This report summarises the likely impact of the Israel-Hamas war and other macros events across a range of categories, as of October 2023.

The Israel–Hamas war poses a major geopolitical risk for oil markets, where a further escalation can lead to a rise in oil prices and fuel inflation in the near future, and is likely to disrupt the pharma trade between India and the Middle East.

Here are some the key issues:

- The anticipated increase in the prices of Crude oil and commodity chemical prices overall are likely to be volatile in 2023.

- Transportation costs (Ocean, Air, Freight) are forecast to rise as the Israel–Hamas war, in addition to the existing production cuts implemented by OPEC+ countries, may contribute to a rise in jet fuel prices; this may lead to higher air freight rates globally

- Prices of plastics, such as HDPE and PP, increased in September 2023 and are further expected to witness an uptrend in the next 1–2 months due to a rise in oil prices amid the Israel–Hamas war; this can lead to a rise in inflation in categories such as SUS and lab supplies

- India’s generic drugs market is likely to be majorly impacted by the Israel–Hamas war due to the country’s high exports to the Middle East.

- Prices of pharma R&D categories are expected to increase due to the ongoing shortage of qualified and experienced researchers

- Manufacturing disruptions in Israel’s med-tech space – due to a short-term diversion of resources (for instance, military reservists) and blockades of certain shipping routes – are expected in the future

- The conflict also threatens to disrupt the global semiconductors supply chain as Israel plays a significant role in chip production and innovation

Multinational manufacturer Teva Pharmaceutical (headquarters Tel Aviv) issued a statement to say it does not expect any major impact of the war on its business performance; Israel accounts for ~2% of the company’s global revenue and <8% of its global production. Despite this statement, the company’s shares dipped ~12% as of 9 October as compared with 2 October.

“Production remains largely unaffected, and we maintain contingency plans with backup production locations for key products, much like our operations during the COVID-19 pandemic and previous instances of security unrest.”

Teva spokesperson, October 2023

Israel-based Taro Pharmaceuticals (subsidiary of Sun Pharma) just had 8% of its overall revenue coming from Israel (<1% of Sun Pharma’s total sales); it only has 1 US FDA-approved API facility in Israel. However, if the conflict escalates, the company anticipates disruption of its business activities

If terrorist acts were to result in substantial damage to our facilities, our business activities would be disrupted, since with respect to some of our products, we would need to obtain prior FDA approval for a change in manufacturing site. Our business interruption insurance may not adequately compensate us for losses that may occur, and any losses or damages sustained by us could have a material adverse effect on our business.”

Taro spokesperson, October 2023

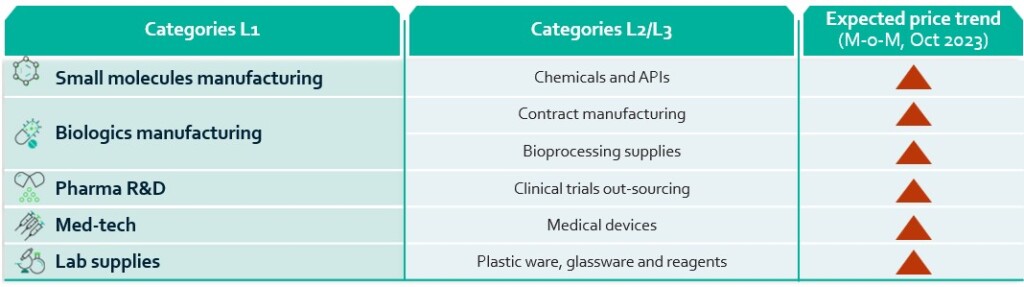

Key issues by category:

The following is a deeper dive into how this is impacting the price of goods in key categories.

Small molecules

The Israel–Hamas war is likely to disrupt the pharma trade between India and the Middle East

Israel is a net importer of pharma products including bulk drugs, intermediaries and biologics

- The value of pharma imports to Israel totalled $108 million in 2022, which accounted for 0.1% of total import flow to Israel

- There will not be any immediate trade impact as Israel has a self-sufficient pharma industry with strong generic drug manufacturers

The Indian small molecules market is likely to be the most severely impacted by the ongoing war in Israel as ~$1 billion trade between India and the Middle East (including the UAE, Bahrain, Oman, Qatar, Egypt and Saudi Arabia) is expected to be disrupted, depending on the scale and duration of the conflict

Contract Manufacturing

The increase in oil and utility prices, and the possibility of supply disruptions due to the Israel–Hamas war, are likely to have an adverse impact on biologics CMOs

Israel has 243 sites that have received approval from the FDA, with Jerusalem serving as the central hub.

- 10% of Israel’s FDA-approved sites for biologics, drugs and medical devices are in Jerusalem; this is one of the areas that is likely to have a greater impact if the conflict continues

In the short term, only the operations of pharma companies operating in FDA-approved sites in the region are expected to be affected, with a potentially greater impact expected in H1 2024 if other regional countries, such as Iran, become involved

- If the conflict continues to escalate, it may result in supply-side issues, potentially affecting services to the Middle Eastern countries

Bioprocessing supplies

Even with the post-COVID-19 easing of supply disruptions, increased capacity of various suppliers and entry of several suppliers in the SUS market, the price reduction has been slow

- According to BioPlan Associates’ annual Biopharmaceutical Manufacturing Capacity and Production market report published in August 2023, 50% of the respondents surveyed by the organisation reported that the prices continued to increase

The SUS market is witnessing an uptick in pricing as raw material (plastics) prices will likely increase in the coming months

- In September 2023, HDPE prices in the US and Europe increased ~6% and ~11% M-o-M, respectively, while US PP prices rose 3.8% M-o-M; in October 2023, plastic (HDPE and PP) prices are projected to increase due to high feedstock prices and tight supply

- The war in Israel is expected to further exacerbate the situation by leading to an increase in oil prices

Clinical Trials outsourcing

The clinical research programmes in Israel will continue unaffected even during the war as the country has contingency plans in place, including a quick transition to decentralised trials if required

- Israel is currently hosting 1,420 planned and ongoing clinical trials, with Phase III trials accounting for 41.13%, Phase II for 27.32% and Phase I for 7.32% of the total trials (Global Data)

Labour costs, which account for >40% of the total cost incurred during drug discovery and clinical phases, are expected to increase further in the US and Europe due to tight labour supply; this could push CROs to increase their tariffs/prices

- Similarly, average hourly earnings in the education and health services sectors in the US increased 0.3% M-o-M in July 2023 and 1.7% Y-o-Y in July 2023

Medical devices

The ongoing Israel–Hamas war, amid other geopolitical complexities, threatens to disrupt the global semiconductors supply chain as Israel plays a significant role in chip production and innovation

Further, Israel has evolved into a major medtech hub due to its government’s support for R&D programmes, including those focussed on medical devices.

- Although manufacturing facilities are continuing to operate despite emergency conditions currently, manufacturing disruptions in Israel’s medtech space – due to a short-term diversion of resources (for instance, military reservists) and blockades of certain shipping routes – are expected in the future

- Israel has 128 US FDA-approved medical devices sites, which remain at the risk of disruption of the conflict continues

Lab suppliers: Plastic ware, glassware and reagents

The lab supplies market faced price fluctuations during 2022 and H1 2023; prices of key raw materials are expected to increase further in Q4 2023

- HDPE and PP prices increased 6.0% and 3.8% M-o-M, respectively, in September 2023; the prices are expected to further rise in October 2023 due to an increase in feedstock prices and fears regarding an oil price increase due to the ongoing war in Israel

- The US PPI for glass and glass products manufacturing witnessed a minor increase of 0.6% M-o-M in September 2023

Logistics – Road/truck freight

Road freight rates are likely to rise due to an expected hike in crude oil prices, driven by the Israel–Hamas war and oil production cuts.

Spot rates for vans in the US declined 13.9% Y-o-Y in September 2023 due to falling demand as well as rising trucking capacities

- However, the rates witnessed a slight increase of 1.6% M-o-M despite a minor fall in demand/load, as indicated by a relatively lower load-to-truck ratio of 2.78 in September 2023 as compared with 2.83 in August 2023

Diesel prices – a key cost driver for road freight – continue to rise due to the expectations of an improved economic outlook for the US and depletion of already low oil inventories (largely driven by sharp production cuts in 2 of the world’s largest oil producers – Saudi Arabia and Russia)

- In September 2023, Saudi Arabia extended its production cut of 1 million b/d till the end of December 2023, and Russia pledged to cut its exports by 0.3 million b/d from September to December 2023

- The ongoing Israel–Hamas war and the prospect of neighbouring oil-producing countries (such as Lebanon, Iran and Jordan) joining the war may further reduce oil production and supply; this will likely adversely impact freight rates globally

Total volume of production cuts in OPEC+ are expected to account to 5 million b/d (~5% of global supply) over September–December 2023.

Logistics – Air freight

Air freight rates are also likely to rise due to an expected hike in jet fuel prices amid the Israel–Hamas war and oil production cuts.

Shippers are benefitting from an overall fall in general air freight amid a continuous weekly decline in jet fuel prices (from $135 bbl in the week ending 15 September 2023 to $121.6 bbl in the week ending 6 October 2023)

- However, the Israel–Hamas war, in addition to the existing production cuts implemented by OPEC+ countries, may contribute to a rise in jet fuel prices; this may lead to higher air freight rates globally

As per Norman Global Logistics (a UK-based logistics company), global air cargo markets did not witness any significant movements in price or demand in September 2023

- Trade lanes between China and the US, and Southeast Asia and the US were the only 2 key lanes that recorded growth, with air cargo spot rates surging 3% and 4%, respectively, on these corridors

In September 2023, the purchasing managers’ index (PMI) of most large countries, such as the US and China, was >50 – indicating an improvement in global manufacturing production; this may positively impact exports, thereby increasing demand for air cargo.

Demand drivers for air cargo (such as trade volumes and export orders) continue to be weak; shorter delivery times and a rising PMI are indicating growing economic activity

- Buyers should monitor the category closely amid these mixed, contradictory signals and strengthening demand

Logistics – Ocean freight

Ocean freight rates are anticipated to rise in Q4 2023 amid increasing demand, diesel prices and congestion in the Panama Canal.

The intensifying Israel–Hamas war is leading to a growing backlog of ships at ports near Israel and Gaza by resulting in operational risks at these ports

- The Port of Ashdod, a vital port situated near the Gaza border, has restricted the transport of hazardous materials; the Port of Ashkelon, Gaza’s nearest terminal, has stopped operations due to missile attack threats

- Although the Port of Haifa, Port of Hadera and Port of Eilat are operational, they are facing longer wait times due to a shortage of workforce and increased security checks

- The Port of Ashdod and Port of Haifa account for only 0.4% of the global container throughput; however, the expansion of the conflict beyond Israel’s border may impact critical shipping routes, such as the Suez Canal and Strait of Harmuz (the narrow channel that connects the Persian Gulf with the Gulf of Oman and Arabian Sea is a vital choke point for oil supply as >one-fifth of the global oil supply is transported through it)

Moreover, crude oil prices are also increasing amid OPEC+ production cuts as well as rising demand for crude oil for transport and trade activities, adversely affecting diesel prices; this may increase ocean freight rates in the coming months

Further, in July 2023, Panama Canal, which facilitates the movement of 40% of the global cargo ship traffic, was hit by a drought; the US is its main source of traffic, with ~72% of the cargo passing through the canal either originating from or arriving at a US port

- This has resulted in reduced daily operations carried out via the canal, causing delays and traffic congestion at sea

- Congestion in the Panama Canal is impacting the US–China dry bulk trade and inter-LATAM trade as the canal is a crucial choke point in the region; this impact is likely to intensify in Q4 2023

- Moreover, ocean container rates will depend on weather conditions and reservoir replenishment; currently, ocean carriers are able to bypass this bottleneck via the Suez Canal, with ~1 week of additional lead time

This category update is powered by The Smart Cube, a WNS Company. For more procurement intelligence, visit Amplifi PRO

Stay ahead of trends and best practices

Stay ahead of trends and best practices