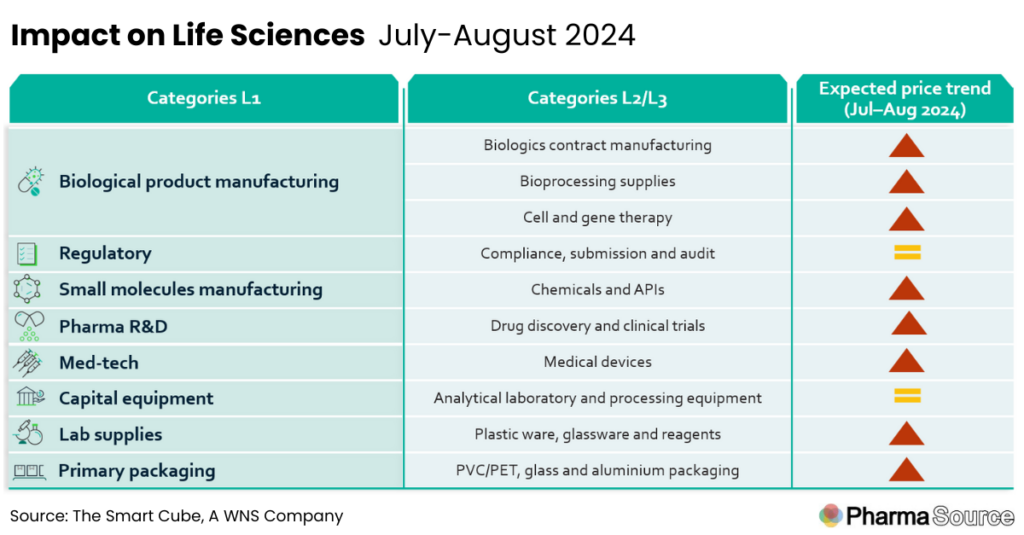

This report summarises key macros events and their expected impact on life science prices over the period Jul-August 2024

- After the BIOSECURE Act was initially excluded from ~350 proposed amendments in June, the House speaker Johnson announced his plans to expedite the act’s approval, impacting many pharma companies reliant on Chinese manufacturing.

- US Government agencies are conducting a comprehensive assessment of the US API industrial base to develop funding strategies and promote domestic manufacturing

- Red sea crisis and multiple port congestions are expected to exert an upward pressure on lab supplies prices

- Saudi Arabia’s discontinuation of the petrodollar agreement is less likely to cause supply-chain disruptions, however, short term demand-supply imbalance is expected

- Corporate sustainability due diligence (CSDDD), approved by the European Parliament, is expected to keep the diligence costs for companies across Europe high

- A stringent and closely monitored regulatory landscape will continue to maintain elevated prices for medical devices

Contract Development & Manufacturing

- The global biopharma contract development and manufacturing (CDMO) market is expected to record a CAGR of 8.2% over 2024–2033; this usually correlates with an increase in prices due to rising demand and the scaling of operations

- BioPharmaceutical CDMOs are focussing on capacity expansions, partnerships and M&A activities to expand their service offerings – to meet the accelerating demand. For example:

- In July 2024, INCOG Biopharma (a US-based CDMO) announced the expansion of its manufacturing capabilities for commercial-scale device assembly capacity; it also added new labelling and final packaging capabilities.

- In July 2024, Siegfried (a Switzerland-based CDMO) acquired an early-phase CDMO site in Grafton (Wisconsin, US) from Curia Global (a US-based CDMO), strengthening Siegfried’s customer offering for drug substances in terms of capabilities and geography

The BIOSECURE Act, currently under consideration in the US Congress, is poised to significantly impact the biologics contract manufacturing industry

- This legislation aims to restrict US federal funding and contracts with biotechnology companies from certain countries deemed national security concerns, particularly targeting China-based firms, such as WuXi Biologics (one of the world’s largest biologics manufacturing companies) and BGI Genomics

- As US-China trade relations are set to be impacted by the BIOSECURE Act, US-based pharma companies exploring new partners/CDMOs outside China (especially India) may need to contend with increased drug development and manufacturing costs

- While the House of Representatives’ committee initially excluded the BIOSECURE Act from ~350 proposed amendments under consideration for congress for Federal FY2025, 8th July House speaker Mike Johnson announced his plans to advance the act by his proposal to bring the BIOSECURE Act to the floor for a vote in the fall – for expedited approval; under the current version of the bill, US drugmakers would need to cut ties with Chinese contractors by 2032

Bioprocessing supplies

Saudi Arabia’s discontinuation of petrodollar agreement is less likely to cause supply-chain disruptions, however, short term demand-supply imbalance is expected

- The single-use system (SUS) market is expected to witness a slight uptick in prices due to anticipated fluctuation in feedstock prices and a steady demand

- In June 2024, high-density polyethylene (HDPE) prices in the US increased 3.3% M-o-M as compared to May 2024, while in Europe, the prices remained constant at $1,715.1 /ton; the prices in Europe are expected to decline in July 2024 (due to an anticipated decline in the feedstock (ethylene) prices) and then increase in August and September due to expected increase in feedstock prices and improved demand

In June 2024, Saudi Arabia discontinued its petrodollar agreement (signed in 1974) with the US; the agreement had mandated that Saudi oil sales be conducted exclusively in the USD

- Raw materials – including PE, PVC and PP – derived from petrochemicals are widely used in manufacturing single-use supplies that are used in biological product manufacturing and medical supplies

- While there is less likelihood of supply chain-related disruptions, supply-demand equilibrium might potentially be affected due to panic purchasing and increased advance ordering to mitigate currency fluctuation risks

Disruption arising from escalations in Middle East conflict can affect the bioprocessing supplies’ supply chain, as plastic and resin production, vital for SUS, heavily relies on crude oil

- Disruption in crude oil supply directly affects plastics, thus impacting SUS manufacturing and potentially causing shortages and increased costs for pharmaceutical companies

- Amidst continued geopolitical disruptions, crude oil prices have risen, primarily due to renewed hopes of a US Federal Reserve rate cut and declining US crude oil inventories

- According to the US EIA, Brent crude oil prices are forecast to average ~$89/b in H2 2024, up from $84/b in H12024

- Higher prices in the second half of the year result from the forecast of persistent withdrawals from global oil inventories

Cell and gene therapy (CGT)

The CGT market has grown significantly over the past few years; however, in Q1 2024, market growth remained a bit slow due to fewer pharmaceutical deals

- The industry experienced a 31% decline in the number of CGT-related patent applications in Q1 2024 compared with Q4 2023 due to its high costs

- Further, in Q1 2024, the number of CGT-related deals in the pharmaceutical industry declined 7% as compared with Q1 2023

Despite a relatively slow pace in Q1 2024, 2024 is poised to be a pivotal year for CGTs, with launches of ~21 cell therapies and ~31 gene therapies expected in 2024

- According to market experts, companies are also facing scalability- and rising costs-related challenges, resulting in market failures within the CGT landscape

According to multiple market reports, the sector is facing a dearth of experienced biomanufacturing staff for advanced CGTs that can potentially lead to elevated prices.

A consistent demand for CGT outsourcing in the industry is expected to further boost the prices.

- In July 2024, Edity (an-Israel-based biotechnology company) and Aurigene (an India-based CDMO) entered into a partnership, wherein Aurigene will provide discovery services in the CGT space

Regulatory compliance, submission and audit

Global pharmaceutical companies may need to allocate more resources to comply with regulatory standards imposed by international regulatory authorities; the heightened regulatory scrutiny could result in elevated compliance costs, which may impact their pricing strategies

- In July 2024, Dr. Reddy’s Laboratories (an India-based pharmaceutical company) recalled 13,752 bottles of Eszopiclone tablets (drugs to treat insomnia and gout) from the US market due to ‘failed impurities/degradation specifications

- Further, on 24 May 2024, the European Parliament approved the Corporate Sustainability Due Diligence Directive (CSDDD) that focuses on human rights and environmental due diligence operating across Europe

- With heightened regulations, pharmaceutical companies in the US and Europe will require additional funds for audits and personnel visits to offshore contract manufacturing facilities

Small Molecule manufacturing – Chemicals and APIs

The global API manufacturing market is expected to register a CAGR of 5.8% over 2024–2033, due to factors such as rising disease burden and increasing demand for pharma outsourcing

In July 2024, the US government agencies, including the Commerce Department’s Bureau of Industry and Security (BIS), announced that they are conducting a comprehensive assessment of the US API industrial base to gain an understanding of the supply chain network

- The resulting information will allow the federal government to more accurately plan and develop funding strategies to help ensure the availability and security of the API supply chain and to raise awareness regarding the currently limited domestic manufacturing capabilities

Supply chain disruptions in the Red Sea coupled with multiple port congestions have created a bottleneck situation which has tripled the freight rates from APAC to US and Europe (since Jan 2024) due to which API prices of certain drugs such as paracetamol, meropenem and metformin have increased multiple folds

- Prices for Omeprazole, an API primarily used in the treatment of conditions related to excessive stomach acid production, increased significantly over the past month, causing major concerns for drug manufacturers and potentially leading to higher costs for consumers

Implementation of the BIOSECURE Act was anticipated to have an impact on the chemical and API supplies (with China being one of the largest exporters of APIs and chemicals)

- However, a delay in the implementation of the BIOSECURE Act is attributed to currently normalise the situation of China-based suppliers

Drug discovery and clinical trials

During April–July, storms, hurricanes and tornadoes in the US may have resulted in reduced patient retention at trial sites for a short term; the recent hurricane (hurricane Beryl) in Texas, resulted in destruction and power outages for ~3 million homes and businesses, including clinics and hospitals, which is expected to have affected the clinical trial operations in the region

Wages account for >40% of the total cost involved in discovery and clinical research; due to the ongoing shortage of qualified and experienced researchers, the operational costs will be high

- Increasing inflationary pressures are anticipated to keep the labour costs high. Euro area’s annual inflation stood at 2.5% in June 2024, down from 2.6% in May 2024

Medical Devices

A stringent and closely monitored regulatory landscape will continue to maintain elevated prices for medical devices.

In the past few months, the EU and US governments have tightened due diligence on China-based products, impacting medical device production and potentially increasing costs

- The US FDA has issued import bans on 4 Chinese manufacturers – Jiangsu Shenli Medical Production, Jiangsu Caina Medical, Zhejiang Longde Pharmaceutical and Shanghai Kindly Enterprise Development Group – due to quality concerns

- The US FDA also issued notice to Cardinal Health, Medline Industries and Sol-Millennium Medical for selling the imported syringes, which were not authorised for distribution in the US, post which Cardinal Health and Medline recalled the affected syringes

In May 2024, the US government announced steep tariff hikes on products including medical products to encourage China to eliminate its unfair trade practices

Furthermore, the US government is looking to pass the CHIP EQUIP Act that prohibits CHIPS Act-funded projects from buying Chinese semiconductor manufacturing equipment and tooling, to restrict any dependence on China

The medical device market is highly regulated, and regulations govern every aspect of design, production and distribution

- Non-compliance leads to frequent product recalls to ensure patient safety and the companies need to spend more time and resources to ensure compliance, which can increase the input cost

- In July 2024, Medtronic recalled nerve integrity monitoring (NIM) standard and contact EMG endotracheal tubes because of issues with blockages

The possible implementation of a new law, restriction of China-based products and regulatory surveillance are altogether expected to keep the medical devices costs elevated

Analytical laboratory and processing equipment

The US PPI for analytical lab instrument manufacturing decreased 0.1%, while that of HVAC and commercial refrigeration equipment dropped by 0.3% M-o-M in June 2024

In analytical laboratories, skilled labour is required to operate sophisticated equipment such as chromatographs, spectrophotometers and mass spectrometers

- According to the Q3 2024 ManpowerGroup Employment Outlook Survey, 77% of healthcare and life sciences employers reported difficulty in finding the skilled talent they need; this shortage may prompt companies to raise wages to attract skilled workers or invest in training programmes

Lab supplies and services

Red sea crisis and multiple port congestions are expected to exert an upward pressure on lab supplies prices

Disruptions in the supply of lab chemicals are being experienced due to the ongoing crisis in the Middle East affecting logistics routes through the Suez Canal, leading to extended delivery lead times and influencing prices in the US

- According to Maersk (July 2024), this supply chain disruption is anticipated to cause cascading effects, resulting in port congestions at several critical hubs

- Further, the US PPI for chemicals and allied products (wholesale) increased 0.3% M-o-M in June 2024 and is expected to increase further in July 2024

Up to 65% cost of manufacturing lab supplies is attributed to raw materials, which include HDPE, glass and polypropylene; Q3 2024 is expected to witness inflation of >2% within the lab supplies category

- In June 2024, HDPE prices in Europe remained constant at $1,715.1 /ton as compared to May 2024; prices in the US increased by 3.3% M-o-M in June 2024 as compared to May 2024 and are expected to increase in July 2024 mainly due to anticipated increase in feedstock (ethylene) prices – driven by hurricane Beryl

Primary packaging

Blister packaging for pharmaceutical products typically involves raw materials, such as aluminium, PET and PVC, while HDPE is used for bulk drums

- PVC suspension prices in the US increased by 5.0% M-o-M in June 2024 to $0.4/lb as compared to May 2024

- Conversely, PET prices in the US and Europe (Italy) decreased by 1.5% and 6.2% M-o-M, respectively, in June 2024, reaching $0.7/lb and $1,245.3/tonne

However, fluctuating crude oil prices are expected to have an upward impact on the plastic packaging

- The global aluminium prices decreased 2.7% M-o-M in June 2024; in July 2024, prices are expected to increase by 0.7% M-o-M, driven by anticipated increase in feedstock (alumina) and utilities (coal) prices

Biologics and injectable drugs are typically packed in glass or plastic vials and ampoules

- The US PPI for flat glass manufacturing decreased by 1.3% in June 2024 as compared with May 2024 which may counter the potential price increase in aluminium packaging

This category update is powered by The Smart Cube, a WNS Company. For more procurement intelligence, visit Amplifi PRO

Stay ahead of trends and best practices

Stay ahead of trends and best practices