AstraZeneca has announced a $15 billion investment in China through 2030 to expand medicines manufacturing and research and development capabilities, with a strategic focus on cell therapies and radioconjugates. The announcement came on Thursday, 29th January during UK Prime Minister Keir Starmer’s official visit to Beijing, marking the pharmaceutical industry’s largest commitment to the Chinese market in recent years.

The Anglo-Swedish drugmaker’s CEO, Pascal Soriot, who accompanied Starmer as part of a 54-member business delegation, described the investment as “an exciting next chapter” for the company in its second-largest market. China currently accounts for approximately 12% of AstraZeneca’s total revenue.

“China has become a critical contributor to scientific innovation, advanced manufacturing, and global public health,” Soriot stated. “By expanding our capabilities in breakthrough treatments like cell therapy and radioconjugates, we will strengthen our contribution to China’s high-quality development and, most importantly, bring next-generation modalities to patients.”

Strategic Focus on Advanced Therapeutics

The investment will significantly enhance AstraZeneca’s capabilities in novel modalities, with particular emphasis on cell therapy and radioconjugates—areas where China has demonstrated strong scientific capabilities. Building on its 2024 acquisition of Gracell Biotechnologies, AstraZeneca will become the first global biopharmaceutical company with end-to-end cell therapy capabilities in China.

The funding will support:

- Development of treatments for cancer, blood disorders, and autoimmune diseases

- Expansion of drug discovery and clinical development infrastructure

- Enhancement of manufacturing capacity across multiple sites

Expanding R&D and Manufacturing Footprint

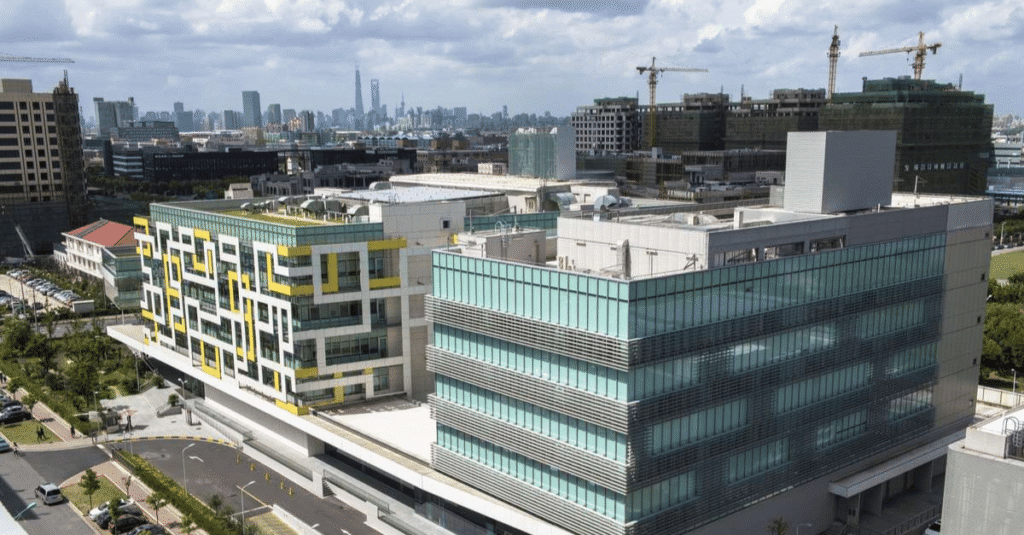

AstraZeneca maintains a substantial presence in China, operating two of its six global R&D centers in Beijing and Shanghai. These facilities have led 20 global clinical trials to date and collaborate with more than 500 hospitals across China. The company also operates four manufacturing sites in Wuxi, Taizhou, Qingdao, and Beijing, which supply medicines to China and 70 markets worldwide.

The investment will expand the company’s China workforce to more than 20,000 employees, further solidifying its position as the largest foreign drugmaker in the country.

Building on Three Decades of Chinese Operations

This $15 billion commitment represents AstraZeneca’s largest single investment in China, where the company has operated for more than 30 years. The announcement follows a series of substantial investments under Soriot’s leadership, including a $2.5 billion commitment to establish a global R&D center in Beijing announced in 2025, and a $1 billion investment fund created in 2019.

Strategic Partnerships with Chinese Biotech

AstraZeneca has actively pursued partnerships with Chinese biotech firms developing early-stage experimental drug candidates. The company has signed more than a dozen deals with Chinese biotechnology companies, including Harbour BioMed, CSPC Pharmaceutical, Jacobio, AbelZeta, and Syneron Bio, alongside its investment in Syneron Bio.

These collaborations reflect China’s growing role as a source of innovative drug assets, a trend highlighted by executives at the JPMorgan Healthcare conference earlier this month.

Industry and Economic Context

The investment announcement carries broader strategic significance amid evolving geopolitical relationships. Starmer characterized the drugmaker’s expansion as beneficial for British manufacturing, noting it will “help the British manufacturer continue to grow—supporting thousands of UK jobs.”

On a November earnings call, Soriot observed that pharmaceutical innovation is “happening in the U.S., very rapidly now it’s happening in China, and there’s not so much in Europe,” citing China as evidence of how the life sciences sector can drive economic growth.

AstraZeneca’s commitment contrasts with some rival drugmakers that have divested Chinese assets following supply chain disruptions, economic slowdown, and competitive pressures in China’s centralized drug procurement program. The company’s CFO Aradhana Sarin noted in November that growth in China had been “strong throughout the year.”