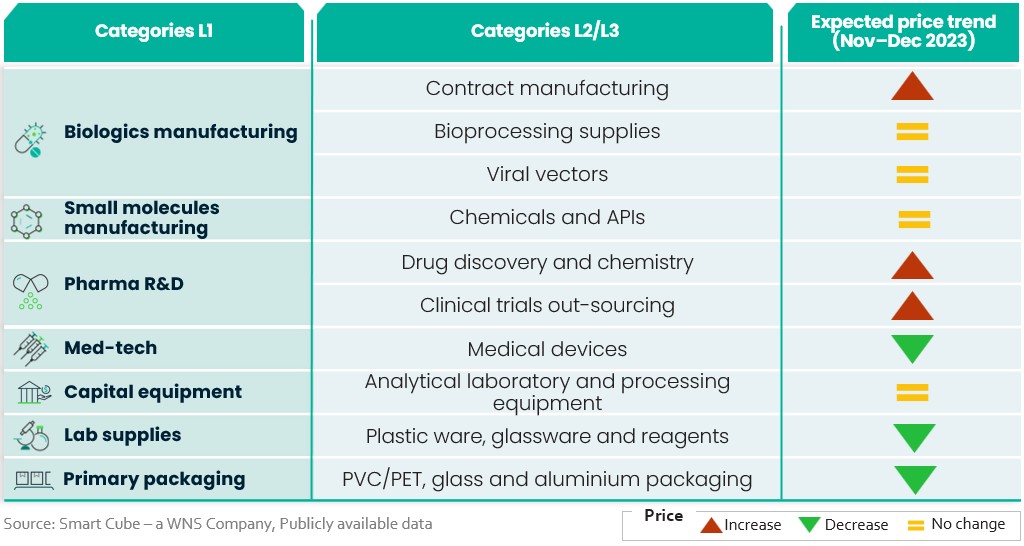

This report summarises the key issues impacting prices across a range of categories in Pharma and Biopharma industry as of December 2023.

Trends and events impacting pricing in December 2023 include:

- Prices of pharma R&D and clinical trials are expected to increase due to a tight labour market with an ongoing shortage of qualified and experienced researchers. In addition, prices for Non Human Primates (NHPs) are currently 10x pre-COVID-19 levels.

- Prices of Single-Use Systems expected to remain strong despite crude oil price decline

- The Medical devices category is experiencing a price downtrend amid declining feedstock prices

- Prices of lab consumables and pharma plastic packaging are projected to drop due to declining raw material prices

- The Biden administration has invoked the Defence Production Act for drugs and medical supplies to boost local supplies. The White House will spend $35 million to boost US production of key starting materials for sterile injectables.

Key issues by category

Bio-Pharma Manufacturing

Contract manufacturing

Cell and gene therapies (CGT) have seen strong growth in H2 2023, with multiple candidates progressing in clinical trial phases; 2024 is poised to be strong year for CGT with the US FDA set to review 2 candidates – from Exa-cel and Orchard Therapeutics.

The increase in oil and utility prices, and the possibility of supply disruptions due to the Israel–Hamas war, are likely to have an adverse impact on biologics CMOs.

A critical shortage of experienced biomanufacturing staff for advanced cell and gene therapies (CGTs) being faced by >50% of the biopharmaceutical industry is creating high demand for contract manufacturers (CMOs) with CGT platforms.

- In 2023, the average annual price increase for drug substance CMO services is expected to be 2.4%

Bioprocessing supplies

Increased supplier capacity and the entry of several new players in the Single-Use Systems (SUS) market is supporting an increase in overall market supply; however, the continued supply-chain disruptions faced by suppliers partially offsets the supply.

The SUS market is expected to continue seeing price volatility as the market is slow to respond to changes in crude oil prices (the feedstock for resins used in producing bioprocessing supplies).

- The European contract reference price for ethylene (feedstock for HDPE and LDPE resins) reported a M-o-M decline of €45/tonne in Nov 2023 to €1,215/tonne – primarily driven by an expected fall in upstream (naphtha) prices

- Crude oil and naphtha prices are expected to remain volatile in Q1 2024 as the OPEC+ is expected to revise the global crude oil production targets to support prices

Viral vectors

Viral vector manufacturing requires large amounts of cGMP-grade plasmid DNA; during the processing and testing stages, a significant amount of the material is lost, which can have a negative impact on yield, thus requiring large quantities to account for losses

Additionally, there are only a few suppliers capable of providing suitable plasmid DNA, affecting the supply of critical custom raw materials

Viral vector production typically requires different skill sets, such as cell processing and viral processing; working with potentially infectious products in increased biosafety level environments requires experience and skills, that further aggravates the issue of labour shortage

Overall, the prices of plasmid DNA and viral vectors are expected to remain stable, in H2 2023, as multiple suppliers have built additional capacity in response to high demand during 2022

- The US PPI for pharmaceutical preparation manufacturing has increased 0.2% Y-0Y in 2023

Small molecule manufacturing (Chemicals and APIs)

The PPI for US pharmaceutical and medicines manufacturing remained stable in October 2023 compared with September 2023

In November 2023, the US government invoked a Cold War-era Defence Production Act to boost investment in the US manufacturing of medicines and medical supplies, as part of a 30-measure series implemented to foster local supply chain and curb inflation

Pharma R&D and clinical trials price uptrend

R&D Drug discovery and chemistry

Wages account for >40% of the total cost involved in discovery chemistry and biology; due to the ongoing shortage of qualified and experienced researchers, the suppliers’ teams comprise only a few highly qualified (PhD) and experienced researchers

The US is experiencing an acute shortage of Non Human Primates (NHPs) for drug development; this is being primarily driven by China’s decision to halt the export of NHPs as the country accounts for 60% (>20,000) of the US’ NHP imports.

- Since the 2023 restriction on import of Cambodian monkeys by the US Fish and Wildlife Service, CROs including Charles River and LabCorp estimated a decline in profit margin for 2023 due to the supply shortage

- Owing to the acute supply shortage, the price of NHPs has increased to up to $60,000 in 2023 from $4,000–7,000 during the pre-COVID-19 levels (the prices are exclusive of the care and maintenance of NHPs)

Clinical trials out-sourcing

The clinical research programmes in Israel will continue unaffected even during the war as the country has contingency plans in place, including a quick transition to decentralised trials if required

- According to GlobalData’s Pharmaceutical Intelligence Centre, Israel is currently hosting 1,420 planned and ongoing clinical trials, with Phase III trials accounting for 41.13%, Phase II for 27.32% and Phase I for 7.32% of the total trials

Medical devices

The medical devices category to experience price downtrend amid declining feedstock prices

40–45% cost of manufacturing medical devices is attributed to raw materials, which majorly include plastics and rubber for routine medical devices

- HDPE and PP prices declined in November 2023 amid a downtrend in the feedstock prices

The use of and waste generated from small medical devices, particularly single-use devices, pose economic and environmental challenge related to medical waste

- This waste disposal cost is significantly driving up the overall healthcare expenses and putting a strain on the healthcare system

Analytical laboratory and processing equipment

The US PPI for analytical lab instrument manufacturing and the US PPI for HVAC and commercial refrigeration equipment have remained stable on a M-o-M basis

However, the biopharma sector is expected to invest lesser than what it usually does in major financing activities, including capital-intensive lab equipment, majorly due to increased borrowing costs (interest rate hikes)

Lab Supplies

Prices of lab consumables and pharma plastic packaging are projected to drop due to declining raw material prices

The lab supplies market faced price fluctuations throughout 2023:

- HDPE and PP prices declined in November 2023 amid a downtrend in the feedstock prices

- The US PPI for glass and glass products manufacturing remained stable on a M-o-M basis.

Overall, the lab supplies and consumables market reported a negative inflation in 2023 (i.e., the prices for the category dropped >10% Y-o-Y); however, in 2024, the prices may again inch up by 3–4% Y-o-Y.

Primary packaging

Prices of PET (bottle-grade) and PVC (suspension) are declined likely to witness a drop in November 2023 due to a decrease in feedstock prices.

Global aluminium prices witnessed an increase of 0.7% M-o-M in October 2023; the prices are forecast to inch up in November 2023 due to likely production cuts by aluminium producers in China.

This category update is powered by The Smart Cube, a WNS Company. For more procurement intelligence, visit Amplifi PRO

Stay ahead of trends and best practices

Stay ahead of trends and best practices