Oncology is one of the most important growth markets for the pharmaceuticals industry, partly because of the increasing prevalence of cancer in a world population that is growing and living longer.

Ahead of the CDMO Live 2024, Giorgio Bertolini, senior vice president of R&D and Roberta Pachera, Vice President of CDMO Small Molecules and the Global Key Account for Olon, explain the key trends and challenges in this important market.

Oncology drug market

By some estimates, cancer drugs now account for 30% of the global pharma pipeline and 25% of industry revenues.

Estimates of the size of the global oncology drugs market size by market research companies vary considerably, depending in large part on definitions, but all agree that the market has massive growth potential for the foreseeable future.

-

- Allied Market Research puts it at $135.5 billion in 2020, with a compound annual growth rate (CAGR) of 7.5% in the years to 2030, when it is projected to reach $274.4 billion.

-

- Fortune Business Insights puts it at a basically similar $144.3 billion in 2019, with a CAGR of 11.6% taking it to $394.4 billion by 2027.

-

- Precedence Research, whose definition includes diagnostics, basically doubles the market size to $286.0 billion in 2021, with a CAGR of 8.2% taking it to $581.2 billion in 2030.

Rise Of Niche Therapies

Alongside the sheer size of the market, oncology therapeutics are seeing rapid advances in technology, enabling previously lethal cancers to be treated and treatment regimens to move away from brutal chemotherapy.

There has been much excitement about new biologics, such as monoclonal antibodies (mAbs), antibody-drug conjugates (ADCs), biospecifics, and cell and gene therapies such as CAR-T therapies, but most of the heavy lifting continues to be done by small molecules, most of them highly potent. In addition, a large proportion of the emerging therapies are precision medicines that are highly specific to subtypes of cancer that affect smaller subsets of the patient population. The blockbuster model, as in much of the pharmaceutical industry as a whole, is in retreat.

“There’s a trend towards more personalized medicine that is more targeted to niche patients,” says Dana Gheorghe, therapy area director, oncology & respiratory, at Datamonitor. “We’ll see more and more fragmentation of the treatments based on biomarkers, new genetic mutations being assessed, and new targets identified and used. It may not spell out good news for the pharma and biotech companies, because their products won’t be all-encompassing.

Therapies will focus on tiny populations, which will be characterized by a biomarker. But that’s not necessarily a bad thing because if it works in a niche population, they show higher efficacy in those patients. That in turn leads to physicians trusting the therapy more, then they could potentially crank up the prices to make up for lost applicability to the wider population.”

For the Italian-based contract development and manufacturing organization (CDMO) Olon, which has been active in highly potent APIs (HPAPIs), including anti-cancer drugs and cytotoxics, for over half a century, the decline of the blockbuster model in oncology and the rise of niche therapies are combining to create opportunities and challenges at the same time.

“We are observing two main trends,” says Roberta Pachera, Vice President of CDMO Small Molecules and the Global Key Account for Olon.

“The first is smaller volume demand – typically in the range of hundreds of kilos – because of the smaller target applications; the second is greater complexity in design, including more chemistry steps in the manufacture of molecules, which means higher value.”

Antibody Drug Conjugates (ADCs) in Oncology

Antibody–drug conjugates are an important new class of oncology therapeutics that combine a tumour-targeting antibody with a cell-killing cytotoxic drug (payload).

The development and manufacture of an ADC are complex tasks, with the requirement for both a monoclonal antibody (mAb) and a cytotoxic payload, which then need to be conjugated, after which the final product must be fill-finished.

Additional complexity results from the need to perform a number of operations in

high-containment facilities because of the toxicity of the materials.

Olon have significant expertise in manfacturing a wide range of ADC services along all the development stages, including:

- Familiarization and optimization of manufacturing process including DoE approach

- Development of proprietary processes

- Risk analysis and safety evaluation

- Analytical development

- Isolation and characterization of impurities

- Analytical methods and process validation

- Demo and GMP production batches including registration product

- Regulatory support for customer filing

Olon can offer the development and manufacturing & purification service of the

main classes of ADC payloads including Auristatin, Antracycline, Campthotecin, Duocarmycin, Maytansine, PBD and other proprietary ADCs.

In addition Payloads can be combined with all the different linker categories such as Peptides, Hydrazone, Disulfide and other stable linkers.

Find out more about ADC services on the Olon website

For Giorgio Bertolini, senior vice president of R&D, the complex chemical structures, and long syntheses of the new compounds form both the main regulatory and the main technology challenge. Defining the registered starting materials (RSMs) is not easy.

“The challenge is often to find the right balance between the complexity of the structure and the number of steps you can run under cGMP. In some cases, you could be carrying out ten steps in house from an already very complex starting material, so it is not easy to convince the regulatory authorities that it is the right RSM.”

A broad range of technologies is needed to be able to develop and make them. “When there are 10, 15 or even 20 chemistry steps you also need to have a very good, sustainable supply chain to be able to source the RSMs,” he adds. “With many of the new chemical entities (NCEs), the starting materials are not available on the market, so we also have to develop some of these as a sort of sub-CDMO activity and be our own supplier.

We need to provide to our customers a very broad and comprehensive approach, not only in terms of the technology that we have internally but also technology that our qualified suppliers have to contribute the starting materials for these products.”

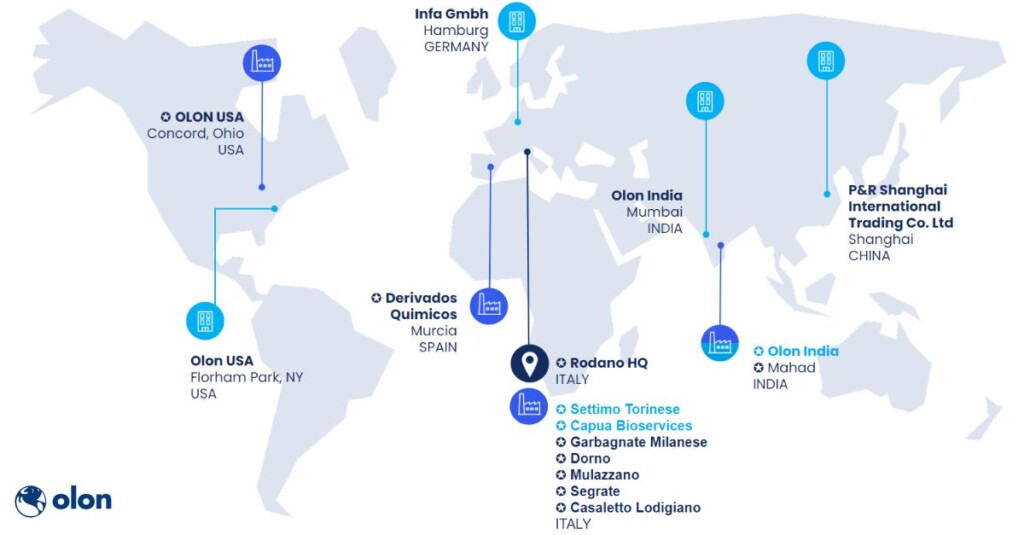

A global network

Through its offices in India and China, Olon has developed a network of suppliers in the last decades, so that it can develop the starting materials it needs, as well as acquiring all of the key capabilities necessary, including high-potency fermentation.

“Customers are looking above all for technology, supply chain, quality, flexibility, sustainability, and reliability. Quality is a must, of course, and in that we are at the same level as our competitors but in terms of technology and flexibility I believe we can provide a better service than the others.”

Rapid Movement Through Phases

Pachera adds that in oncology in particular, compounds can move very rapidly from phase I to phase III, sometimes in just a couple of years. For this reason, the complexity is not only in the manufacturing but is also linked to time-to-market. To address that requires a significant footprint – Olon itself has a global network of 11 sites – coupled with the flexibility and agility to move a compound around a plant in order to keep the manufacturing times very tight. In addition, a certain skillset is needed. “You need to have a critical mass in the R&D team and people who, when they are developing a project in phase I, already have in mind what will be needed to support the customer in phase III.” In the context of fast-moving projects, project management skills are obvious to the fore but this needs to go more than just having a single contact person managing the whole project internally and coordinating all the activity between the sites; it involves multiple functions working together, including quality, operations, EHS, sourcing, and planning.

“Our departments are working all together in synergy on projects. There are no silos, we are working together in a team. This is managed by a project manager, but it is not just any project manager that can guarantee the efficiency of the system,” says Bertolini, who likens the project manager’s role to the conductor of an orchestra.

The ‘one-stop shop’ is a well-worn cliché in the pharmaceuticals industry, but it is clearly relevant in oncology where the pace of development is so fast. For Olon, Pachera says, this means being totally integrated so that it can anticipate customers’ future needs from early on in the process.

“Having the know-how within the same company is crucial. It means you don’t need to move around from one supplier to another to a third. We can serve our clients from milligram-scale for preclinical and throughout phases I, II and III,” she says. “This enables customers to discharge any risks related to toxicological studies quickly, as well as avoiding tech transfer.”

What is high containment?

Olon cites ‘high containment’ as a key capability. The term varies in meaning from company to company but to Olon, this essentially means occupational exposure levels (OELs) of <10 μg/m3. It can also go down as far as 0.1 μg/m3 and is now investing in a new plant, due to open next year, that will enable it to reach levels of 10 ng/m3. Further recent and planned investments include new capabilities at the site in Cleveland, Ohio, which mainly makes preclinical and phase I-II volumes; a new line in Italy to make 20-50 kg batches of high potency anti-cancer compounds; and a large-scale highly potent plant for 100 kg batches.

As well as the ‘hardware’ like gloveboxes and isolators, Bertolini stresses the need for the ‘software’: the human experience needed to handle HPAPIs correctly. “All of our people are trained in how to manage the starting material, how to make the products, how to take out a sample for analysis,

and so on,” he says.

“A lot of companies now say, ‘We have high potency capabilities’ or ‘We have put up a high potency plant’, but this is not enough. You need experience, you need knowledge; you cannot just pick this up in a few years. You need a very long journey to build up that knowledge and Olon is one of the companies that has this kind of knowledge in this area.”

Olon are sponsoring CDMO Live 2024. Join the event to meet with the team and discuss your challenges.

Stay ahead of trends and best practices

Stay ahead of trends and best practices