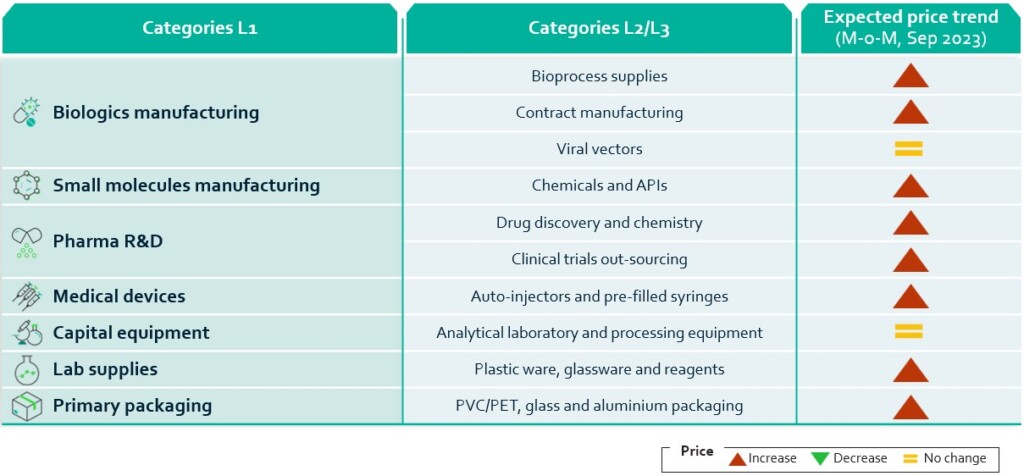

This report summarises the key issues impacting prices across a range of categories in Pharma and Biopharma industry as of September 2023.

Some of the macro trends impacting pricing in September 2023 include:

- The US Inflation Reduction Act (IRA) 2022 will limit pharma R&D activities, especially for small molecule drugs – hampering the development of ~139 therapies over the next decade.

- A tight labour market and an acute shortage of non-human primates (NHPs) and blood needed for research in the US can lead to increased prices of pharma R&D outsourcing services.

- The price of plastics, such as HDPE and PP, increased in August 2023 is expected to witness an uptrend in the next 1–2 months, leading to a rise in inflation in categories such as lab supplies and primary packaging.

This is in the context of global inflation which is seeming to decelerate with some expressing tentative hopes of ‘green shoots of growth’.

“The chance of having a relatively soft landing and navigating through this [recession] has gone up very meaningfully over the last 12 months. The environment is definitely better. I have a personal point of view that inflation is going to be a little bit more sticky than the more optimistic views. There’s still work to do. ”

David Solomon, CEO, Goldman Sachs (September 2023)

Key issues by category

The following is a deeper dive into the issues within important life sciences categories, and how this is impacting the price of goods.

1. Biologics Manufacturing

Bioprocessing supplies

The single-use systems (SUSs) market is witnessing an increase in the number of new and small suppliers entering the market as well as a return to price discounting due to the easing of supply chain issues; this is resulting in an overall drop in revenue growth of the companies in this space.

- The average revenue of bioprocessing suppliers grew 17.5% and 24.5% in 2021 and 2022, respectively; in 2023 the revenue growth is expected to return to the previous level of 13.1%.

Even with the post-COVID-19 easing of supply disruptions, increased capacity of various suppliers and entry of several suppliers in the SUSs market, the price reduction has been slow.

- According to BioPlan Associates’ annual Biopharmaceutical Manufacturing Capacity and Production market report published in August 2023, 50% of the respondents surveyed by the organisation reported that the prices continued to increase In 2023, the projected average price increase for disposables and single-use devices is 4.5%, down from 7.1% in 2022.

Prices of single-use systems are expected to witness an uptrend in 2023, but the increase will likely be lower than the hike recorded in 2022

Contract manufacturing

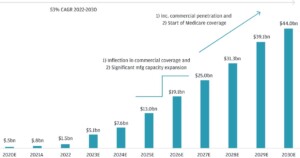

Q2 2023 was a notable quarter for approvals, with 6 new therapies being approved, 2 for each of the gene, cell and RNA therapy categories.

- Both new gene therapy approvals (Elevidys in Duchenne muscular dystrophy and Vyjuvek for dystrophic epidermolysis bullosa) are the first gene therapies to be approved in their respective indications.

A critical shortage of experienced biomanufacturing staff for advanced cell and gene therapies (CGTs) being faced by >50% of the biopharmaceutical industry is creating high demand for contract manufacturers (CMOs) with CGT platforms.

- CMOs are more concerned about hiring and retaining CGT staff as it can take up to 6–12 months to train new staff.

- In 2023, the average annual price increase for CMO services is expected to be 3.3%.

Viral vectors

Viral vector manufacturing requires large amounts of cGMP-grade plasmid DNA; during the processing and testing stages, a significant amount of the material is lost, which can have a negative impact on yield, thus requiring large quantities to account for losses

Additionally, there are only a few suppliers capable of providing suitable plasmid DNA, affecting the supply of critical custom raw materials.

Viral vector production typically requires different skill sets, such as cell processing and viral processing; working with potentially infectious products in increased biosafety level environments requires experience and skills, that further aggravates the issue of labour shortage.

Overall, the prices of plasmid DNA and viral vectors are expected to remain stable in H2 2023, as multiple suppliers have built additional capacity in response to high demand during 2022.

The US PPI for pharmaceutical preparation manufacturing has increased 0.2% Y-o-Y in 2023.

2. Small Molecules

Chemicals and APIs

The US Inflation Reduction Act (IRA) 2022 mandates a 13-year price protection period for biologics before the implementation of reduction controls; small molecules are subject to these controls only within 9 years – far earlier than they receive competition from generic drugs.

- This has led to US-based biotechnology companies receiving 48% ($1.05 billion) more overall venture financing for biologic innovator drugs as compared with small molecule drugs in 2023.

- An economic modelling study suggests that due to the IRA, ~139 therapies may not be developed and made available to patients in the next 10 years.

- Consequently, several pharma companies are reconsidering their R&D strategy; ~78% of the respondents in a 2022 PhRMA survey stated that they expected to cancel their early-stage pipeline projects.

The PPI for US pharmaceutical and medicines manufacturing increased 0.1% M-o-M in August 2023.

The US Inflation Reduction Act will limit pharma R&D activities, forecast to result in ~1% decline in the number of novel drug approvals over the next 30 years

3. R&D and clinical trials continue to show a pricing uptrend due to the tight labour market

Prices of pharma R&D categories are expected to increase due to the ongoing shortage of qualified and experienced researchers.

Drug discovery and chemistry

Wages account for >40% of the total cost involved in discovery chemistry and biology due to the ongoing shortage of qualified and experienced researchers. Suppliers’ teams typically comprise only a few highly qualified (PhD) and experienced researchers.

As an alternative, the biopharmaceutical industry is redefining its operations by increasing its use of technologies, including generative AI for drug discovery.

- Insilico Medicine (a US-based biotechnology company) developed a generative adversarial network-based AI platform that designed the world’s first AI-generated anti-fibrotic small molecule inhibitor; the inhibitor entered phase 2 clinical trials in June 2023.

The US is experiencing an acute shortage of NHPs for drug development; this is being primarily driven by China’s decision to halt the export of NHPs as the country accounts for 60% (>20,000) of the US’s NHP imports.

- Owing to the acute supply shortage, the price of NHPs has increased to $30,000 in Q1 2023 from $2,500 in Q1 2020 (the prices are exclusive of the care and maintenance of NHPs).

Clinical trials outsourcing

Labour costs, which account for >40% of the total cost incurred during drug discovery and clinical phases, are expected to increase further in the US and Europe due to tight labour supply; this could push CROs to increase their tariffs/prices.

- Similarly, average hourly earnings in the education and health services sectors in the US increased 0.3% M-o-M in July 2023 and 1.7% Y-o-Y in July 2023.

The US is currently facing an acute shortage of blood, as announced by the American Red Cross; blood supply in the country currently stands at 34%, which is significantly lower than the usual rate of ~90%.

- The increased blood shortage can lead to a potential slowdown in R&D activities, thereby increasing the time spent and costs incurred by biopharmaceutical innovators w.r.t such activities.

4. Packaging

Auto-injectors and prefilled syringes

Injectable devices such as autoinjectors and pre-filled syringes experienced a surge in uptake during the pandemic for vaccination purposes; most biologics and CGTs require injectable drug delivery devices due to their dosage forms, further increasing the demand.

- With reduced demand of COVID-19 vaccines, suppliers have free capacities that are being reallocated to CGTs.

40–45% cost of manufacturing these devices is attributed to raw materials, which majorly include plastics and rubber.

- Prices of polymers, i.e., HDPE and PP, in the US increased 8.2% and 2.8% M-o-M, respectively, in August 2023; they dropped ~15% and ~28% Y-o-Y, respectively, in August 2023.

- Natural rubber prices in APAC dropped ~11% Y-o-Y in August 2023 and further fell 2.3% M-o-M in August 2023; however, these prices are expected to witness an uptrend in September 2023 on account of a seasonal fall in output in India.

Demand for injectable drug delivery devices, such as autoinjectors and prefilled syringes, is expected to increase with a rise in CGTs

Primary Packaging: PVC/PET, glass and aluminium packaging

In August 2023, prices of PET (bottle-grade) in the US dropped 0.9% while PVC (suspension) increased 9.9% M-o-M; the prices are likely to witness an uptrend in August 2023 due to an increase in upstream (ethylene) prices

In 2022, >19% of injectable drug recalls in the US were associated with glass vial delamination or breakage, and >25% were attributed to the confirmed presence of silica and iron oxide

- Heavy reliance (~50%) on China’s glass vials globally adds to supply chain concerns

- To overcome these challenges, PP-based vials can be used by the pharmaceutical industry; their usage can also reduce the overall cost of transport as they are relatively lighter

Global aluminium prices witnessed a drop of 0.9% M-o-M in August 2023; the prices are forecast to remain stable with bearish overtones due to higher supply and comparatively low demand.

5. Lab Technology

Analytical laboratory and processing equipment

In August 2023, the US PPI for analytical lab instrument manufacturing and the US PPI for HVAC and commercial refrigeration equipment remained stable on a M-o-M basis

Average electricity prices, after remaining stable in early Q2 2023, witnessed a 3.0% M-o-M increase in June 2023; the prices are likely to inch upwards due to tight supply of natural gas

Overall, the biopharma sector is expected to invest lesser than what it usually does in major financing activities, including capital-intensive lab equipment, majorly due to increased borrowing costs (interest rate hikes) and banking sector fallout

Prices of lab consumables and pharma plastic packaging may inch up due to a likely increase in HDPE and PP prices

Plastic ware, glassware and reagents

The lab supplies market faced price fluctuations during 2022 and H1 2023; prices of key raw materials are expected to increase further in the next 1–2 months

- HDPE and PP prices increased 8.2% and 2.8% M-o-M, respectively, in August 2023; the prices are expected to further rise in September 2023 due to an increase in feedstock prices

- However, the US PPI for glass and glass products manufacturing witnessed a minor decrease of 0.8% and 0.1% M-o-M in August and July 2023, respectively

The US FDA expects the supply of multitarget respiratory specimen nucleic acid tests, micropipettes, microbiological specimen collection devices and other products used in response to COVID-19 to return to normal by end of Q3 2023 (the FDA had listed some of these shortages back in August 2020 that were forecast to continue over the duration of COVID-19)

- As of July 2023, the US FDA has removed tubes, vials, applicators, saline flush syringes from the shortages list

This category update is powered by The Smart Cube, a WNS Company. For more procurement intelligence, visit Amplifi PRO