An overview of APIs (Active Pharmaceutical Ingredients) and its significance in the pharmaceutical and biotech industries.

This guide provides you with the overall market size and trends, key drivers, opportunities and challenges, key suppliers in the category and how to improve strategic supplier partnerships.

Contract Development and Manufacturing Organizations (CDMOs) are critical to the global pharmaceutical supply chain, providing outsourced development and production of active pharmaceutical ingredients (APIs). With rising chronic disease prevalence driving demand for new therapies, the need for advanced API manufacturing continues to grow.

Over the past decade, pharma companies have increasingly outsourced discovery, development, and manufacturing activities, with smaller biotech firms especially dependent on CDMOs to support product development throughout clinical stages.

Furthermore, rising demand for generic medicines in markets such as India and China is accelerating the growth of the API-focused CDMO sector, reinforcing the importance of outsourcing partners in meeting global production requirements. The pharmaceutical and biotech industries heavily rely on APIs (Active Pharmaceutical Ingredients) for the development and production of drugs and therapies. APIs are the chemical substances responsible for the therapeutic effect of a pharmaceutical product. They are crucial components that provide the desired pharmacological activity.

The API market encompasses a wide range of chemical compounds that serve as active ingredients in pharmaceutical formulations. These compounds are crucial for delivering the desired therapeutic effect to patients. In this chapter, we provide an overview of the main product categories of APIs, highlighting their unique characteristics and applications.

APIs can be categorized based on various factors such as their chemical structure, therapeutic class, and mode of action. The following are some of the common product categories of APIs:

1. Small Molecule APIs: Small molecule APIs are organic compounds with a low molecular weight. They are chemically synthesized and account for a significant portion of the API market. These APIs are typically well-defined, stable, and have a high level of purity. Small molecule APIs are widely used in various therapeutic areas, including cardiovascular diseases, infectious diseases, oncology, and central nervous system disorders.

2. Biologic APIs: Biologic APIs, also known as large molecule APIs, are complex molecules derived from living organisms or manufactured through biotechnological processes. They include proteins, peptides, antibodies, and nucleic acids. Biologic APIs exhibit high specificity and are used in advanced therapies such as monoclonal antibodies, recombinant proteins, and gene therapies. They require specialized manufacturing processes and stringent quality control measures.

3. Synthetic APIs: Synthetic APIs are chemically synthesized compounds that are manufactured through organic synthesis. These APIs are created by assembling and modifying chemical structures using various reactions and techniques. Synthetic APIs offer advantages such as scalability, cost-effectiveness, and consistent quality. They are widely used in the pharmaceutical industry and have applications in diverse therapeutic areas.

4. Natural Product APIs: Natural product APIs are derived from natural sources such as plants, animals, or microorganisms. These APIs are obtained through extraction or isolation processes from natural materials. Natural product APIs have a long history of use in traditional medicine and continue to be valuable sources of therapeutic compounds. They often possess complex chemical structures and exhibit diverse pharmacological activities.

API Market Trends

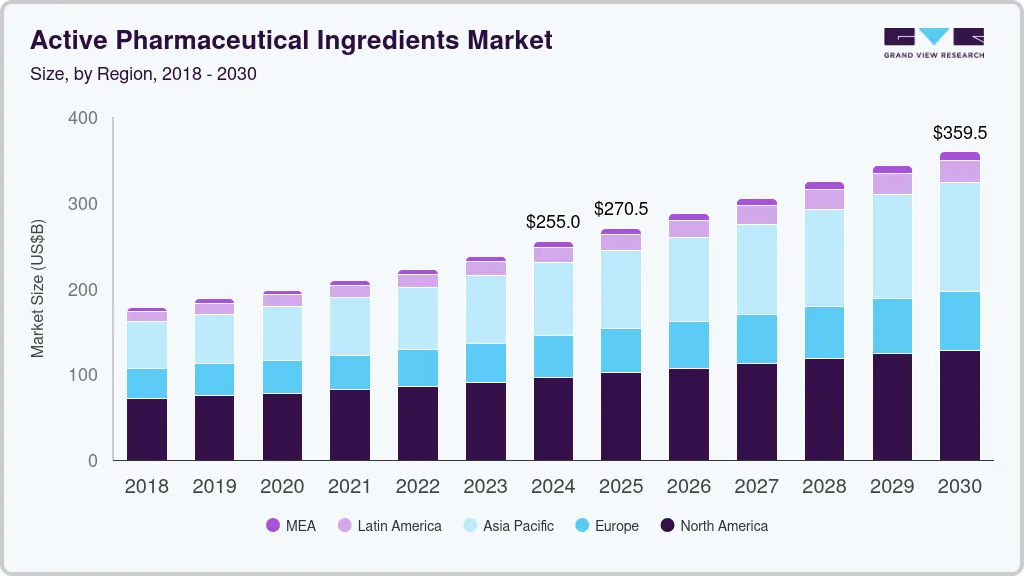

The global active pharmaceutical ingredients (API) market was valued at USD 255,007.2 million in 2024 and is expected to reach USD 359,450.1 million by 2030, reflecting a CAGR of 5.8% from 2025 to 2030. Growth is being driven by rising global demand for pharmaceuticals—particularly in emerging markets—along with the increasing prevalence of chronic conditions such as cancer, diabetes, and cardiovascular diseases.

Additionally, advancements in biologics, biosimilars, and novel drug formulations are fueling demand for specialized APIs. The expanding use of generics and the growing role of contract manufacturing organizations (CMOs) are further accelerating API production and market expansion. (Source- Grand View Research)

Check out this expert insight from PharmaSource, exploring how the FDA’s latest actions are reshaping global peptide supply chains and driving Chinese API makers toward generics and biosimilars.

Strengths

Weaknesses

Strengths

- Established Supplier Networks: Procurement executives often have established supplier networks and relationships with reputable API manufacturers. These relationships provide a strong foundation for sourcing high-quality APIs and negotiating favourable terms and pricing agreements.

- Regulatory Compliance Expertise: Procurement teams possess expertise in navigating regulatory requirements and ensuring compliance throughout the supply chain. This strength is crucial in selecting API manufacturers that adhere to stringent quality standards, regulatory guidelines, and good manufacturing practices.

- Market Knowledge and Insight: Procurement executives have a deep understanding of the pharmaceutical market, including industry trends, product requirements, and customer needs. This knowledge enables them to identify potential API manufacturers, assess market dynamics, and make informed decisions that align with the organization’s goals and strategies.

Weaknesses

- Reliance on Limited Suppliers: Procurement teams may face the challenge of relying on a limited number of API suppliers, which can lead to reduced negotiation power and potential supply chain disruptions. Diversifying the supplier base and actively seeking new partnerships can help mitigate this weakness and ensure a more robust and resilient supply chain.

- Limited Transparency in the Supply Chain: Lack of transparency in the API supply chain can pose challenges in assessing the quality, sustainability, and ethical practices of API manufacturers. Strengthening supplier relationships, conducting thorough audits, and implementing traceability measures can address this weakness and ensure transparency and accountability throughout the supply chain.

Opportunities

Threats

Opportunities

- Increasing Demand for Specialty APIs: The growing demand for specialty APIs presents an opportunity for procurement executives to collaborate with manufacturers specializing in niche therapeutic areas. By partnering with specialized API manufacturers, procurement teams can ensure a reliable supply of high-quality APIs for targeted treatments and personalized medicine.

- Expansion in Emerging Markets: The rapid growth of pharmaceutical and biotech industries in emerging markets, particularly in Asia-Pacific regions, offers opportunities for procurement executives to explore new markets and establish strategic partnerships with API manufacturers in these regions. This expansion can provide cost advantages and access to a broader customer base.

- Advancements in Technology: Technological advancements in API manufacturing, such as process automation and data analytics, create opportunities for procurement executives to optimize supply chain management, improve efficiency, and enhance quality control. By leveraging these technologies and partnering with API manufacturers at the forefront of innovation, procurement teams can gain a competitive edge in the market.

Threats

- Supply Chain Disruptions: The API market is vulnerable to supply chain disruptions, including raw material shortages, manufacturing issues, geopolitical events, and natural disasters. These disruptions can impact the availability and pricing of APIs. Procurement teams must proactively monitor potential threats and develop contingency plans to mitigate risks and maintain a steady supply of APIs.

- Regulatory Changes: Changes in regulatory requirements and guidelines can pose challenges for procurement executives. New regulations may require additional documentation, testing, or compliance measures, which can impact the sourcing process and increase costs. Staying informed about regulatory updates and maintaining close communication with API manufacturers can help address potential threats and ensure compliance.

- Intense Market Competition: The API market is highly competitive, with numerous suppliers vying for market share. Intense competition can exert downward pressure on prices and pose challenges in securing reliable and cost-effective API sources. Procurement executives need to actively engage in supplier evaluation, negotiation, and continuous monitoring to ensure competitive pricing and maintain quality standards.

Building Strong Partnerships with API Manufacturers

Establish Clear Communication Channels

Maintain regular, open communication on product requirements, timelines, and challenges.

Foster a collaborative environment to quickly resolve issues and share insights.

Develop Long-Term Relationships

Build trust and stability with manufacturers to enhance supply chain reliability.

Gain benefits such as preferential treatment, early access to new technologies, and better pricing.

Conduct Regular Audits and Inspections

Perform routine audits to ensure compliance with quality, regulatory, and ethical standards.

Prioritize partners with strong quality systems and proven GMP adherence.

Encourage Innovation and Continuous Improvement

Collaborate on R&D projects to drive process innovation and efficiency.

Promote continuous improvement to strengthen product quality and stay ahead of market trends.

Evaluate Total Cost of Ownership (TCO)

Assess all cost components beyond API price, such as transportation, storage, packaging, and hidden costs.

Use TCO analysis to support informed, strategic procurement decisions.

Optimize Supply Chain Efficiency

Identify opportunities to streamline processes, reduce lead times, and improve inventory management.

Work with manufacturers to adopt lean practices and eliminate unnecessary expenses.

Negotiate Pricing Agreements

Use market insights and competitive bids to secure favorable pricing terms.

Balance cost savings with quality and supplier reliability.

Explore Alternative Sourcing Options

Diversify sourcing across multiple manufacturers and regions to reduce risk.

Rigorously evaluate new suppliers for quality, compliance, and capability.

Implement Value Engineering

Partner with manufacturers to reduce waste, improve efficiency, and optimize production processes.

Pursue cost reductions without compromising quality or product integrity.

Monitor Market Trends and Raw Material Prices

Track industry trends and raw material fluctuations to anticipate cost changes.

Use this insight to guide strategic sourcing and pricing negotiations.

Recent API CDMO News-

Curia Invests $4 Million to Upgrade Aseptic API Suites in Spain (Oct 2025)

Cambrex Announces $120M Investment to Expand U.S. API Manufacturing (Oct 2025)

Wilmington PharmaTech Partners with Curewell to Expand U.S. Small Molecule API Capacity (Oct 2025)

Phlow Corp. Selected for FDA National Priority Voucher Pilot Program for ketamine API (Oct 2025)

AbbVie Expands U.S. Manufacturing with New API Facility in Illinois (Sept 2025)

Aenova Launches Hot Melt Extrusion Platform for OEB 5 APIs at Regensburg Site (July 2025)

BioSpring Breaks Ground on One of World’s Largest Nucleic Acid API Sites in Germany (July 2025)

Nippon Shokubai Announces Major CDMO Expansion for Nucleic Acid APIs (June 2025)

Lonza Launches Design2Optimize to Accelerate Small Molecule API Development (May 2025)

Benuvia Operations Signs Multi-Year Dronabinol API Supply Agreement (May 2025)

Download our CDMO News Tracker to stay ahead of every shift in the CDMO landscape.

FAQ-

1. What is an active pharmaceutical ingredient (API)?

An API is the primary component in a drug responsible for producing the intended therapeutic effect.

2. What are the main types of APIs?

APIs are generally classified as synthetic APIs and biological APIs, depending on their manufacturing process.

3. What factors are driving the demand for APIs?

Key drivers include rising rates of chronic diseases, growing demand for pharmaceuticals, and increased use of generic medications.

4. Why is API outsourcing becoming more common?

Pharmaceutical companies outsource to reduce operational costs, access specialized expertise, and streamline manufacturing processes.

5. What role do CDMOs play in the API market?

CDMOs support drug developers by providing outsourced API development, manufacturing, and regulatory assistance.

6. Which therapeutic areas generate high API demand?

Oncology, cardiovascular diseases, diabetes, infectious diseases, and central nervous system disorders.

7. How does regulation impact the API market?

Strict regulatory guidelines ensure quality and safety, influencing manufacturing practices and supplier selection.