Successful biotech-CDMO partnerships require distinct capabilities at different clinical stages—and recognizing when to evolve your outsourcing strategy can make or break a development program. The priorities that matter in Phase 1, including development expertise and hands-on collaboration, give way to tech transfer excellence in Phase 2, and ultimately speed, compliance, and manufacturing capacity in Phase 3.

These insights emerged from a Nordic Life Science Days workshop where Charlotte Friberg (Bonsai Therapeutics), Ola Sandborg (Lipum), and Arvid Söderhell (Empros Pharma) shared real-world experiences with the NorthX Biologics leadership team. The discussion, titled “Growing the CDMO Partnership Alongside Clinical Phase Development,” revealed that successful biotech-CDMO relationships require far more than transactional manufacturing arrangements—they demand strategic alignment, transparent communication, and phase-appropriate expertise.

The “D” in CDMO Matters More Than You Think

For early-stage biotechs, selecting a CDMO with robust development capabilities is critical. Charlotte emphasized that understanding how much “D” (development) versus “M” (manufacturing) a potential partner offers should guide selection decisions.

“If your project is still in the early stages and requires significant development, it’s crucial to partner with a CDMO that has a strong development capability — one that can truly guide you through that essential process,” Charlotte explained.

Key evaluation criteria for early-phase partnerships include:

- In-house expertise specific to your therapeutic modality

- Track record with similar molecules or platforms

- Infrastructure adaptability from lab to commercial scale

- Cost transparency around development-driven modifications

Charlotte also stressed the importance of geographic proximity in Phase 1, where face-to-face meetings are essential for addressing technical challenges and building mutual understanding.

When Distance Becomes a Dealbreaker

Ola built on Charlotte’s point about geographic proximity with a practical example from Lipum’s development journey.

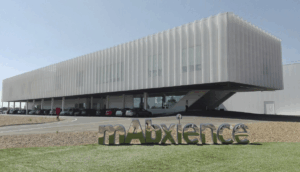

After completing Phase 1 with a California-based CDMO, Lipum decided to switch providers as they prepared for Phase 2. The nine-hour time difference had become one of the main drivers for change. “That company was located in California, so you have this time difference of nine hours. I would say that was one of the main drivers for this change,” Ola explained, though he noted it wasn’t the only factor.

The switch meant executing a tech transfer to their new European partner—a process that reinforced the importance of proximity and collaboration. “Performing a tech transfer is a challenge, especially with biologic systems. Not only just to follow the recipe, it’s essential to fully understand your responsibilities, foster collaboration, share information, and be willing to challenge one another,” Ola said.

He emphasized that successful tech transfer requires more than a buyer-seller transaction. “Creating a joint project team is where the real work takes shape — the relationship between project leaders is fundamental to success.”

Maintaining Optionality Matters

The panel unanimously agreed that maintaining relationships with multiple CDMOs offers strategic advantages. Arvid shared how Empros Pharma’s obesity drug program evolved from working with one European CDMO to adding a U.S. partner—then reconsidering their European option as geopolitical factors shifted.

“I don’t see that we have left the previous manufacturer but rather added another one to it,” Arvid explained. “Continue to build a good relationship with the CDMO that you have started to work with and don’t burn any bridges if you have to leave.”

Current tariff uncertainties and API sourcing challenges underscore why maintaining optionality matters. For Empros, importing API from China to manufacture in the U.S., then exporting elsewhere, suddenly became a geopolitical risk requiring contingency planning.

How CDMO Value Shifts From Phase 1 to Phase 3

The workshop included interactive polling that revealed how CDMO value propositions shift across development stages:

Phase 1 priorities:

- Development expertise and problem-solving capability

- Geographic proximity for collaboration

- Infrastructure flexibility

Phase 2 priorities:

- Tech transfer execution

- Communication and collaborative culture

- Project management excellence

Phase 3 priorities:

- Speed to clinic and market

- Quality and regulatory compliance

- Manufacturing capacity and reliability

Interestingly, while cost efficiency matters throughout, it consistently ranked below capabilities, communication, and timeline considerations—suggesting that biotechs prioritize execution quality over price optimization.

Critical Success Factors Across All Phases

Despite phase-specific needs, several themes emerged as universal:

Transparent communication topped the list when participants ranked relationship-building factors. All three CEOs emphasized that open dialogue about challenges, timelines, and expectations prevents costly misalignments.

Collaborative mindset separates transactional vendors from strategic partners. Ola noted that even in buyer-seller dynamics, “this way of working together is key from my perspective.”

Technical competence remains table stakes, but CDMOs that bring strategic guidance and co-innovation capabilities deliver disproportionate value.