As the pharmaceutical industry enters 2026, manufacturing leaders face a complex landscape shaped by geopolitical uncertainty, capacity constraints, and evolving therapeutic modalities.

We asked senior executives across the sector what they see ahead—and their predictions reveal an industry bracing for continued volatility while seeking strategic stability.

The Macro Picture: Cautious Optimism Amid Uncertainty

The pharmaceutical sector enters 2026 with mixed signals. While most remain confident in their own organizations’ prospects, only 41% of life sciences executives feel optimistic about the global economy, according to Deloitte’s 2026 outlook.

Marine Joly-Battaglini, Founder of Pharma Dev Consulting, sounds a cautious note: “My impression is that it is very hard to predict what is going to happen in 2026. Many are hoping for a rebound and better times, mostly for biotechs. Many are also hoping to be able to get funding and pursue the projects they are working on.”

More positively, Raman Sehgal, Host of Molecule to Market, expects a year of incremental growth in the sector.

“Stability will be key. A stable environment will drive measured investment and flow through to pharma services. As always, there will be winners and losers across different segments and modalities, but on the whole, a better year than the previous few.”

US Policy Uncertainty: Tariffs and Pricing Pressures Loom Large

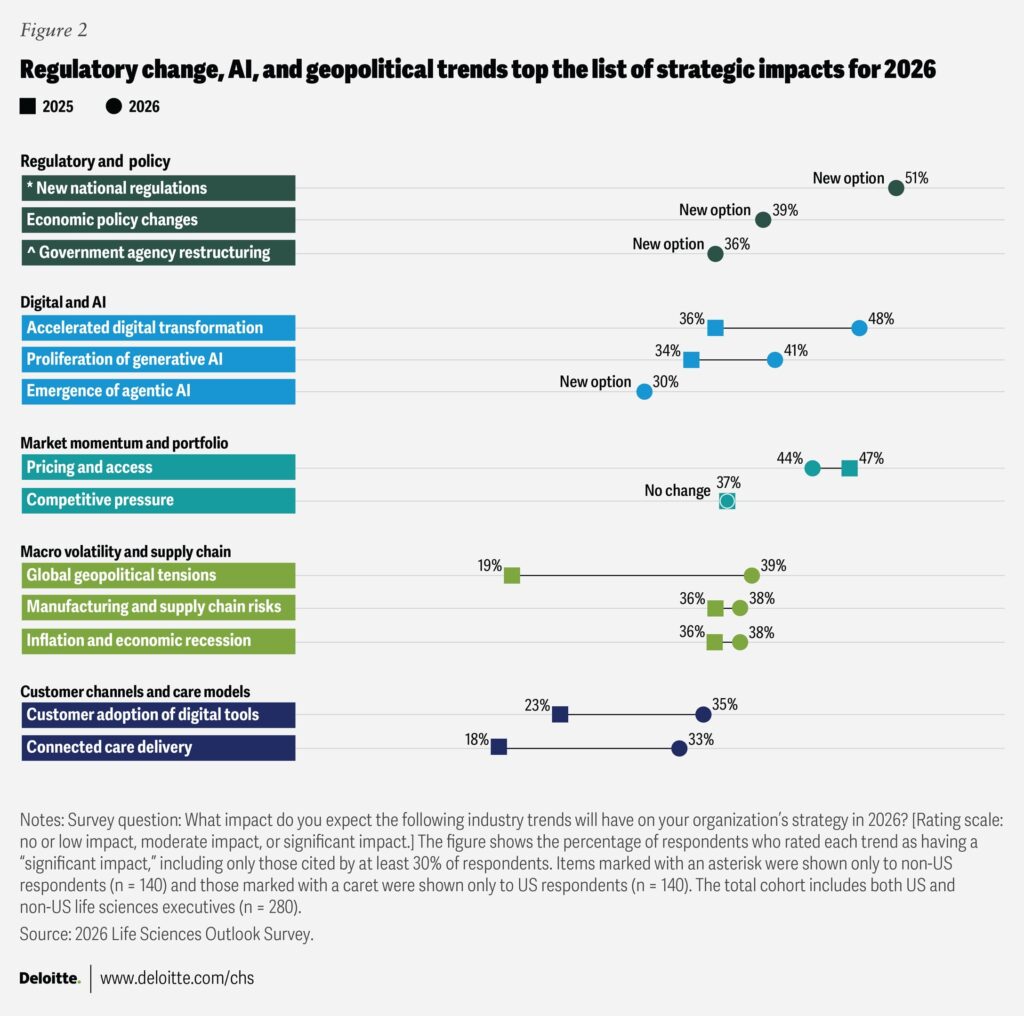

Trade policy and pricing reforms continue to dominate strategic discussions, creating uncertainty for global supply chains and business models. The same Deloitte study highlights that industry leaders expect new national regulations to have the greatest impact on their business in 2026.

Malik Akhtar, Chief Procurement Officer at Bayer, predicts “the further impact of tariffs and much of the talk about localized US manufacturing becoming reality” will define 2026.

While major pharmaceutical companies have largely secured exemptions from broad tariff applications, the threat of targeted measures and Most Favored Nation (MFN) pricing policies creates ongoing strategic uncertainty.

MFN proposals, which would tie US drug prices to those in other developed nations, could fundamentally reshape pharmaceutical economics and manufacturing investment decisions.

Fabrice Le Garrec sees broader consequences: “An even bigger pressure on costs and profitability for big pharma in the wake of many patent cliffs coming up and China pharma players becoming more aggressive than ever, pushing even more manufacturing work to CMOs and continuing downsizing of big pharmas with weak or uncertain pipelines.”

Le Garrec also warns: “Europe will be forced to put up protectionist measures against aggressive nations to avoid getting its pharma industry wiped out within 10 years. In the context of high geopolitical instability, trading blocks will be forced to reform and nationalist views are exploding everywhere—time to go very fast local to local to avoid losing your skin.”

Biotech Funding: Capital Efficiency Becomes Paramount

The funding environment for biotechs remains challenging heading into 2026, with investor focus shifting dramatically toward capital efficiency and clear paths to value creation.

Audrey Greenberg describes the new reality: “Fund what creates option value. In 2026, investors want clarity on manufacturability, cost trajectory, and regulatory readiness. CMC leads should prioritize: critical path analytics and comparability; early de-risking of upstream bottlenecks; manufacturability studies that forecast cost of goods at Phase II. Cut everything that doesn’t accelerate a milestone or materially influence valuation.”

“Teams are lean, capital is finite, and CMC must be built for speed without compromising regulatory credibility. We structure programs around platform-first thinking (don’t reinvent assays), early CDMO partnership selection based on technical adjacency, and a staged data package strategy that avoids premature scale-up. Virtual biotechs often overbuild too early; our approach is to treat CMC as an asset, not a cost center, designed to accelerate inflection points.”

The days of abundant capital for exploratory work have given way to rigorous scrutiny of every dollar spent, with investors demanding proof that CMC investments directly contribute to inflection points that drive valuation.

Capacity Constraints: The Continuing Bottleneck

Manufacturing capacity—particularly for biologics and fill-finish operations—remains tight heading into 2026. Analysts note demand for “tight capacity for biologic drug substance and fill/finish” and “growing demand for U.S. capacity,”

Stephen Sheehan, Director of External Development & Manufacturing at Alkermes, offers detailed predictions:

“CDMO capacity will stay tight—and timelines will be ‘planned,’ not promised. Expect this as a norm in 2026 as CDMOs balance multi-program demand and specialist equipment constraints. Specialized unit operations (e.g., micronization under containment) become a bottleneck.

For OEB-4/HPAPI work, access to qualified jet milling (with robust IPC methods) will drive slot scarcity and longer lead times. Validation strategies trend toward multi-batch to derisk scale-up.”

Capacity as Competitive Advantage—and Valuation Driver

The capacity crunch has elevated manufacturing capability from operational detail to strategic asset, particularly for biotechs seeking funding.

Greenberg explains: “Capacity is now part of the valuation model, not an afterthought. Investors are scrutinizing CDMO availability, lead times, and the concentration risk of single-source suppliers. A biotech with secured capacity and a credible scale path commands a premium; one relying on hope and queue-jumping pays for it in discounted valuations and delayed timelines. Capacity certainty is market currency.”

This represents a fundamental shift in how biotechs must approach CDMO relationships. Securing manufacturing slots early—and demonstrating a credible path from clinical to commercial scale—now directly impacts fundraising success and company valuation.

Stefan Fath raises an important regional question: “In my perspective, 2026 will be interesting to see how the US capacity expansions will influence European manufacturing landscape. Will we see overcapacity, especially in sterile fill and finish where crazy investments happened? Will we see shutdowns and closures? M&A and increased CDMO outsourcing?”

The Partnership Evolution: From Transactions to Strategy

A clear theme emerges from expert predictions: the shift from transactional CDMO relationships to strategic partnerships.

Marta Kijanka, Founder of MK Bio Consultancy, predicts “sponsors will favor CDMOs with proven regulatory track records and experience in given modality.”

“Cost pressure and supply chain resilience will remain top concerns.”

Matthew Holt, Co-Founder and Managing Director at Collaborative Sourcing, sees a reckoning ahead:

“In 2026, pharma companies will realize that a light-touch approach to supplier relationship management with CDMOs will become their biggest liability. They have outsourced the development and production, but they have lost oversight of the deeper supply chain.”

Holt argues companies “must reclaim oversight of areas such as risk management, cost optimization, quality, and ethical practices if they are to maintain quality and speed-to-market. This will require a focus on communication, governance, collaboration, and genuine partnership building.”

AI and Digital Transformation: The Widening Digital Divide

While executives express growing interest in AI adoption, the reality of digital maturity in pharma manufacturing reveals a stark divide between aspiration and implementation.

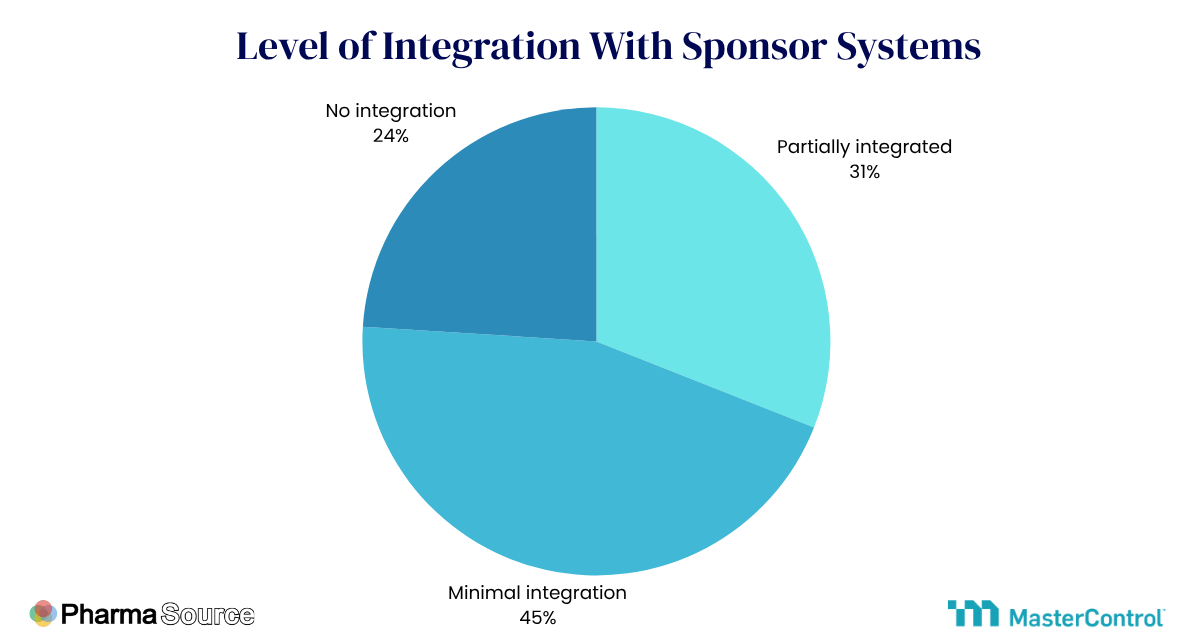

Recent research from PharmaSource and MasterControl reveals the challenge facing the industry: 60% of CDMOs operate at preliminary digital maturity levels even as 92% report sponsors are now raising digital requirements in negotiations. Despite this, the level of integration with sponsor systems remains low.

Contract manufacturing organizations recognize digital value but face resource constraints, legacy infrastructure, and the unique complexity of digitizing environments where compliance failures carry existential risks.

Lana Radosevic predicts “more AI tools incorporated for S2P activity within the ERP systems,” while Harch Ooi notes simply: “companies expressing an interest in leveraging AI more.”

Sheehan predicts that “internal systems/process maturity will be a competitive differentiator. Teams that industrialize demand/supply planning and cross-functional communication (SharePoint hubs, standardized dashboards, monthly D&OP cycles) will translate CDMO ‘planned dates’ into realistic integrated plans faster—and absorb protocol/clinical changes with fewer expedites.”

For 2026, the message is clear: digital readiness is shifting from competitive advantage to market requirement. Resource-constrained organizations must deploy capabilities with surgical precision.

Modality-Specific Predictions

Small Molecules & Oral Solids: Strategically Important Again

Small molecules are experiencing renewed strategic importance, particularly in the obesity/metabolic space following the FDA approval of oral Wegovy on December 23, 2025.

Stephen Sheehan predicts: “Modalities: small-molecule HPAPI & complex solid dosage operations stay hot; precision particle engineering rises.”

This creates manufacturing implications including growing demand for oral solid dose production, API scaling, and specialized capabilities for high-potency compounds.

Kyriakos Kansos and George Ntortas of Fuliginous Management Consulting “Small molecules will remain highly relevant, but innovation will sit largely in high-potency oncology, CNS, and orphan indications. Combination products, PFS/cartridges, and long-acting injectables are shaping capacity decisions. We need to keep in mind that new products come with small sales volume that do not require big manufacturing capacity.”

- Read their full article: Four Forces Reshaping Pharma Outsourcing in 2026

GLP-1: The Scale Modality

The obesity market represents perhaps the most significant commercial opportunity in 2026. Beyond the oral Wegovy approval, the CMS BALANCE model launches in May 2026 for Medicaid, with an interim Medicare GLP-1 demonstration beginning July 2026 and full Medicare Part D implementation in January 2027.

This represents a major expansion of access to these medications, with significant manufacturing demand implications.

Manufacturing implications include accelerated investment in API and oral solid dose capacity, continued pressure on injectable fill-finish capacity, and emphasis on supply assurance and regional manufacturing.

Biologics / mAbs: Capacity is the Story

Biologics continue dominating pipelines, but expansion remains constrained by capacity. Analysts highlight “tight capacity for biologic drug substance and fill/finish” and rising demand for U.S. capacity as defining characteristics of the 2026 market.

Expect continued emphasis on US/EU regional capacity, multi-site redundancy, and integrated CDMO offerings to address these constraints.

Biosimilars: Volume Growth Plus Affordability Pressure

Continued expansion of biosimilar adoption will be driven by payer incentives and patent expiries, with competitive pricing pressure intensifying.

Research and Markets projects the biosimilars market at approximately $38.12B in 2025, growing to roughly $122B by 2034 (13.8% CAGR), though market size numbers vary significantly by publisher definition.

Manufacturing implications include demand for cost-efficient biologics capacity, with analytics/comparability and operational efficiency becoming key differentiators.

Cell & Gene Therapy: Selective Scaling Plus Industrialization Pressure

Cell and Gene Therapy (CGT) faces a critical juncture in 2026, with the challenge is no longer the science; it’s industrialization.

Audrey Greenberg “CGT developers are hitting a wall where process robustness, supply-chain variability, and capacity specialization collide. The cost of goods remains structurally too high, and variability across sites, especially in viral vector production, continues to impede scale-out. In 2026, the differentiator will be developers who adopt industrial engineering rigor early: modularized CMC, standard vector platforms, and automated analytics to tighten release timelines.”

Manufacturing implications include ongoing push toward automation, closed systems, higher QA throughput, and regional hub models to address these industrialization challenges.

ADCs: Specialist Manufacturing Bottlenecks

ADC pipeline momentum continues, with manufacturing implications centering on conjugation suites, HPAPI payloads, and sterile fill-finish as recurring constraints, particularly as more ADCs move into later-stage and commercial supply.

Vaccines: US Uncertainty Plus Adult Vaccine Investment

Vaccines face unique exposure to shifts in public confidence and US policy dynamics.

Despite uncertainty, major players continue investing—especially in adult vaccines—suggesting confidence in long-term demand even as short-term policy volatility creates planning challenges.

Radiopharma: Infrastructure Wins

Radiopharma growth remains constrained by infrastructure—isotope supply, short half-life logistics, and regional manufacturing hubs.

Reuters reports Novartis opened a radioligand manufacturing facility in California, specifically aimed at improving delivery speed and reliability, exemplifying the continued build-out of hub networks, distribution capabilities, and strategic isotope supply planning expected in 2026.

R&D and Early-Stage Development

Eduardo da Fonseca, Senior Director of Supply Chain Management at Neurocrine Biosciences, offers a prediction focused on upstream implications:

“Generally, as patents expire and prices even for originator products become under increased pressure, companies will want to increase the number of pre-clinical molecules in R&D to increase their chances of finding successful future candidates.

They will also want to further speed up pre-clinical stages to select faster which candidates will enter clinical studies (‘fail fast’). This will require additional R&D and formulation capacity ahead of First In Human studies, and companies may need to increasingly outsource part of this work to CDMOs.”

Key Takeaways for 2026

Several themes emerge consistently across expert predictions and industry research:

1. Policy Uncertainty is the New Operating Environment

US tariff threats and MFN pricing proposals create strategic uncertainty that extends beyond 2026. Companies must build flexibility into strategic planning rather than committing to rigid long-term plans that may be upended by policy changes.

2. Capacity Remains Constrained—and Drives Valuation

Despite capacity expansions, demand continues outpacing supply for key capabilities—particularly biologics drug substance, fill-finish operations, and specialized operations like HPAPI handling. More critically, capacity certainty has become “market currency” that directly impacts biotech valuations.

3. Capital Efficiency Becomes Non-Negotiable

The funding environment demands that every CMC dollar spent directly contributes to value creation. Biotechs must prioritize activities that accelerate milestones and demonstrate clear manufacturability, cost trajectory, and regulatory readiness to investors.

4. Partnerships Over Transactions

The evolution from transactional supplier relationships to strategic partnerships accelerates in 2026, driven by capacity constraints, quality requirements, and the need for supply chain resilience. “Light-touch” approaches to CDMO relationships have become liabilities.

5. Digital Readiness Becomes Market Requirement

The digital divide is widening, with 92% of CDMOs reporting sponsors raise digital requirements in negotiations, yet non having full integrations. Early movers who achieve sponsor connectivity will capture outsized value.

6. Regional Manufacturing Solidifies

Despite questions about reshoring feasibility, the trend toward regional manufacturing networks continues, representing a conscious trade of cost efficiency for supply security.

7. CGT Faces Industrialization Challenges

Cell and gene therapy reaches a critical inflection point where manufacturing capability—not scientific innovation—determines commercial success. The emphasis on “industrial engineering rigor” frames 2026 as a make-or-break year for the modality’s commercial trajectory.

8. Operational Excellence Differentiates

Operational excellence—standardized dashboards, D&OP cycles, planning discipline—may matter more than cutting-edge technology for navigating 2026’s challenges.

9. Cost Pressure Intensifies

Patent cliffs and competitive pressure from China, combined with margin compression warnings, suggest 2026 will test the industry’s ability to balance resilience investments with cost discipline.