“The complexity is there’s an antibody component, linker-payloads with highly potent toxic agents that need high containment, and linking a biologic with a highly potent small molecule – it’s inherently challenging.”

Dr. Harch Ooi, VP of Manufacturing and Chemistry at IsoBio Inc., brings 17 years of specialized expertise in antibody-drug conjugate (ADC) manufacturing and external partnerships from Seagen (acquired by Pfizer in 2023). There, he contributed to the development and manufacturing of SGD-1006, the vedotin linker-payload that is used in Adcetris, Padcev, Tivdak, Polivy (from Genentech/Roche), and Emrelis (from Abbvie). Over the years, Dr. Ooi has witnessed the field’s dramatic transformation, from a single approved ADC in 2000 to a robust pipeline of 15 approved therapies today.

In the latest podcast episode, Harch explains why mastering ADC outsourcing strategy is crucial for biotechnology companies navigating this complex modality. He shares practical insights on CDMO selection, safety protocols, and operational strategies that drive success from early development through commercial launch.

The Four-Component Challenge: Understanding ADC Manufacturing Complexity

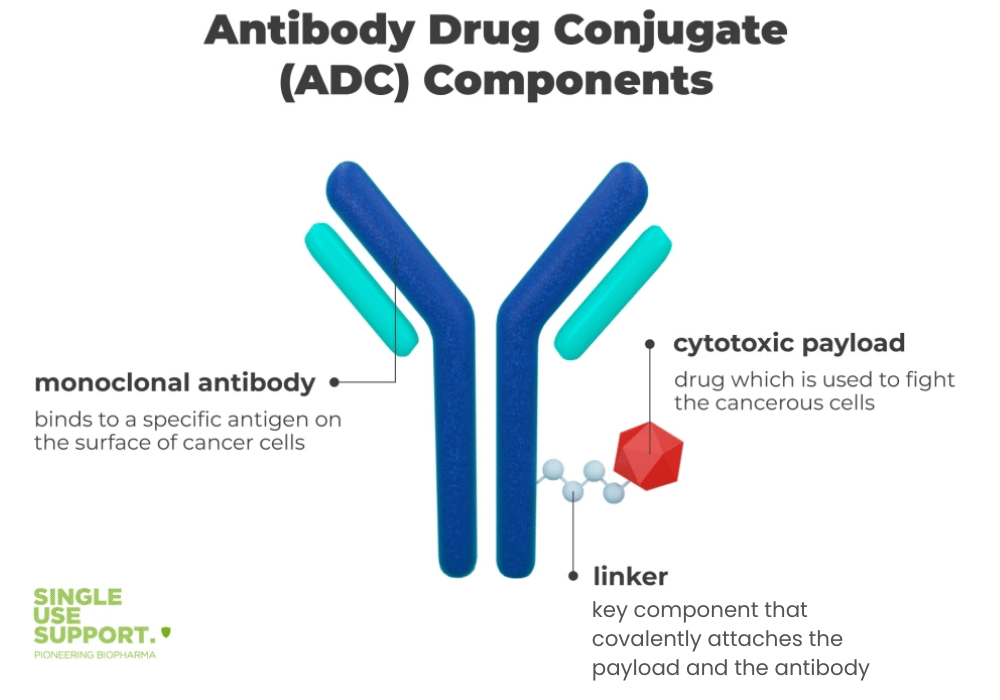

ADCs represent one of the most sophisticated manufacturing challenges in biotechnology. Unlike traditional biologics or small molecules, they require four distinct manufacturing activities: antibody production, linker-payload synthesis, conjugation, and fill finish.

“What ADCs help to do is allow targeting of a very potent chemotherapeutic agent against cancer cells more selectively,” Harch explains. “You’re trying to help patients by not exposing them to general toxicity with traditional chemotherapy.”

The manufacturing complexity stems from combining biological and chemical components whilst maintaining worker safety. Each step requires specialised expertise and equipment, particularly for handling compounds with occupational exposure levels between one and 100 nanograms per cubic metre.

Regional Expertise: Mapping the Global ADC Manufacturing Landscape

The global distribution of ADC manufacturing capabilities varies significantly by region. Harch’s experience across the US, Europe, China, and India reveals patterns in specialisation and development.

“Historically, a lot of the CDMOs that were embracing working in the ADC space were in Europe, and some in the US,” he notes. “But as interest in the field has grown, you’re seeing CDMOs come into play, especially in China, but also in India.”

This geographic evolution reflects the field’s maturation and growing commercial opportunity. European CDMOs established early leadership, whilst Asian markets are rapidly developing capabilities to meet increasing demand.

Strategic CDMO Selection: Five Critical Evaluation Criteria

Selecting appropriate CDMO partners requires a systematic approach focusing on safety, logistics, and technical capabilities. Harch emphasises that evaluation must be conducted on a case-by-case basis, considering each company’s internal expertise and outsourcing needs.

“I certainly recommend making sure that any CDMOs selected for linker-payload, conjugation, and fill finish have appropriate health and safety approaches in place,” he advises.

The most valuable partnerships involve CDMOs capable of multiple manufacturing steps without cross-border material movement. Shipping ADCs presents surprising challenges due to cold chain requirements and complex customs procedures that can introduce unexpected delays.

Safety First: Non-Negotiable Containment Standards

Worker safety represents the paramount consideration when evaluating potential partners. CDMOs must demonstrate robust capabilities for handling highly potent compounds through comprehensive testing and training programmes.

“Each company will set its own banding system, so it’s important to understand how the bands correlate to occupational exposure levels,” Harch explains. “What would be ideal is where they’ve trained their employees well and done surrogate testing with monitoring around the containment and testing attached to employees.”

Red flags include inadequate documentation of safety protocols, insufficient surrogate testing, and unclear employee training standards. Site visits should focus on infrastructure evaluation and understanding how safety metrics are established and maintained.

Technology Transfer Excellence: Avoiding Common Pitfalls

Successful technology transfers require careful attention to often-overlooked elements that can derail timelines. Contractual frameworks frequently present the first major hurdle, despite technical enthusiasm from both parties.

“One of the things often underestimated is actually putting the contract in place,” Harch notes. “Sometimes there are contractual terms that need to be squared away, and people underestimate how much time and energy that takes.”

Master services agreements can accelerate future transfers, whilst letters of agreement enable rapid project initiation during ongoing contract negotiations. However, analytical method establishment often becomes the rate-limiting factor, requiring specific methods for each manufacturing step to evaluate process performance and intermediate purity.

The surprising importance of logistics

One of the most surprising revelations from Harch’s experience is that transporting ADC components between sites often presents greater challenges than the sophisticated manufacturing processes themselves.

“Sometimes it seems that getting one component of the ADC from one manufacturing site to another can be more complicated than any of the individual manufacturing steps,” he explains. “Which seems counterintuitive given the complexity of the modalities we’re actually making.”

The challenges stem from cold chain requirements, customs procedures, and cross-border regulations that can introduce unexpected delays. This insight explains why Harch emphasizes considering CDMOs that can perform multiple manufacturing steps on the same site or within the same country.