- WuXi XDC has signed an MOU with Standard Chartered China to establish a strategic partnership supporting global expansion, investment, and financial operations.

- Standard Chartered China will provide cross-border financing, settlement, and supply chain financial services to advance WuXi XDC’s bioconjugate CRDMO activities.

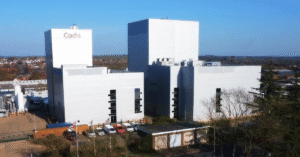

WuXi XDC Cayman Inc. (WuXi XDC), a global contract research, development and manufacturing organisation focused on the bioconjugate sector, has entered into a Memorandum of Understanding with Standard Chartered Bank (China) Limited to establish a comprehensive strategic partnership. The collaboration is intended to support WuXi XDC’s global business development, domestic and international strategic planning, and the broader bioconjugate ecosystem.

Under the MOU, Standard Chartered China will provide financial support for WuXi XDC’s global investment and financing activities, including overseas project construction. The bank will offer services such as cross-border settlement and foreign exchange risk management to facilitate secure and efficient financial operations.

According to the press release, the partnership will also enhance WuXi XDC’s financial flexibility through cross-border cash pooling, direct connectivity between bank and enterprise systems, and cash management solutions. The two organisations will explore supply chain finance models to support the research, development, and manufacturing of bioconjugate drugs, including sustainable finance approaches.

“This strategic partnership with Standard Chartered China will provide robust financial support for our global expansion, cross-border trade, and domestic and international strategic planning.” He said the collaboration would also advance innovation in sustainable and digital finance.

Mr Michael Xi, chief financial officer of WuXi XDC

WuXi XDC provides end-to-end CRDMO services for bioconjugate drugs, supporting programmes from concept through commercialisation. As of 30 June 2025, it had supported nearly 100 IND submissions and partnered with 13 of the top 20 global pharmaceutical companies across various stages of development. The press release states that the company holds more than 22% of the global market by revenue, with the highest number of active projects in the sector.