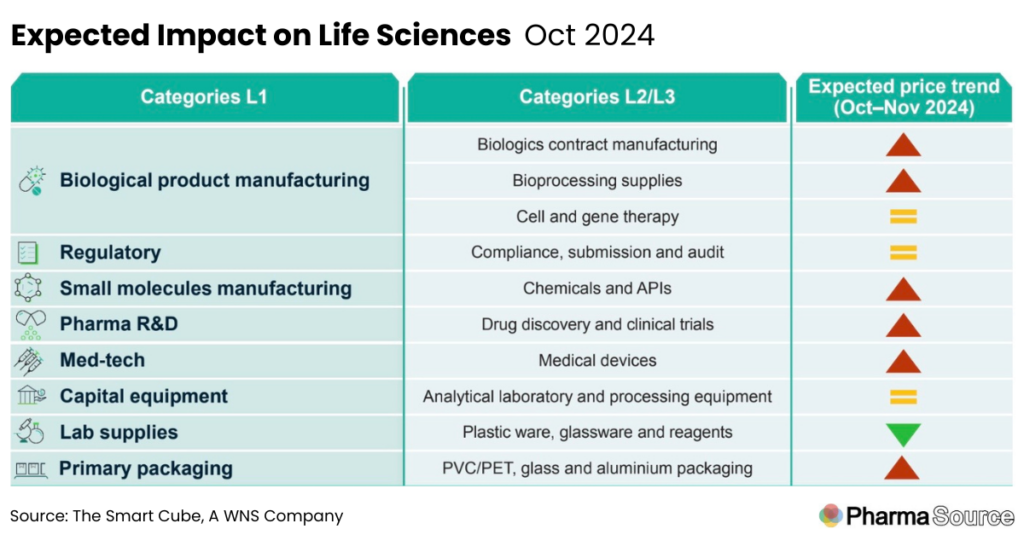

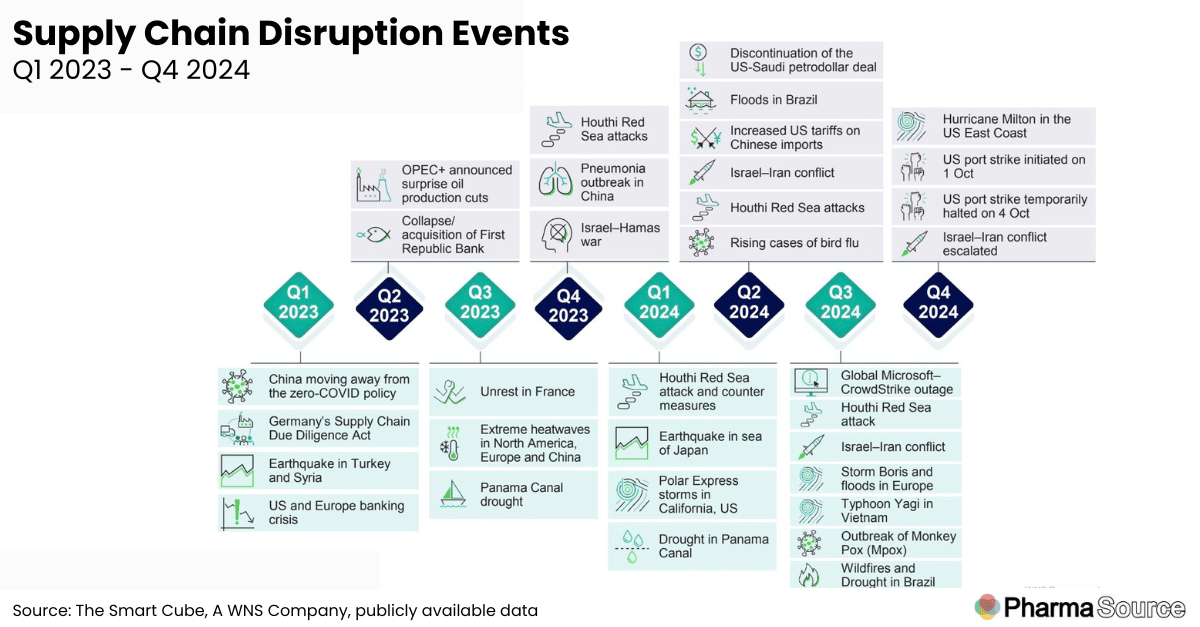

This report summarises the key issues impacting prices across a range of categories in the BioPharma industry in October-November 2024.

- The prices of biologics contract manufacturing are expected to rise in Q4 due to increasing demand and existing regulatory restrictions, such as the BIOSECURE Act, limiting access to cheaper manufacturing options in China.

- Prices of bioprocessing supplies are expected to continue the upward trend due to supply chain disruptions caused by hurricanes in key US states (North Carolina and Florida), where major pharma companies and CDMOs operate their bioprocessing facilities.

- With the final modification in People’s Republic of China’s (China) Act (Section 301), the rise in tariffs is expected to disrupt the supply of medical equipment and devices, potentially leading to higher prices and supply shortages in the market in 2025.

Biologics contract manufacturing

The BIOSECURE Act can lead to a supply shortage of biologic products, potentially driving prices upwards.

The global market for biologics contract manufacturing (biopharma CMO) is expected to grow at an average annual rate of 9% from 2024 to 2033. This growth is leading to higher service costs due to increased demand and expanding operations.

Pharmaceutical CDMOs are focused on increasing their capacity to offer more services and meet rising demand. Additionally, pharmaceutical companies are starting to enter the CDMO market to address this need

- In October 2024, Almac Group, a UK-based CDMO, announced plans to invest $14.7 million to expand its analytical labs and resources across all its sites. This includes adding new specialized instruments and techniques for areas like biologics, chromatography, and spectroscopy.

- In September 2024, Eurofins, a France-based CDMO, revealed a $64 million investment to construct a biologics manufacturing facility in Ontario, Canada.

On 9 September 2024, the BIOSECURE Act passed in the US House of Representatives with a bipartisan vote of 306 to 81

- This bill aims to prevent US companies and federal agencies from working with biotech firms linked to certain foreign adversaries, especially China, due to national security concerns.

- As a result of this act, WuXi Biologics and WuXi AppTec are considering selling some of their manufacturing facilities in the US and Europe.

Chinese CDMOs and other raw material suppliers have been a key source of relatively inexpensive contract manufacturing. The BIOSECURE Act could raise the overall costs of biologics contract manufacturing in the US

- Another challenge from this act is that CDMOs and CROs outside China may struggle to meet the demand from US and European pharmaceutical companies.

Bioprocessing Supplies

The single-use system (SUS) market is likely to see a slight increase in prices due to expected changes in feedstock prices and steady demand. The costs are largely influenced by crude oil prices.

- In September 2024, the price of high-density polyethylene (HDPE) in the US fell by 1% compared to August 2024. In Europe, prices dropped by 3.8% month-over-month to $1.51/kg.

- This downward trend is mainly due to a decrease in ethylene feedstock prices, which has lowered production costs for HDPE.

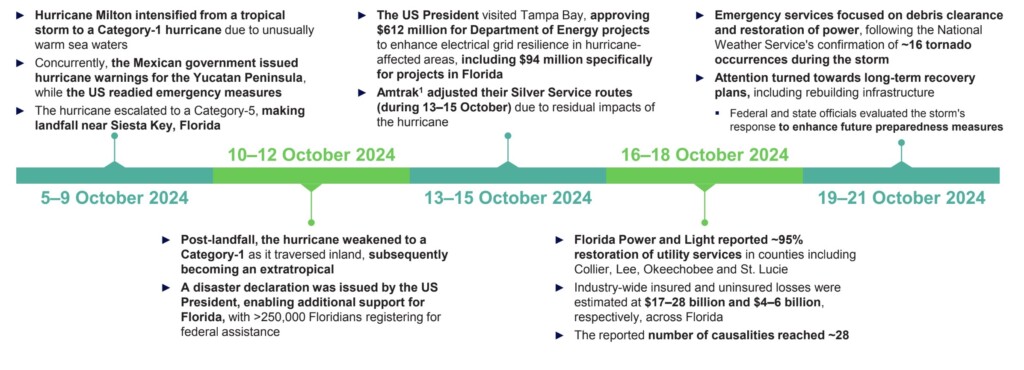

Several US states, including North Florida, North Carolina, and Georgia, experienced infrastructure damage and flooding in late September and early October from hurricanes Helene and Milton.

- These hurricanes disrupted the supply chain in North Carolina and Florida, where major pharmaceutical companies and CDMOs, such as FUJIFILM Diosynth, Pfizer, and Thermo Fisher, have bioprocessing facilities.

- Some healthcare companies, including Baxter and B. Braun, also reported damage to their facilities.

Hurricane Francine hit the Northern Gulf Coast of the US in mid-September 2024, leading to severe flooding and power outages in the area.

- The hurricane forced around 12% of crude oil production and 16% of natural gas output in the US Gulf of Mexico to shut down. Offshore oil and gas producers lost 2.4 million barrels of oil and 4.9 billion cubic feet of gas due to the storm.

Hurricane Milton also caused flooding and structural damage to some port storage facilities along the US Gulf Coast, but base oil production remained stable as the essential infrastructure was mostly unharmed.

Cell and gene therapy (CGT)

Hurricane Milton has caused major disruptions in Florida, USA, affecting many industries across the state.

- This situation is particularly concerning for the cell and gene therapy (CGT) sector, as significant companies like Thermo Fisher, Brammer Bio, and Beacon Therapeutics have CGT facilities in Florida.

- The hurricane could result in facility closures and logistical delays, impacting the production and supply of essential therapies.

The CGT market has also faced challenges in Q2 2024, despite its rapid growth in previous years.

- There were 100 CGT deals in Q2 2024, which marks a 20% decline compared to the previous quarter and a 15% drop compared to the same period last year.

- Financing in the CGT sector fell by 39% quarter-over-quarter, with only 52 transactions reported in Q2 2024.

- Additionally, there were no new approvals for gene therapy or cell therapy during Q2 2024.

Regulatory compliance, submission and audit

Global pharmaceutical companies, especially those in low-cost countries, may have to invest more resources to meet strict regulatory standards from international organizations like the US FDA. This increased scrutiny could lead to higher compliance costs, which might affect their pricing strategies.

- In October 2024, Glenmark Pharmaceuticals, a pharmaceutical company from India, recalled Ryaltris Nasal Spray and over 11,000 tubes of Ciclopirox Gel in the US due to manufacturing defects.

- In September 2024, Dr. Reddy’s Laboratories, another India-based pharmaceutical company, recalled over 100,000 bottles of Ibuprofen tablets in various strengths (800 mg, 600 mg, and 400 mg) from the US market because they did not meet impurity and degradation standards.

Small molecule manufacturing Chemicals and APIs

In early October 2024, Hurricane Milton caused significant disruptions to energy supplies in the affected regions, leading to higher energy costs. This is particularly important for the chemical and API production sectors, where energy is a critical input.

- These disruptions could result in price increases across the chemical and pharmaceutical sectors.

Additionally, Hurricane Milton is likely to affect shipping costs in the short term. Carriers may incur higher expenses due to delays, rerouting, and potential damage to vessels. These increased costs will ultimately be passed on to businesses and consumers worldwide, adding to inflationary pressures.

The cost of chemicals is expected to rise in Q4 2024 as a result of Hurricane Francine in the US and the flooding in central Europe caused by Storm Boris.

- The hurricane led to offshore producers in the US losing 2.4 million barrels of oil and 4.9 billion cubic feet of gas, driving up crude oil prices and downstream chemical costs within the pharmaceutical industry.

The passage of the BIOSECURE Act adds further uncertainty for Chinese chemical manufacturers operating in the US, which is likely to increase overall costs.

APU / Drug discovery and clinical trials

Wages make up more than 40% of the total costs in discovery and clinical research. Given the ongoing shortage of qualified and experienced researchers, operational costs are expected to remain high.

Despite this, the inflation rate showed a slight slowdown in September 2024, offering some temporary relief in costs.

- In the US, the inflation rate held steady at 2.4% in September 2024, compared to 2.5% in August 2024.

- In the Euro area, annual inflation dropped to 1.7% in September 2024, down from 2.2% in August.

Medical devices

On 13 September 2024, the US Trade Representative (USTR) announced final changes regarding the review of tariffs in the Section 301 investigation into China’s trade practices.

- As a result of this legislation, tariff rates are expected to increase in 2025 across various sectors, including the import of medical devices from China. This is likely to disrupt the availability of medical equipment in the US.

- While the tariffs aim to bolster domestic manufacturing, the current US healthcare system may not have the infrastructure in place to handle the sudden rise in demand.

Recently, both the EU and US governments have tightened their scrutiny of products from China, which has affected medical device production and raised costs.

- The US FDA has imposed import bans on four Chinese manufacturers—Jiangsu Shenli Medical Production, Jiangsu Caina Medical, Zhejiang Longde Pharmaceutical, and Shanghai Kindly Enterprise Development Group—due to quality concerns.

- The advancement of the BIOSECURE Act to the US Senate may lead to further bans on additional Chinese medical device manufacturers.

Analytical laboratory and processing equipment

In September 2024, the US Producer Price Index (PPI) for analytical lab instrument manufacturing saw a slight increase of 0.2%. In contrast, the PPI for HVAC and commercial refrigeration equipment dropped by 0.9% month-on-month.

However, the rising costs of lab equipment and ongoing inflation have compelled several diagnostic labs in India, including Metropolis Healthcare and Dr. Lal PathLab, to raise their service prices.

- Diagnostic labs are likely to review and adjust their pricing strategies within the next 12 to 24 months.

Lab supplies and services

Prices of lab supplies are projected to increase due to fluctuating raw material prices

Plastic ware, glassware and reagents

Approximately 65% of the cost of manufacturing lab supplies comes from raw materials like HDPE, glass, and polypropylene.

- In September 2024, the global HDPE market experienced a downturn, particularly in the US, Europe, and Asia.

- In the US, HDPE prices fell by 1% month-on-month compared to August 2024, while European prices dropped by 3.8% month-on-month to $1.50 per kilogram.

- This decline can be attributed to weak demand, an oversupply in the market, and decreasing feedstock ethylene prices, which have all contributed to lower production costs for HDPE.

Additionally, the US Producer Price Index (PPI) for chemicals and allied products decreased by 1.4% month-on-month in September 2024.

Primary packaging

PVC/PET, glass and aluminium packaging

Blister packaging for pharmaceutical products primarily uses raw materials like aluminium, PET, and PVC, with HDPE employed for bulk drums.

- In the second week of October 2024, aluminium prices in London jumped over 2% after Emirates Global Aluminium, a UAE-based manufacturer, suspended bauxite exports from Guinea. Bauxite is a crucial raw material for aluminium production.

- Meanwhile, China’s domestic alumina market is experiencing pressure from local shortages, high costs for imported bauxite, and rising demand, pushing prices to their highest level since 2012.

- These developments are likely to exert upward pressure on aluminium prices.

Biologics and injectable drugs are generally packaged in glass or plastic vials and ampoules.

- The US Producer Price Index (PPI) for flat glass manufacturing increased by 1.8% in September 2024 compared to August 2024. This rise could lead to higher prices across the broader flat glass category.

This category update is powered by The Smart Cube, a WNS Company. For more procurement intelligence, visit Amplifi PRO.

Stay ahead of trends and best practices

Stay ahead of trends and best practices