- Avid Bioservices announces a merger agreement for a $1.1 billion all-cash acquisition by GHO Capital and Ampersand Capital.

Avid Bioservices, Inc., a contract development and manufacturing organization (CDMO), announced a definitive merger agreement to be acquired by GHO Capital Partners and Ampersand Capital Partners in an all-cash transaction valued at approximately $1.1 billion.

As part of the merger agreement, GHO and Ampersand will acquire all outstanding shares of Avid from its stockholders at a cash price of $12.50 per share. This offer represents a 13.8% premium over Avid’s closing stock price of $10.98 on November 6, 2024, the last trading day before the announcement, and a 21.9% premium over the company’s 20-day volume-weighted average share price up to that date.

GHO and Ampersand, both investment firms with expertise in the CDMO space, are acquiring Avid as a strategic addition to their portfolios. The acquisition, valued at a 6.3x multiple of projected FY2025 revenue, is intended to strengthen Avid’s offerings in biologics manufacturing for biotechnology and pharmaceutical clients, with services spanning clinical to commercial stages.

Nick Green, CEO of Avid Bioservices, highlighted the value for shareholders and strategic alignment with the new ownership. “Partnering with GHO Capital and Ampersand Capital Partners allows us to build on our strong foundation by accessing their significant knowledge base, network and capital,” Green said.

Alan MacKay, Managing Partner of GHO, emphasised the firm’s commitment to healthcare improvements through efficient manufacturing. “Avid operates in high-growth markets, producing complex biologics for leading innovators,” he noted, adding that GHO’s experience will support Avid’s future development.

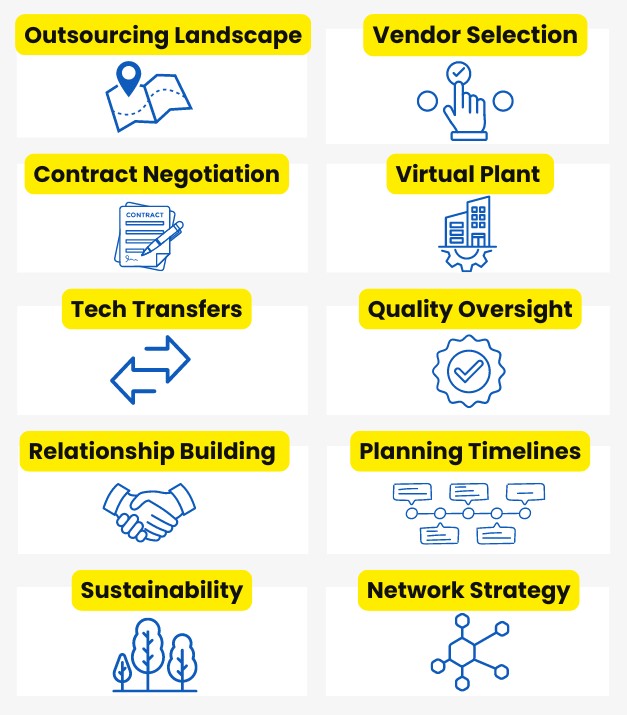

Overview of outsourcing trends

Overview of outsourcing trends