“The GLP-1 agonist market is seeing unprecedented growth, and we’re investing €900 million to capture a fair amount of that business,” says CordenPharma’s Dr Mimoun Ayoub, outlining the CDMO’s most ambitious expansion plan to date in response to surging demand for peptide manufacturing.

Dr Mimoun Ayoub serves as Senior VP and Global Head of Sales and Key Account Management at CordenPharma, a full-service CDMO operating an extensive network of 11 cGMP facilities across Europe and the US. With decades of experience in pharmaceutical manufacturing and a deep understanding of the CDMO landscape, he oversees the company’s global sales strategy and manages relationships with key pharmaceutical and biotech partners.

Speaking to the PharmaSource podcast at CPHI Milan, Dr Ayoub provided detailed insights into CordenPharma’s expansion plans, particularly in the rapidly growing GLP-1 market, and discussed how the CDMO is positioning itself to support pharmaceutical companies’ evolving needs across multiple technology platforms.

Strategic Investment in Peptide Manufacturing Capacity

CordenPharma’s latest investment of €900 million represents the company’s largest strategic commitment to date, primarily focused on expanding its peptide technology platform. This significant investment follows a period of substantial growth, during which the company has already invested approximately €500 million in various expansions across its US and European sites over the past three years.

“Some of this new capacity is already coming online and fully qualified, and we’ve begun manufacturing in these expanded facilities,” Ayoub explains. “The investment is primarily driven by the unprecedented growth in GLP-1 agonists, both in terms of currently marketed drugs and the rich pipeline across biotech and pharma companies.”

The company’s strategic positioning in the GLP-1 space is particularly noteworthy given the market’s trajectory. “The market uptake for these products has been exceptional, and the pipeline across biotechs and pharmaceutical companies continues to expand,” Ayoub notes. “We’re working closely with our customers to plan ahead of the curve and ensure sufficient capacity to meet their needs.”

Evolving Landscape of GLP-1 Development

The competitive landscape for GLP-1 products is becoming increasingly dynamic, with most major pharmaceutical companies securing their position through various strategies. “Looking at the big pharma companies, most have acquired GLP-1 assets, either through in-licensing or through the acquisition of biotech companies with these assets in their pipeline,” Ayoub explains. “There are still some big pharma companies without GLP-1 products in their pipeline, but this may just be a matter of time.”

Research and development in this space continues to evolve rapidly. “There’s extensive research happening in second-generation or next-generation GLP-1 agonists,” Ayoub notes. “We expect this market to become quite fragmented by the mid-2030s, offering multiple opportunities for manufacturing partners who can support various formulation approaches.”

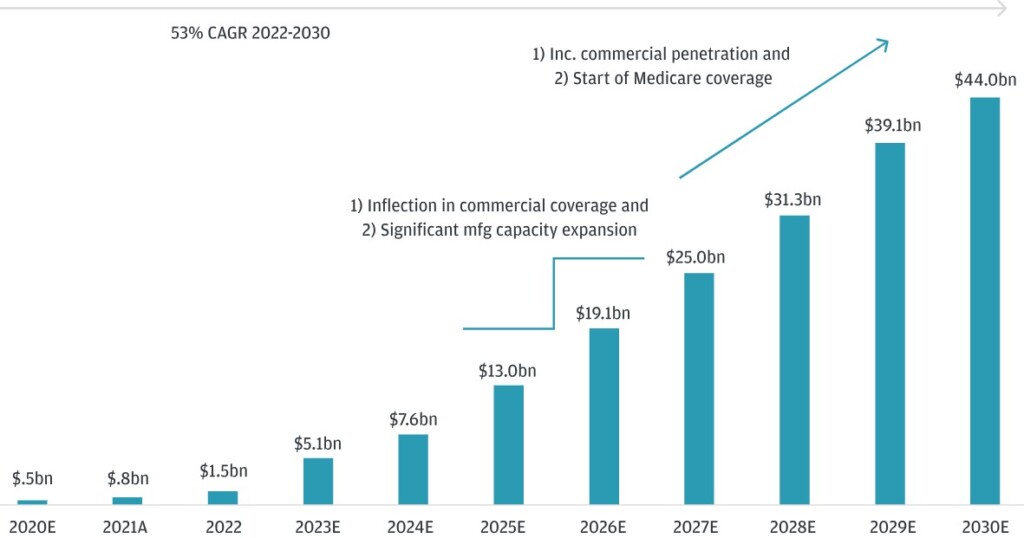

J.P. Morgan Research forecasts that the GLP-1 category will exceed $100 bn by 2030. This will be driven by diabetes and obesity usage as the U.S. obesity market is forecast to reach $44 bn in 2030 — up from just $0.5 bn in 2020 (see below).

Innovation in Drug Delivery Technologies

CordenPharma is actively involved in advancing drug delivery technologies for peptides, addressing one of the traditional limitations in this field. The company’s work spans both injectable and oral delivery systems, with particular attention to the challenges and opportunities each presents.

“One of the historical limitations for peptide drugs has been drug delivery, with most requiring injectable administration,” Ayoub explains. “However, new technologies are enabling oral delivery of peptides, including marketed products like oral semaglutide. Several other oral GLP-1 agonists are currently under investigation.”

The company maintains a pragmatic view on the future of delivery systems: “While oral delivery is advancing, we’re also seeing significant improvements in injectable formulations. Current GLP-1 products typically require weekly injections, with some moving to monthly administration. Looking ahead 5-10 years, we might see quarterly dosing becoming reality. This evolution in injection frequency could impact the competitive landscape between oral and injectable formulations, particularly given the bioavailability challenges of oral peptides, which typically hover around 1%.”

Comprehensive Manufacturing Capabilities

CordenPharma distinguishes itself through fully integrated manufacturing capabilities across six technology platforms, including peptides, injectables, highly potent and oncology, small molecules, lipids, and oligonucleotides. The company’s manufacturing network comprises nine facilities in Europe and two in the United States, offering end-to-end services from drug substance to finished product packaging.

“Our true differentiator is being a fully integrated CDMO across all our technology platforms,” Ayoub emphasizes. “For each platform, we provide both drug substance and drug product manufacturing, extending through to packaging and labeling services for global pharma customers. This integration makes us a genuine one-stop shop for our biotech, pharma, and specialty pharmaceutical partners.”

High-Potency API Manufacturing Excellence

The company has also made significant strides in high-potency API manufacturing, another growing market segment. “In the highly potent space, we’ve not only expanded our API manufacturing capacity but also enhanced our drug product capabilities,” Ayoub notes. “We offer hot melt extrusion capability, long-acting release formulations for tablets and capsules, and various other technologies that add substantial value for our customers.”

Collaborative Approach to Customer Partnerships

CordenPharma’s approach to customer relationships emphasizes long-term partnership and collaboration. “We always try to see things through the customer’s eyes and understand the challenges they face,” Ayoub explains. “This collaborative approach, combined with our ability to deliver on our promises, creates rich, long-term relationships with our partners.”

The company’s project management approach recognizes the long-term nature of drug development relationships: “When you start a project, you’re essentially embarking on a relationship that will last several years, from development through clinical supply and commercial manufacturing. While every CDMO faces technical challenges and delays, it’s how we react to these challenges that makes the difference. We maintain a proactive approach, anticipating potential issues and addressing them before they become significant problems.”

Sustainability and ESG Initiatives

The company has implemented a comprehensive sustainability strategy, focusing particularly on carbon footprint reduction. “ESG considerations have become integral to our operations and our customer relationships,” Ayoub states. “Every contract now includes detailed ESG sections, and we recognize that our future success as a preferred supplier depends on our ability to meet increasingly stringent ESG guidelines.”

To manage these initiatives, CordenPharma has established dedicated teams at both corporate and site levels to monitor environmental impact and progress toward sustainability goals. “We regularly report our progress to shareholders and are continuously working to reduce our scope one and scope two emissions.” Ayoub explains.

Industry Outlook and Future Prospects

Looking ahead, Ayoub expresses optimism about the industry’s trajectory while acknowledging recent challenges. “The disruption caused by COVID-19 is behind us, but it also brought opportunities. CordenPharma grew during the pandemic, supporting COVID-19 vaccine production with our lipid supply capabilities. We’re proud to have contributed to addressing the pandemic.”

The company has also demonstrated resilience in facing post-pandemic challenges: “After COVID-19, we faced geopolitical issues that caused energy prices to skyrocket. However, our ability to anticipate and respond to these challenges demonstrates our organizational agility. We’re now seeing a return to more normal conditions, and I believe the best is still to come for our industry.”