Trend Briefing: “China-Proofing” the Pharma Supply Chain

Life sciences supply chains are moving out of China. Here are the key points you need to know.

Life sciences companies have traditionally relied heavily on China as a key source for raw materials, intermediates, active pharmaceutical ingredients (APIs), packaging, and other inputs required for manufacturing pharmaceuticals, medical devices, and consumer healthcare products. The scale, cost efficiency and robust manufacturing capabilities made China an attractive sourcing destination.

However, the COVID-19 pandemic and other recent supply chain disruptions have triggered a rethink in regions like the US and Europe about overdependence on China. Governments are now pushing policies and incentives to boost domestic manufacturing and reduce reliance on Chinese imports.

Supply chain disruptions have triggered policy changes

The COVID-19 crisis exposed vulnerabilities in global supply chains centred in China. Lockdowns and production halts in early 2020 led to acute shortages of pharmaceutical ingredients, stalling manufacturing across the world. These disruptions, coupled with the ongoing US-China trade war, have catalysed efforts to reshape supply chains.

Reducing supply chain reliance on China is a key priority for the US government, where legislators have introduced several bills over 2021-2023 urging domestic production. Laws such as the Pharmaceutical Supply Chain Risk Assessment Act are part of efforts to restrict access to federal healthcare programs for drugs with Chinese APIs and offer benefits like tax credits for local manufacturing. The FDA will maintain lists of China-sourced pharmaceuticals and require more frequent disclosures from overseas producers.

“The US drug supply chain was vulnerable to interruption because ~80% of all fine chemicals come from China. We have a much broader dependence on China than I think most people realize for a wide range of products including medicine.”

Willy Shih, Professor at Harvard Business School

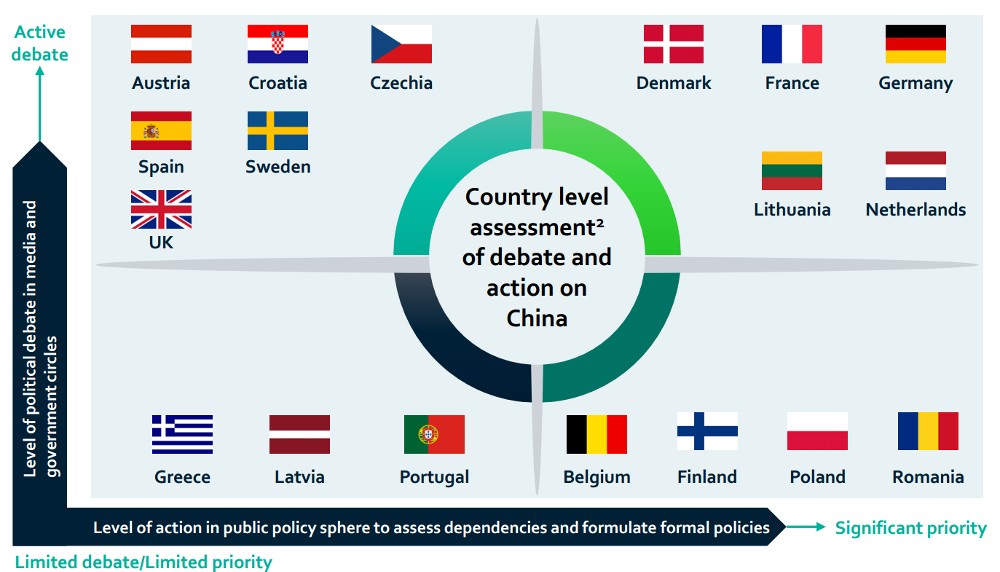

Parallel policy discussions are underway in Europe about boosting self-reliance in drug ingredients. In 2021, the EU began assessing its pharmaceutical supply chain risks and set up the Health Emergency Preparedness and Response Authority (HERA) to monitor threats and strengthen domestic capabilities. In 2023 both France and Germany announced their own strategy to reduce dependence on China.

This diagram shows country-level assessment of debate and action on China in general and not related solely to Life Sciences.

Source: The Smart Cube

Operational strategies to reduce reliance on China

Modifying sourcing and operational strategies will be required to effect the move away from China

Pharma companies have two main options to respond to this changing market landscape:

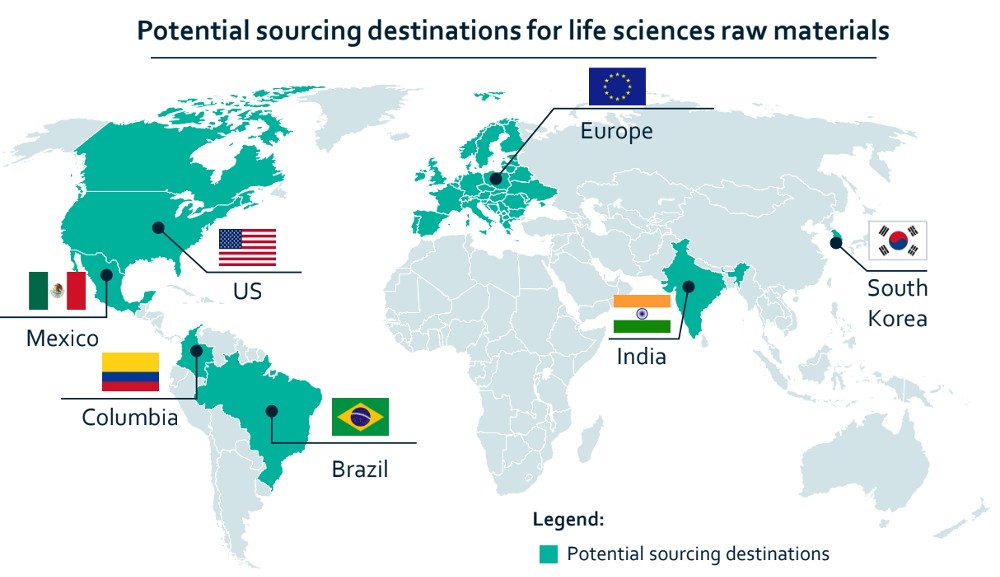

- Leverage Alternative Sourcing Locations

In the medium term, life sciences players can tap alternative sourcing locations like Mexico, Brazil, India and South Korea where governments are incentivising investments in manufacturing capacity. US authorities are engaging with several countries to diversify sourcing.

For instance, India has unveiled production-linked incentives for pharmaceutical manufacturing since 2020. Firms like Sun Pharma and Dr. Reddy’s have expressed interest in building new plants.

Source: The Smart Cube

However, China currently meets a major share of raw material demand. Complete self-sufficiency will take time to develop.

2. Focus on domestic manufacturing capabilities

Companies are also likely to consider insourcing production of critical but low volume APIs and intermediates as a long-term strategy.

Some like Novo Nordisk, GSK and Eli Lilly have recently announced major investments to expand in-house manufacturing at sites in Europe and the US.

“The geographic concentration of the supply chain was a primary concern for our company way before the COVID-19 pandemic started…Dipharma has sought to geographically diversify its sources and started in-house production of selected raw materials to minimize exposure to shortages.”

Andrew Gradozzi, former API business leader at Dipharma

The shift will be gradual

While reducing dependence on any one source is a wise supply chain strategy, China’s dominance in life sciences cannot be displaced rapidly. Alternative countries need time to build technical capabilities and scale. Firms also have significant capital already invested in China.

But clear government policy priorities, especially in the US, will compel companies to expand local production and diversify sourcing. Tax benefits, federal procurement preferences and pressure to onshore manufacturing will accelerate this shift.

Executives need to adopt a phased, long-term approach to making their supply chains “China-proof”.

This report is powered by The Smart Cube a WNS Company. Find out more on their website.