- Social media and press coverage showcasing dramatic weight loss stories

- Advances in drug delivery, including long-acting formulations and oral options

- Expanding indications beyond diabetes to include obesity treatment

“We’re in a situation where it’s the right molecule at the right time,” Ben notes. “For diabetes, having a very long-acting treatment to influence insulin levels is very favourable. For weight loss, it’s been enormously successful at producing significant results in patients.”

The history of GLP-1 drugs spans several decades. Ben explains, “In the late 1970s into the early 1980s, a researcher at Massachusetts General Hospital found an antibody for incretins that identified GLP-1s. By the mid-1980s, the amino acid sequence for GLP-1 was discovered. Everything at the cutting edge of popular medicine now really had its seeds several decades ago.”

Market Impact and Competition

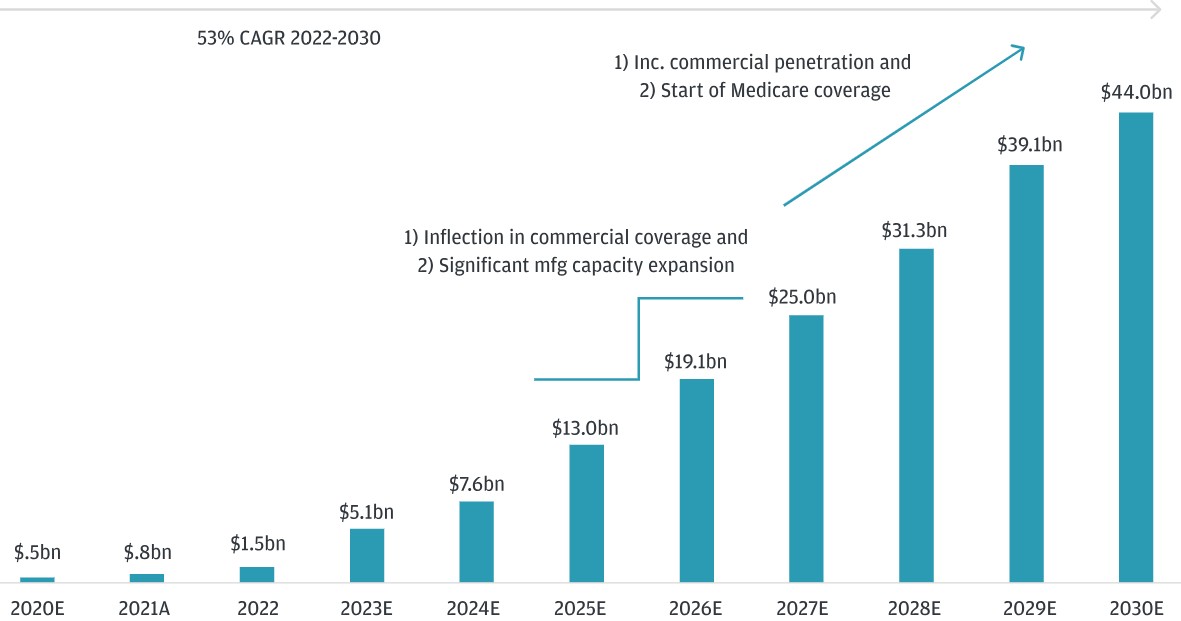

J.P. Morgan Research forecasts that the GLP-1 market will exceed $100 billion by 2030, driven equally by diabetes and obesity usage.

While Novo Nordisk and Eli Lilly currently dominate the GLP-1 market, other major players are quickly entering the space. Ben mentions Sanofi, Merck, Pfizer, AstraZeneca, and GSK as companies with significant patent activity in this area.

The rush to capitalise on GLP-1 drugs’ success is having wider implications for the pharmaceutical industry:

- Manufacturing capacity is being diverted from other therapeutic areas to meet GLP-1 demand.

- Investment may be shifting away from rare diseases and niche therapies.

- The drug development landscape is experiencing a “fashion” phase focused on weight loss and blood sugar control.

Ben highlights the potential consequences: “If weight loss and diabetes control are showing themselves to be so profitable at the moment, we’re going to be in this period of pharma fashion where these areas will dominate for the next 5-15 years. In being so concerned about finding revenue opportunities in this GLP-1 space, what other therapies, conditions, and patients aren’t maybe getting equivalent sorts of interest, money, and research time invested in them as they otherwise might have?”

How GLP-1s are changing healthcare dynamics

The popularity of GLP-1 drugs is altering the traditional doctor-patient relationship. Ben observes, “Patients are now coming in with a therapy already in mind, influenced by what they’ve seen on social media or in advertisements. The physician’s job is no longer just diagnosis leading to a selected therapy; it’s evaluating whether the patient-requested treatment is appropriate.”

This shift highlights the need for balanced, evidence-based information to counter the “aggressive anecdotes masquerading as influential clinical data” often found on social media platforms.

Ben elaborates on this change: “For the last 2,400 years, you would go to see somebody who was the medical doctor, and the diagnostic part was always the most important theme. Now, this is all flipped on its head because of impacts like social media. The physician’s job isn’t to conduct a differential diagnosis; it’s either to talk the patient off a ledge and say you don’t need this, or to do their mental math and say, what’s the benefit versus safety ratio here for this particular patient?”

Drug Delivery Innovations

The evolution of GLP-1 drugs has been marked by significant advancements in drug delivery methods. Ben explains the progression: “The first GLP-1 molecule discovered was liraglutide, which has a 13 to 15-hour active life. This then led to semaglutide, which lasts 165 hours. What they basically did was take the GLP-1 molecule and make some molecular substitutions so that it would bind more strongly to albumin in blood and would last longer in circulation.”

The shift from injectable to oral formulations is another important development. Ben notes, “With an oral, solid dose, you’re not having to go the route of injections, which a lot of people would prefer. There have been some studies that show semaglutide tablets, like Rybelsus, are as good as the injections, like Ozempic, for type 2 diabetes treatment.”

However, the choice between oral and injectable formulations isn’t straightforward. “If we get to the point where it’s an injection once every two weeks, is that more palatable than taking a pill every day or a couple of pills every day? That becomes a balance for the patient to decide what’s better for them,” Ben explains.

Future Outlook

As the GLP-1 market continues to evolve, it will be crucial for healthcare providers, patients, and the pharmaceutical industry to navigate the balance between innovation, safety, and responsible use of these powerful new treatments.

Ben speculates on the future: “We’re going to get to the point where we’re going to have at least the first half-dozen major players involved in this, whether they’re in-licensing a molecule or developing their own. But we’ll get to the point where there are a lot of different options on the market, and then it’s going to be up to which one has the most catchy drug pitch, advertisement, or name.”

The success of GLP-1 drugs may also influence future drug development trends. As Ben notes, “Every 10-15 years or so, we get new punctuations along the timeline of drug development and discovery. What becomes sort of popular at the moment, that’s why I call it fashionicity.”