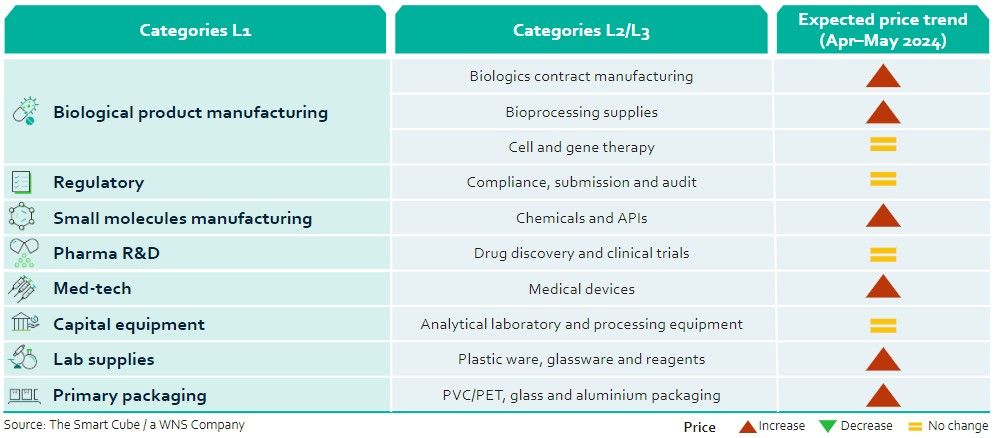

This report summarises the key issues impacting prices across a range of categories in the BioPharma industry in April 2024:

- Due to the incoming BIOSECURE Act in the United States, biologics category managers are expected to look for other low-cost destinations outside China (including India) and raise bioprocessing supply prices.

- Pharma companies with affiliates in the Middle East are facing supply chain challenges

- Rise in regulatory scrutiny may drive pharma companies to invest in compliance, potentially leading to increased costs and affecting pricing strategies

- Earthquake in Taiwan led to disruption in semiconductor manufacturing, causing mild–moderate delays in shipping

- Prices of lab supplies are projected to increase due to fluctuating raw material prices

Biologics contract manufacturing

Due to the incoming BIOSECURE Act in the United States, biologics category managers are expected to look for other low-cost destinations outside China

Read: WuXi Leaves BIO As Pharma Scrambles for Alternatives

The global biologics contract development and manufacturing (CDMO) market is expected to record a CAGR of ~8.2% over 2024–2033, due to an increase in demand for biologics

- According to the Convention on Pharmaceutical Ingredients (CPHI), Convention on Pharmaceutical Ingredients (CPHI), biologics demand is expected to reach 4,400 kiloliters by 2027

- Pharma companies are going for acquisition and expansion of their biologics manufacturing facilities to meet increasing demand for biologics

- Lonza, a US-based CDMO, signed an agreement to acquire large-scale biologics site in Vacaville, US, from Roche for $1.2 billion

- Syngene, an India-based CDMO, announced the opening of a newly upgraded biologics facility in Bangalore, India, to be operational for clinical and commercial supply for the US and European clients in H2 2024

The BIOSECURE Act targeting certain biotech companies that are headquartered in foreign adversary countries, and prohibiting federal agencies from procuring services from or funding a company of concern (biotech company and its tier 2 suppliers), could have a significant impact on biopharma companies in the US

- The Act will affect especially those pharma companies who have direct contracts with companies such as WuXi AppTec, one of the world’s largest biologics manufacturing companies, manufacturing 19 biosimilar and innovator drugs approved in the US; other targeted suppliers include BGI Genomics and MGI

- The Act would affect US pharma companies that rely on these biologics manufacturers based in China, to reduce costs, potentially leading to a shift in supply chains and increased scrutiny of partnerships with Chinese entities

Bioprocessing supplies

The BIOSECURE Act is expected to raise bioprocessing supplies prices, while Middle East conflicts may worsen supply chain disruptions

The single-use systems (SUS) market is expected to witness increase in price due to volatile feedstock prices

- In March 2024, high-density polyethylene (HDPE) prices in Europe increased 5.8% M-o-M, while in the US it remained unchanged at $0.59/lb

- The prices in Europe are expected to uptrend in April 2024, driven by an anticipated rise in demand for material supplies

Disruption arising from Middle East conflict can affect the bioprocessing supplies’ supply chain, as plastic and resin production, vital for SUS, heavily relies on crude oil

- Disruption in crude oil supply directly affects plastics, thus impacting SUS manufacturing and potentially causing shortages and increased costs for pharma companies

- Further global crude oil prices are expected to rise, amid the ongoing Iran-Israel conflict

The implementation of the BIOSECURE Act is expected to lead to an increase in the prices of bioprocessing supplies

- Pharma companies, such as Merck and Thermo Fisher, are anticipated to experience a significant Y-o-Y decline of 40–50% in revenue in 2024 from the bioprocess segment in China; this is attributed to Wuxi AppTec and WuXi Biologics being key customers in the Chinese market

- Global Life Sciences Technologies (Shanghai), a division of the Danaher Group, is also expected to see a decrease in revenue in 2024, for its filter and accessories segment due to Wuxi AppTec and Biologics being major customers

- Under the BIOSECURE Act, entities that utilise biotechnology equipment or services from these suppliers in the execution of government contracts will be barred from receiving federal loans, grants or contracts, including extensions and renewals

Cell and gene therapy (CGT)

Rise in regulatory scrutiny may drive pharma companies to invest in compliance, potentially leading to increased costs and affecting pricing strategies

The increase in spending (such as for R&D and regulatory), along with increasing manufacturing costs in the field of gene therapy, is expected to increase the price of CGT products

- Spending on cell and gene therapies is increasing rapidly and reached $5.9 billion in 2023, up 38% from 2022

- As of the end of 2023, 76 cell and gene therapies have been launched globally, more than double the number of therapies that had been launched since 2013

- In March 2024, the US FDA approved Lenmeldy – gene therapy for metachromatic leukodystrophy (MLD) – for $4.25 million; Lenmeldy is one of the world’s most expensive drug till date

- Manufacturing expenses for gene therapy, according to SK Pharmteco – a US-based pharma company – can range from $500,000 to $1 million, excluding research and clinical trial costs, imposing significant financial burdens on patients

Regulatory compliance, submission and audit

Pharma companies may need to invest more resources in ensuring compliance with regulatory standards set by the US FDA and other international regulatory bodies; this increased regulatory focus could result in higher compliance costs, which may influence pricing strategies

- As of April 2024, Lupin and Glenmark Pharmaceuticals – pharma companies headquartered in India – recalled 26,352 bottles of Rifampin capsules, 300 mg (antibiotic for treating bacterial infections) and 6,528 bottles of Diltiazem Hydrochloride extended-release capsules (used for treating blood pressure), respectively, in the US due to manufacturing issues and failed dissolution specifications

- In April 2024, Marksans Pharma’s Goa manufacturing facility and Cipla’s Patalganga facility – India-based pharma companies – received 5 and 6 new inspectional observations from the US FDA, respectively

- These actions come in response to the US FDA’s announcement in February 2024, to increase inspections of Indian drug manufacturing units due to concerns over drug quality

- With heightened regulations, pharma companies in the US and Europe will require additional funds for audits and personnel visits to offshore contract manufacturing facilities

Small molecule manufacturing Chemicals and APIs

The global API manufacturing market is poised to register a CAGR of 5.8% over 2024–2033, due to factors such as rising disease burden and increasing demand for pharma outsourcing

- In April 2024, the prices of terbinafine hydrochloride, a key API, are predicted to rise globally due to an increase in demand from the pharma and healthcare sectors, particularly as India serves as a major API manufacturer

The conflict in the Middle East is likely to affect Indian API manufacturers, including Sun Pharma, Dr. Reddy’s and Lupin, due to their substantial presence in the MENA1 region

- Taro Pharmaceutical, an Israel-based subsidiary of Sun Pharmaceutical, is reportedly facing supply chain issues due to the Middle East conflicts

- Additionally, post the implementation of the BIOSECURE Act, supply of chemical and API may get impacted (with China being one of the largest exporters of APIs and biopharma chemicals) as biopharma companies may refrain from buying Chinese products

APU / Drug discovery and clinical trials

Many clinical research sites in the US are exposed to financial risks due to the current inflation (the CPI in the US increased 0.4% in March 2024 over January 2024, on a seasonally adjusted basis)

- With the majority biopharma sponsors having a 90-day payment cycle, clinical sites suffer lower profitability; also, since many clinical sites operate at lower margins, delayed receivables impact their ability to reinvest operating profits in technology, quality management systems and training

Wages account for >40% of the total cost involved in discovery and clinical research; due to the ongoing shortage of qualified and experienced researchers, the suppliers’ teams comprise only a few highly qualified (PhD) and experienced researchers

- However, the average hourly earnings for private education and health services in the US saw a slight decrease of 0.03% in March 2024, compared with February 2024, with the average US employee in private education and health services earning up to $33.8 per hour

Medical devices

The early April earthquake in Taiwan has disrupted global electronic parts supply chains, impacting medical device production and potentially increasing costs

- Taiwan, home to one of the largest global chip manufacturers, is vital to these supply chains, and the earthquake has led to minor–moderate delays in the shipment of chips; the delay in shipment caused by the earthquake will affect the production and supply of medical devices, and in turn result in price increase of medical devices

- The US-based chip manufacturers having facilities in Taiwan faced productions disturbances in the country, resulting in delays and supply chain issues

Furthermore, the US government is funding semiconductor manufacturing companies, to diversify their supply chains by increasing chip capacity outside of Taiwan, to geographies such as the US

- In April 2024, the US Commerce Department allocated a $6.6 billion subsidy to Taiwan Semiconductor Manufacturing Company’s US unit to enhance chip production

The EU has launched an investigation into China’s procurement of medical devices due to concerns about unfair advantages for domestic suppliers

- This is because China was criticised for restricting market access to non-Chinese producers and favouring domestic suppliers in public tenders, raising medical device costs in Europe

Analytical laboratory and processing equipment

The US PPI for analytical lab instrument manufacturing increased 0.3%, while that of HVAC and commercial refrigeration equipment dropped 0.1% M-o-M in March 2024

In analytical laboratories, skilled labour is required to operate sophisticated equipment such as chromatographs, spectrophotometers and mass spectrometers

- According to the Q2 2024 ManpowerGroup Employment Outlook Survey, 77% of healthcare and life sciences employers report difficulty in finding the skilled talent they need; this shortage may lead companies to raise wages to attract skilled workers or invest in training programmes

Lab supplies and services

Prices of lab supplies are projected to increase due to fluctuating raw material prices

Plastic ware, glassware and reagents

Up to 65% cost of manufacturing lab supplies is attributed to raw materials, which include HDPE, glass and polypropylene; Q2 2024 is expected to witness inflation of 1–2% within the lab supplies category

- In March 2024, HDPE prices in Europe increased 5.8% from February 2024; prices are expected to uptrend in April 2024, driven by supply tightness and rising feedstock (ethylene) prices

- Iran’s attack on Israel has potential to drive Brent and WTI prices to up to $100 per barrel; this will have major impact on energy-intensive material such as plastics and glass, potentially raising prices

- Additionally, OPEC+1 countries’ extension of additional voluntary cuts of 2.2 million barrels per day until the end of Q2 2024 is further exacerbating the oil supply shortages globally

Lab chemicals supply is also experiencing disruptions due to the ongoing Red Sea attacks, as the rerouting will impact the shipment of ~24% of chemicals, the delays of which have been impacting prices in the US

- The US PPI for chemicals and allied products (wholesale) increased 0.8% M-o-M in March 2024 and is expected to further increase in April 2024

Primary packaging

PVC/PET, glass and aluminium packaging

Blister packaging for pharma products typically involves raw materials such as aluminium, PET and PVC, while HDPE is used for bulk drums

- The PVC suspension prices in the US remained stable at $0.42/lb in March 2024

- The PET price in the US and Europe (Italy) remained stable in March 2024, at $0.67/lb and $1,326.8/tonne, respectively

- The global aluminium prices increased 1.8% M-o-M in March 2024; in April, prices are forecast to increase 4.8% in line with the rise in restocking activities after the spring festival holidays in China, recovery in demand from the downstream automotive sector and elevation in feedstock (alumina) price

Biologics and injectable drugs are typically packed in glass or plastic vials and ampoules

- The US PPI for flat glass manufacturing dropped 0.3% M-o-M in March 2024

This category update is powered by The Smart Cube, a WNS Company. For more procurement intelligence, visit Amplifi PRO

Stay ahead of trends and best practices

Stay ahead of trends and best practices