The instability in the Middle East is causing ripple effects across the life sciences industry, disrupting supply chains and causing price fluctuations globally.

This report summarises the key issues impacting prices across a range of categories in Pharma and Biopharma industry in February 2024:

- The attacks in the Red Sea pose risk of supply disruptions of key pharmaceutical ingredients and chemicals – including API shipping from APAC (India and China) to the US and Europe.

- Plastics are a commodity that will be impacted by the ongoing attacks in the Red Sea due to their inability to absorb freight hikes. This is likely to result in fluctuating prices in single-use systems, lab supplies and packaging.

- ~700 medical devices companies based in Israel remain at risk due to the ongoing crisis in the region.

Key issues by category

Bio-Pharma Manufacturing

Contract manufacturing

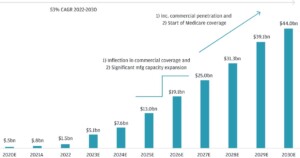

Although the global biologics contract development and manufacturing (CDMO) market is poised to grow at an overall CAGR of ~13% during 2023–2028, 2023 marked a significant drop with single-digit market growth, compared to ~15% in 2022

- Key growth inhibitors include drop in sales from COVID-19-related contracts, slowdown in funding and the financial challenges faced by biopharma and CDMO at large

- In WuXi Biologics’ December 2023 business update, the company announced that it expects to miss its original sales target for FY2023 by ~$400 million, plummeting the company’s share by ~24% and then continuing to fall to current -60% pre-annoucement.

However, the CDMO market is expected to outpace the overall biopharma market growth by 2028, as CDMO become increasingly vital. During the pandemic, several pharma companies built their own manufacturing facilities, which the companies are now either selling or spinning off into their own CDMOs (due to high costs involved)

Bioprocessing supplies may experience increase in prices due to instability in raw material (plastic) prices

Bioprocessing supplies

The SUS (Single Use Systems) market is expected to continue seeing price increase due to volatile feedstock prices

- In December 2023, HDPE prices dropped 11.9% M-o-M in the US while increasing 3.8% in Europe; PP price increased 7.7% M-o-M in the US

- The plastic resin prices are expected to increase further in January 2023 on account of rise in feedstock (ethylene) prices

- Further, plastics are one of the key commodities that are most severely impacted by the ongoing attacks in the Red Sea due to their inability to absorb freight hikes, thereby fluctuating prices

Gamma irradiation (using cobalt-60 radioisotopes) is considered the standard method of sterilising SUS; however, suppliers are now moving towards X-raw sterilisation as an alterative

- Although global cobalt prices remained stable M-o-M in January 2024, the overall cost associated with production of its radioisotopes is very high; additionally, the high demand for gamma irradiation has caused issues in supply chain

The escalating situation in Red Sea may increase pharma API prices due to rise in shipping costs and delays

Small molecule manufacturing (Chemicals and APIs)

The attacks in the Red Sea pose risk of supply disruptions of key pharmaceutical ingredients and chemicals, especially from APAC (India and China) to the US and Europe

- Due to the forced reroute through the longer channel, rise in shipping costs can be passed on to API buyers in regions that typically import these goods from APAC

- Although pharmaceutical exporters plan majority of their deliveries before the long year-end break in the US and Europe, the supply of critical materials is bound to be disrupted if the attacks continue

- >65% of pharmaceutical exports from India are by sea, and the remaining (high value and emergency supplies) are by air

In December 2023, the PPI for US pharmaceutical and medicines manufacturing dropped marginally by 0.03% M-o-M, while the PPI for US chemicals and allied products remained stable during the period

Pharma R&D and clinical trials

Many clinical research sites in the US are exposed to financial risks due to the current inflation

- With majority biopharma sponsors having a 90-day payment cycle, clinical sites suffer lower profitability

- Additionally, since many clinical sites operate at lower margins, delayed receivables impact their ability to reinvest operating profits in technology, quality management systems and training

Wages account for >40% of the total cost involved in discovery and clinical research; due to the ongoing shortage of qualified and experienced researchers, the suppliers’ teams comprise only a few highly qualified (PhD) and experienced researchers

- The US average hourly earnings for health services increased 2.5% Y-o-Y and 0.3% M-o-M in December 2023; an average US employee now earns ~$34 per hour

Medical devices

~700 medical devices companies based in Israel remain at risk due to the ongoing crisis in the region

Electronic parts, including those needed for medical devices, may be at increased risk of disruption due to the ongoing Red Sea attacks.

- A typical electronics consignment from Taiwan to Netherlands takes ~25 days via the Suez Canal; this distance can increase >35% if rerouted via the Cape of Good Hope, taking ~34 days and thereby increasing costs.

- Currently, Taiwan Semiconductor Manufacturing Company (TSMC, world’s largest chip manufacturer) has announced that it does not anticipate significant impacts due to enterprise risk management system.

Israel is home to ~700 medical devices companies, that manufacture devices ranging from ultrasounds to neurostimulators.

- Given the extent of conflicts in the region, these companies remain at the risk of disruption.

Further, the 7.6 preliminary magnitude earthquake that hit Japan on 1 January 2024, forced Ishikawa Prefecture chip and electronics companies (including Toshiba, Global Wafers and Murata) to temporarily shut their operations.

- Although this can disrupt the semiconductor chip industry operations and allied industries in the short-term, the impact is not far-reaching due to the current downtrend in the semiconductor industry, paired with off-season period.

Analytical laboratory and processing equipment

The US PPI for analytical lab instrument manufacturing remained stable, while the US PPI for HVAC and commercial refrigeration equipment declined 0.3% M-o-M in December 2023.

Capital expenditure and investments in the biopharmaceutical sector are expected to slowly take up in 2024 (after a steep decline in 2023), majorly due to potential ease in fiscal policies.

- In addition to the US Federal Reserve’s decision to keep interest rates constant, it outlined plans for at least three rate cuts in 2024.

Prices of pharma plastic packaging and supplies are projected to increase due to fluctuating raw material prices

Lab Supplies

Up to 65% cost of manufacturing lab supplies is attributed to raw materials, which include HDPE, glass and polypropylene; Q1 2024 is expected to witness an inflation of 2–3% within the lab supplies category.

- The Houthi attacks in the Red Sea have potential to impact the global plastics prices.

- HDPE prices increased 3.8% M-o-M in Europe while PP prices increased 7.7% M-o-M in the US in December 2023.

- The US PPI for glass and glass products manufacturing increased 0.3% M-o-M in December 2023.

Lab chemicals are also experiencing disruptions due to the ongoing Red Sea attacks, as the rerouting will impact the shipment of ~24% chemicals, the delays of which are already impacting prices in the US.

- The US PPI for chemicals and allied products dropped 0.7% M-o-M in December 2023 and that in EU declined 0.6% M-o-M.

Primary packaging

Blister packaging for pharma products typically involves raw materials such as aluminium, PET and PVC, while HDPE is used for bulk drums.

- Prices of PET (bottle-grade) remained stable, and PVC (suspension) dropped 7.14% in the US in December 2023; prices are likely to rise in January 2024 mainly due to increase in feedstock prices and the ongoing challenges in the Red Sea.

- Global aluminium prices witnessed a decline of 3% M-o-M in December 2023 and are expected to remain stable in January 2024.

- HDPE prices in the US are projected to inch up in January on account of rising feedstock prices.

Biologics and injectable drugs are typically packed in glass or plastic vials and ampoules.

- The US PPI for glass and glass products manufacturing increased 0.3% M-o-M in December 2023.

This category update is powered by The Smart Cube, a WNS Company. For more procurement intelligence, visit Amplifi PRO