“The Basel cluster has such a long history—it’s about chemistry meeting innovation, trading roots, and an open mindset. That unique mix created something remarkable.”

Dr. Christof Klöpper, CEO of Basel Area Business & Innovation, brings a rare combination of academic rigour and practical experience to understanding biotech ecosystems. With a doctorate focused on innovation processes in biotechnology from the University of Basel and years leading the region’s business development efforts, he has helped Basel emerge as one of Europe’s most concentrated life sciences superclusters—home to over 800 companies and 33,000 professionals.

In the latest PharmaSource podcast, Christof explains how Basel evolved from silk production and chemicals in the 1800s to become a global pharmaceutical powerhouse, what makes the region uniquely attractive for biotech companies, and why the ecosystem continues to outpace most European competitors.

From Dye Stuff to Drug Development: Basel’s Manufacturing Heritage

Basel’s pharmaceutical dominance has deep historical roots that continue to shape its competitive advantages today. The cluster began with textile manufacturing requiring chemical dyes, attracting innovators from across Europe to a city already known for its openness to new ideas.

“It really started early, like many clusters in pharmaceutical and chemical industry,” Christof explains. “The beginning was having a textile industry, needing dye stuff, having innovators coming from different countries—many from Germany and France—then coming to Basel and starting innovating in the field of dye stuff, meaning chemicals.”

The Rhine River played a crucial dual role—first as a waste disposal system for the chemical industry, then later as the recreational centrepiece it is today. This industrial foundation eventually transformed into pharmaceutical expertise as chemical companies shifted focus.

The consolidation of giants like Ciba-Geigy and Sandoz into Novartis in the late 1990s marked a critical inflection point. “Novartis became the pharmaceutical part, and Syngenta the agro-sciences. The chemical part went into different companies—Clariant is one of them, and BASF which took over Ciba in 2009 is another,” Christof describes.

This created a cluster of large companies spanning chemicals, agro science, and pharmaceuticals—providing the foundation for what would follow.

The Entrepreneurial Turn: From Corporate Spinoffs to Global Ecosystem

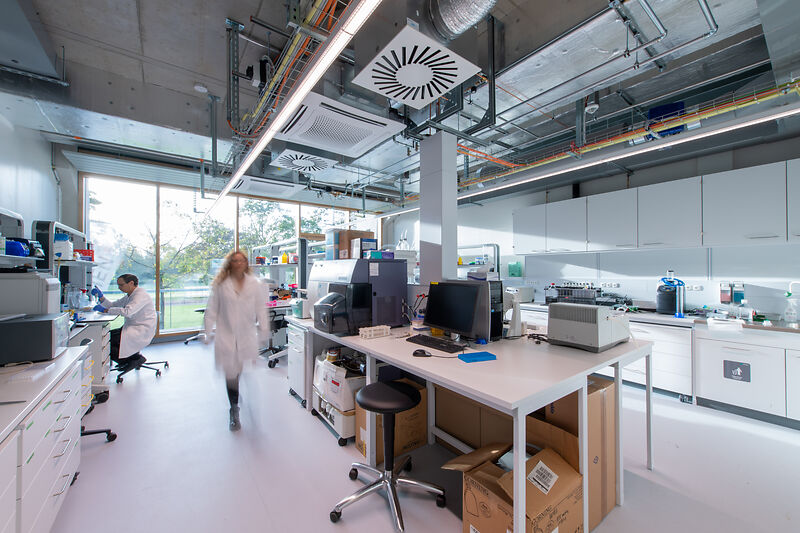

The past two decades have witnessed Basel’s transformation from a corporate manufacturing hub to a vibrant entrepreneurial ecosystem. Between the towers and campuses of pharmaceutical giants Roche and Novartis,, a dynamic startup culture has emerged.

“Over the last 20 years between the campuses and towers of these large companies, you saw suddenly a move to entrepreneurialism —so many startups,” Christof notes.

The acquisition of Actelion by Johnson & Johnson for approximately $30 billion exemplifies the scale of success possible in the Basel ecosystem. This landmark deal not only validated the region’s entrepreneurial potential but also brought another pharmaceutical multinational into the cluster.

Today’s ecosystem includes a mix of corporate spinoffs, independent biotechs, and international companies attracted by Basel’s unique advantages.

The academic landscape has evolved alongside industry growth. While the University of Basel provides the historical foundation, newer institutions like ETH Zurich’s Life Sciences department D-BSSE and privately funded institutes including the Friedrich Miescher Institute and Roche’s Institute of Human Biology have expanded research capabilities.

The Botnar Institute for Immune Engineering represents the latest evolution, with a CHF 1 billion endowment dedicated to bringing the world’s best immune engineering researchers to a single Basel location.

Basel vs. Boston: Different Strengths, Shared Ambitions

When benchmarking against global competitors, Christof identifies Boston as Basel’s closest comparable, whilst acknowledging important differences in how each cluster developed.

“Boston is a benchmark of where we want to be,” Christof acknowledges. “Boston’s concentration of very good universities with an entrepreneurial spirit is fantastic.”

Basel’s competitive advantage lies in its industry-first development model rather than purely academic origins. “Basel comes actually more from this industry environment of having Roche and Novartis and the other companies,” Christof explains. “While we do have academic excellence here, maybe it is not as pronounced as in Boston.”

This creates a unique strength: Basel offers the complete pharmaceutical value chain from R&D through company headquarters to production sites. “I think that is an advantage,” Christof emphasises. “You would also have R&D in Boston, but here in Basel we also have the company headquarters and the production sites.”

Within continental Europe, Basel stands apart from other clusters in Germany and France. “It’s really different to other European clusters mainly in the sense that Switzerland tends to be more American in terms of economic policy.”

Lower taxes, business-friendly labour laws, and less government intervention create an environment easier for international companies to understand and navigate than many European alternatives.

Addressing the Funding Gap: BaseLaunch’s Early-Stage Solution

Despite Basel’s strengths, European venture funding remains a persistent challenge compared to the United States and China. Basel has developed targeted interventions to address this weakness.

“Europe is a bit behind the US,” Christof admits. “Switzerland is OK in comparison at least to continental Europe It’s not on the level of Germany or France, but we see a much higher level of investment into companies.”

BaseLaunch, the early-stage incubator operated by Basel Area Business & Innovation, specifically targets the funding gap between scientific breakthrough and Series A investment. “We try to bring early projects to an A round because we believe that is a phase where we lose a lot, because funding is so hard in Europe for the seed and pre-seed phases,” Christof explains.

BaseLaunch has demonstrated significant success, with approximately CHF 1 billion invested into the 28 projects it has incubated. The model works by attracting promising science from across Europe, helping scientists transform research into companies, and providing access to Basel’s talent and funding networks until the company can raise a Series A round.

“These companies need to be also in Basel,” Christof explains. “It’s good for them to be in Basel because the talent base and access to funding is good. But they can also keep research labs at their home university.”

The CDMO Concentration: History Meets Cluster Effects

Basel has emerged as a major hub for contract development and manufacturing organisations, including established giants like Lonza and Bachem alongside growing companies like Primopus, Celonic, Corden Pharma, and ten23 health.

This concentration reflects both historical factors and modern cluster dynamics. “I think it’s a mix,” Christof explains. “History has a part—a company like Lonza has been in Basel for a very long time. It has its history in the valley in the Alps, where they use the energy of the Lonza river that gave the company its name.”

But cluster effects have driven more recent CDMO establishment. “For many of the others, I think in the end it’s a cluster effect,” Christof notes. “You have companies here. These companies need the services of these CDMOs, or they have people in their teams that in the end would like to have their own company.”

He cites examples like Bachem, founded by someone already active in the cluster, and ten23 health, launched by Hanns-Christian Mahler from Lonza. “Suddenly you have this cluster effect of having companies who create demand for the services, but you also have people with an entrepreneurial mindset establishing the next company.”

The presence of pharmaceutical manufacturers creates natural demand for CDMO services, whilst also providing experienced professionals who may launch their own specialised manufacturing companies. “This creates this environment,” Christof concludes, describing the self-reinforcing cycle that has built Basel’s CDMO ecosystem.

Navigating Geopolitical Uncertainty: The European Perspective

Whilst global headlines focus on US reshoring initiatives and tariffs, Basel continues attracting investment interest despite broader European funding challenges. Christof reports steady interest levels even as decision-making timelines have extended.

“We see all the promises to invest now in the US—they have to be done,” Christof observes. “For sure they are connected to the policies in the US, to the market activity in the US, which is important that this remains, and connected to the price level.”

Basel continues receiving strong interest from potential investors, though converting that interest into actual investment commitments has become more challenging. “We still see that the interest stays extremely high,” Christof notes. “It’s a bit harder than in previous years to turn interest into a decision to then really invest.”

Companies understandably hesitate to make major investment decisions amid policy uncertainty. “Times are relatively uncertain currently,” Christof acknowledges. “We see that regarding tariff levels, so we feel there’s a lot of changes coming. In that situation, companies are a bit more reluctant to invest.”

Interestingly, Asian companies show growing interest in Basel operations, potentially influenced by US-China tensions. “From the Asian side, we feel rather growing interest and more decisions coming to Basel, maybe also a bit connected to the global situation with US and China,” Christof reveals.

Looking Forward: Digital, Diverse, and Agile

When asked about Basel’s trajectory over the next five years, Christof anticipates continued ecosystem expansion with increasing diversity of players beyond the two pharmaceutical giants.

“I believe this regional supercluster will further go into this direction of an ecosystem,” Christof predicts. “The players around the two large ones—I think they will further gain in significance.”

Significant real estate investment is creating multi-tenant facilities crucial for ecosystem health. “We see a lot of investment currently going into the real estate space, where many developers build now facilities for many tenants,” Christof notes. “That development I believe will go on.”

Digital transformation of drug development will reshape infrastructure requirements. “For sure we will see changes in how drugs are developed—it will become more digital,” Christof predicts. “We also see more and more companies here in this field.”

The ETH Zurich institute in Basel focusing on the intersection of digital technologies and lab work could become a lighthouse attracting companies working at this interface. “I think we will see a change that also will bring change to drug development and the infrastructures we will need,” Christof explains.

Asian companies will likely play an increasingly important role in the Basel ecosystem. “The region is becoming more attractive for Asian players,” Christof observes. “We see a lot of interest for them to be connected to the global players. I think we will see a bit of a change of more Asians—maybe Europeans and Americans stay at the same level.”

Despite rapid global changes creating uncertainty, Christof remains confident in Basel’s ability to adapt. “Currently everything changes so quickly, so we have to stay agile,” he concludes, emphasising flexibility as the essential characteristic for navigating an unpredictable future.