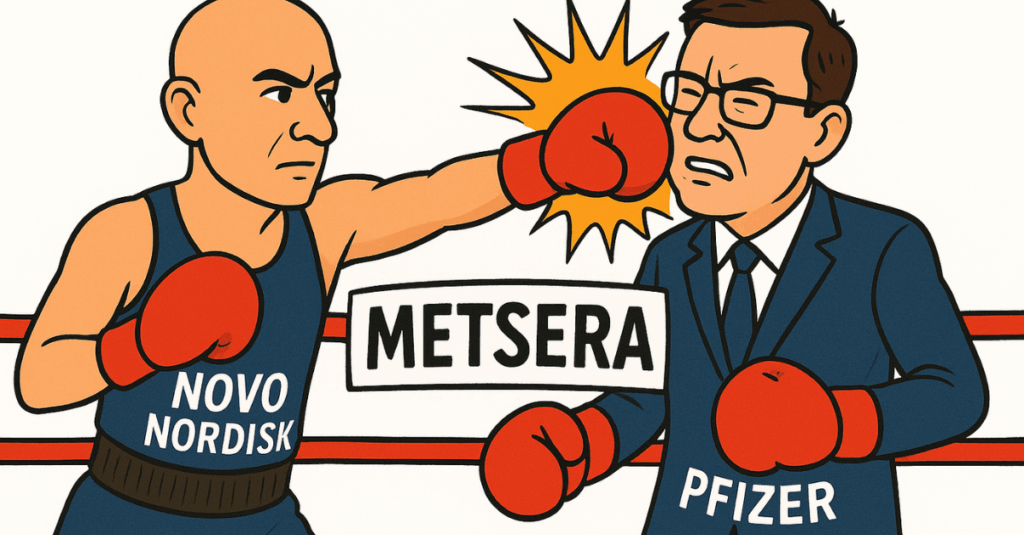

Novo Nordisk and Pfizer have escalated their competing bids for obesity drug developer Metsera to approximately $10 billion, transforming what began as a straightforward acquisition into a high-stakes corporate battle marked by legal challenges and regulatory scrutiny.

Metsera’s board declared on November 4 that Novo Nordisk’s revised proposal constitutes a “superior company proposal” compared to both Pfizer’s original September agreement and an updated counteroffer, according to a company statement. The board’s determination triggers a brief negotiation window for Pfizer to respond before Metsera shareholders vote on November 13.

Deal Structure and Valuation Details

Novo Nordisk’s latest bid proposes an initial payment of $62.20 per share in cash upon signing, up from $56.50 in its prior offer. Under the Danish drugmaker’s structure, it would acquire half of Metsera’s stock and pay dividends of $62.20 per share to equity holders. Upon deal closure, Novo would acquire remaining shares for $24 each, increased from $21.25 previously. The total package values Metsera at up to $86.20 per share, or approximately $10 billion including milestone payments.

This represents a 159% premium to Metsera’s September 19 closing price, the last trading day before Pfizer’s initial acquisition announcement.

Strategic Value of Metsera’s Pipeline

The intense competition centers on Metsera’s differentiated obesity treatment portfolio. The company’s lead asset, MET-097i, is a GLP-1 receptor agonist designed for once-monthly subcutaneous injection, offering less frequent dosing than current weekly treatments including Novo’s Wegovy and Eli Lilly’s Zepbound.

In mid-stage trials, MET-097i demonstrated placebo-adjusted weight loss of up to 14.1% after 28 weekly doses ranging from 0.4 mg to 1.2 mg. Metsera plans to initiate late-stage trials in 2025 and develop the drug for combination therapies and oral formulations.

The company’s second candidate, MET-233i, is an amylin analog currently in early-stage trials. The injectable drug helped patients achieve 8.4% placebo-adjusted weight loss at 36 days. Amylin mimics a pancreatic hormone co-secreted with insulin and may address muscle loss concerns associated with existing GLP-1 medications.

Metsera is also developing MET-002o, an oral GLP-1 receptor agonist in early-stage trials. Leerink analysts estimate the pipeline could generate over $5 billion in peak annual sales.

Legal and Regulatory Complications

Pfizer has filed two lawsuits challenging Novo’s bid. In Delaware Court of Chancery, Pfizer charged Metsera and Novo with breach of contract. A separate filing in Delaware District Court claims Novo engaged in anticompetitive action by attempting to “capture and kill a nascent American competitor before it gains the support of Pfizer.”

“It is an illegal attempt by a foreign company to do an end run around antitrust laws, taking advantage of the government shutdown,” Pfizer CEO Albert Bourla stated during the company’s November 4 earnings call. “What they want is to catch and kill an emerging competitor, which is a significant antitrust concern given Novo’s dominant market position.”

A Delaware Chancery judge denied Pfizer’s request for a temporary injunction blocking Novo’s offer, ruling the objections do not warrant a delay.

The Federal Trade Commission has separately raised concerns about Novo’s deal structure. In a November 5 letter to lawyers for Novo and Metsera, FTC Bureau of Competition Director Daniel Guarnera noted that Novo’s two-phase acquisition approach—purchasing half of Metsera’s stock before completing Hart-Scott-Rodino Act review—may violate premerger notification requirements. Guarnera expressed concern that after paying a significant upfront amount, Novo may have reduced incentive to continue developing Metsera’s products.

Novo Nordisk maintains its proposal “complies with all applicable laws and is in the best interest of patients,” adding that it “highlights Novo Nordisk’s commitment to investing in the U.S. and interest in continuing to grow the scale of its US investments.” Metsera has characterized Pfizer’s legal arguments as “nonsense.”

Strategic Imperatives for Both Bidders

For Pfizer, acquiring Metsera represents another opportunity to establish a position in obesity treatment following setbacks with internally developed candidates. The company discontinued oral GLP-1 candidates lotiglipron in 2023 and danuglipron in 2025 due to liver safety concerns, leaving it without a viable in-house obesity drug. Pfizer CEO Bourla has previously indicated acquired products could generate $20 billion in annual revenue by 2030.

Novo Nordisk faces different strategic pressures. While the company established the obesity treatment market, it has recently lost market share to Eli Lilly, whose Zepbound posted $3.6 billion in third-quarter 2025 sales, up 185% year-over-year, while Mounjaro generated $6.5 billion. Wegovy sales have slowed due to competition and copycat products. With Wegovy’s patent protection expiring in the 2030s, Metsera’s pipeline could provide a sales buffer.

“Having a monthly GLP-1 would cater to a certain segment of the markets,” Novo CFO Karsten Munk Knudsen stated following third-quarter results. “And then also Metsera has an amylin and we’re getting more and more interested in the amylin biology.”

Company Background and Ownership

Founded in 2022 by Population Health Partners and ARCH Venture Partners, Metsera went public on Nasdaq in January 2025 at an initial valuation of $2.7 billion with an IPO price of $18 per share. The company’s market value has expanded to approximately $7.5 billion as of November 6.

Arch Venture Partners holds approximately 25% of Metsera through its Funds XII and XIII, making it the largest shareholder. Alphabet Inc. owns approximately 5% of the company. Executive Chairman Clive Meanwell co-founded Population Health Partners.

The shareholder vote on the original Pfizer merger agreement is scheduled for November 13, with both companies expected to submit final offers before that deadline.