An overview of the pharmaceutical Excipients market for pharmaceutical procurement teams. This guide provides you with the overall market size and trends, key drivers, opportunities and challenges, key suppliers in the category and how to improve strategic supplier partnerships.

Definition

The pharmaceutical industry relies on a diverse range of components to formulate and manufacture medications. While active pharmaceutical ingredients (APIs) play a crucial role in the therapeutic effects of drugs, pharmaceutical excipients serve as inactive substances that aid in the delivery, stability, and overall performance of the medication.

Pharmaceutical excipients encompass a wide array of substances, including binders, fillers, disintegrants, coating agents, lubricants, and glidants, among others. These excipients are carefully selected and integrated into drug formulations to enhance drug solubility, control drug release, improve patient acceptability, and ensure dosing accuracy.

The role of excipients in the pharmaceutical industry extends beyond formulation. They also play a crucial role in ensuring the quality, safety, and effectiveness of medications. Excipients undergo rigorous testing to meet regulatory standards, ensuring they are free from impurities, compatible with APIs, and do not interfere with the therapeutic effect of the drug.

Market Size and Trends

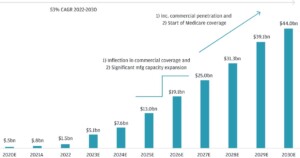

The global pharmaceutical excipients market is a rapidly growing sector that is expected to reach a market size of USD $11.5 billion by 2027, with a compound annual growth rate (CAGR) of 5.9% from 2022 to 2027.

Factors driving this growth include the increasing demand for pharmaceutical products, the rising complexity of drug formulations, and the growing generic drugs market. The market size is influenced by factors such as population growth, the prevalence of chronic diseases, advancements in drug delivery technologies, and expanding healthcare infrastructure in emerging economies.

Market size value in 2022

$8.6 Billion (USD)

Revenue forecast 2027

$11.5 Billion (USD)

Growth Rate

5.9.% CAGR from 2022 to 2027

Source: MarketsAndMarkets

Market Segmentation by Excipient types

The pharmaceutical excipients market can be segmented based on the type of excipient used in drug formulations. The main categories include:

- Binders are excipients that are used to hold together the active ingredients and other excipients in a cohesive solid dosage form. They provide tablet hardness, improve compressibility, and ensure uniform drug content.

- Fillers and diluents are inert substances used to increase the bulk of a solid dosage form, ensuring the proper size and weight of tablets or capsules. They enhance tablet flowability during manufacturing and aid in the uniform distribution of the active ingredient.

- Disintegrants are excipients that facilitate the breakup of tablets or capsules into smaller particles when exposed to water or other bodily fluids. This enables the drug to dissolve and be absorbed effectively, ensuring optimal therapeutic outcomes.

- Coating Agents are used to provide a protective layer on tablets or capsules. They serve multiple purposes, including taste masking, improving stability, enhancing appearance, and controlling drug release.

- Lubricants and Glidants are excipients used to prevent tablet sticking to the equipment during manufacturing and aid in tablet flow. They reduce friction between particles and enhance the efficiency of tablet compression and coating processes.

Other categories include antioxidants, preservatives, pH modifiers, solubilizers, and colouring agents, among others. These excipients are utilised for specific purposes depending on the formulation requirements.

Market trends and key drivers for Excipients

1. Growing Demand for Generic Drugs

The increasing demand for affordable healthcare solutions has fueled the growth of the generic drugs market. Generic drugs, which are cost-effective alternatives to branded medications, require a wide range of excipients for formulation.

This has resulted in a significant demand for pharmaceutical excipients as generic drug manufacturers seek high-quality and cost-efficient excipient options to maintain competitiveness in the market.

2. Increasing Complexity of Drug Formulations

Advancements in pharmaceutical research and development have led to the development of complex drug formulations. These formulations often require a precise combination of multiple excipients to achieve desired drug delivery profiles, improved bioavailability, and enhanced patient compliance.

The evolving landscape of drug formulations drives the demand for innovative excipients with specific functionalities, such as modified-release systems, nanotechnology-based formulations, and personalized medicine solutions.

3. Technological Advancements in Excipient Manufacturing

The pharmaceutical excipients industry has witnessed significant technological advancements in recent years. Manufacturers are investing in research and development to enhance the functionality, safety, and performance of excipients. This includes innovations in excipient manufacturing processes, such as spray drying, co-processing techniques, and nanotechnology applications. Technological advancements contribute to the development of excipients with improved properties, such as enhanced solubility, controlled release, and better compatibility with APIs.

4. Rising Focus on Patient Safety and Drug Delivery

Patient safety and drug delivery have become paramount concerns in the pharmaceutical industry. Excipients play a crucial role in ensuring the safety and effectiveness of medications. The industry is witnessing a shift towards excipients that have minimal side effects, improved biocompatibility, and better control over drug release. There is also a growing emphasis on excipients that facilitate targeted drug delivery, such as nanocarriers, liposomes, and microparticles, to enhance therapeutic efficacy and reduce adverse effects.

5. Stringent Regulatory Requirements

The pharmaceutical industry is subject to stringent regulatory standards and requirements to ensure product safety, efficacy, and quality. Regulatory agencies closely monitor the use of excipients, including their sourcing, manufacturing processes, and quality control measures. Compliance with regulatory guidelines, such as Good Manufacturing Practices (GMP) and International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) guidelines, is essential for excipient manufacturers. Procurement teams need to work closely with contract manufacturers who adhere to these regulatory standards to ensure the integrity of the supply chain and compliance with applicable regulations.

SWOT Analysis

Overall, the pharmaceutical Excipients market presents both significant opportunities and challenges for contract manufacturers, as this SWOT analysis shows:

Strengths

Weaknesses

Strengths

Wide range of excipient options, providing pharmaceutical companies with flexibility in formulating drug products. This allows manufacturers to tailor their formulations to specific requirements, ensuring optimal drug performance and patient acceptability.

Well-established distribution networks, ensuring efficient and timely supply of excipients to pharmaceutical manufacturers. These networks facilitate smooth logistics and enable quick response to changing market demands.

Weaknesses

- Limited innovation and differentiation among excipient products. This can make it difficult to identify excipient options that offer unique functionalities or improved performance compared to existing alternatives.

- The prices of raw materials used in excipient manufacturing can be subject to volatility, which can impact the overall cost of excipients. Fluctuating raw material prices can pose challenges in budgeting and cost management.

Opportunities

Threats

Opportunities

- Emerging markets present significant growth opportunities for the excipients market. The expanding population, rising healthcare expenditure, and increasing access to healthcare in these regions contribute to the demand for pharmaceutical products, including excipients.

- The shift towards personalised medicine opens up opportunities for excipient manufacturers. Personalised medicine often requires customised drug formulations and delivery systems, which may involve specialised excipients tailored to specific patient needs.

Threats

- Ensuring regulatory compliance and maintaining high-quality standards are critical challenges for excipient manufacturers. Procurement teams need to partner with contract manufacturers who have robust quality control measures, adhere to regulatory guidelines, and provide necessary documentation and certifications.

- Highly competitive market, with numerous manufacturers vying for market share. This competition can lead to pricing pressures and challenges in identifying reliable suppliers who can consistently meet quality standards and delivery requirements.

Key Suppliers

Here is a summary of pharmaceutical excipient contract manufacturers, in alphabetical order:

- Ashland

- Avantor

- BASF

- Clariant

- Colorcon

- Croda International

- Dow Chemical Company

- DuPont

- Evonik

- Innophos

- JRS Pharma

- Kerry Group

- Lubrizol Life Science

- Meggle Pharma

- Merck

- Pfanstiehl

- Roquette

- Sigachi Industries

- Shin-Etsu Chemical

- SPI Pharma

- Wacker Chemie

How to partner better with excipient contract manufacturers

Advice for pharmaceutical buyers to create better strategic partnerships with Excipient manufacturers by understanding cost management, collaboration, quality assurance and risk management. These strategies include:

1. Conduct a comprehensive cost analysis

Pharmaceutical procurement teams should perform a thorough cost analysis to identify areas where cost savings can be achieved without compromising quality. This includes evaluating the cost of raw materials, manufacturing processes, packaging, logistics, and overhead expenses. By understanding the cost breakdown, teams can identify potential cost-saving opportunities.

2. Explore bulk purchasing and long-term contracts

Negotiating bulk purchasing agreements and long-term contracts with excipient contract manufacturers can provide cost advantages. By committing to larger volumes over an extended period, procurement teams may be able to secure discounted prices and favourable terms, reducing overall costs.

3. Seek competitive bidding

Engaging in competitive bidding processes can help identify excipient contract manufacturers offering competitive pricing. Requesting quotes from multiple suppliers and comparing their proposals can enable procurement teams to select the most cost-effective option while maintaining quality standards.

4. Foster open communication

Establishing clear lines of communication with excipient contract manufacturers is crucial for building a strong partnership. Regular communication and feedback exchange allow for a better understanding of expectations, challenges, and opportunities. This collaboration facilitates proactive problem-solving and aligns both parties’ goals.

5. Encourage collaboration in research and development

Partnering with excipient contract manufacturers who have a strong focus on research and development (R&D) can lead to innovative solutions and improved cost-efficiency. By involving contract manufacturers early in the drug development process, procurement teams can tap into their expertise, leading to optimised formulations and cost-effective manufacturing strategies.

6. Foster long-term relationships

Developing long-term relationships with excipient contract manufacturers promotes stability and trust. By fostering mutually beneficial partnerships, procurement teams can benefit from the contract manufacturers’ commitment to quality, continuous improvement, and reliability. Long-term relationships also provide opportunities for joint value creation and customised solutions.

7. Ensure compliance with regulatory standards

Pharmaceutical procurement teams must prioritise regulatory compliance when selecting excipient contract manufacturers. Verify that the chosen manufacturers adhere to relevant regulations, such as Good Manufacturing Practices (GMP) and International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) guidelines. Conduct audits and inspections to assess compliance and ensure consistent quality.

8. Implement robust quality control measures

Procurement teams should work closely with contract manufacturers to establish robust quality control measures. This includes clear specifications, testing protocols, and documentation requirements for excipient materials. Regular quality audits and inspections should be conducted to monitor adherence to quality standards throughout the manufacturing process.

9. Establish risk mitigation strategies

Identify and assess potential risks in the supply chain and develop strategies to mitigate them. Establish contingency plans for potential disruptions in the excipient supply, such as alternative sourcing options or safety stock. Collaborate with contract manufacturers to develop risk management protocols and ensure business continuity.

By implementing these strategies, pharmaceutical procurement teams can enhance their partnership with excipient contract manufacturers, effectively manage costs during periods of high inflation, and ensure the delivery of high-quality pharmaceutical products. This collaborative approach contributes to improved supply chain efficiency, product innovation, and patient safety.