“If you can’t demonstrate international quality standards, nobody is going to take a chance on a million-dollar batch to save a few dollars on their manufacturing. It just won’t happen.”

Eric Langer is President of BioPlan Associates, where he has systematically documented the evolution of the biomanufacturing industry since the early 2000s. In the latest PharmaSource podcast episode, Eric explains why biopharmaceutical outsourcing budgets are projected to surge 11% in 2025, the cost of talent constraints, and the rise of complex modalities like cell and gene therapies. He shares critical insights from BioPlan’s 22nd annual report on what manufacturers must prioritize to succeed in an increasingly competitive landscape.

Biologics Demand Drives Structural Growth

A key driver behind outsourcing expansion remains the relentless growth in biologics demand, according to Eric.

“The real excitement comes from the innovative therapies like cell and gene and ADCs. These are all advancing in the same way that monoclonals were advancing 20 or 30 years ago. A lot of these innovative technologies just don’t have the kinds of quality manufacturing or technical expertise necessary to produce them,” Eric notes.

Many emerging innovators originate from academic settings and lack core manufacturing competencies. For these organizations, CDMOs represent not merely a tactical resource but an essential infrastructure component. This structural dependency creates sustained demand growth independent of cyclical market fluctuations.

Strategic Versus Tactical Outsourcing Decisions

Eric distinguishes between two distinct approaches to outsourcing that reflect different organizational philosophies.

Strategic outsourcing stems from fundamental organizational philosophy regarding core competencies. Companies must determine early whether they position themselves primarily as biologics developers, manufacturers, or integrated entities combining both capabilities.

Eric emphasizes that this decision often reflects company culture and founder philosophy as well as financial calculations. Organizations focused on innovation typically concentrate resources on pipeline development, while manufacturing-oriented firms may prioritize in-house capabilities for flexibility and value capture.

Tactical outsourcing addresses immediate capacity constraints, regional manufacturing requirements, or specialized capability gaps. These needs drive significant CDMO engagement even among organizations with substantial internal manufacturing infrastructure.

Geographic Manufacturing: The Proximity Paradox

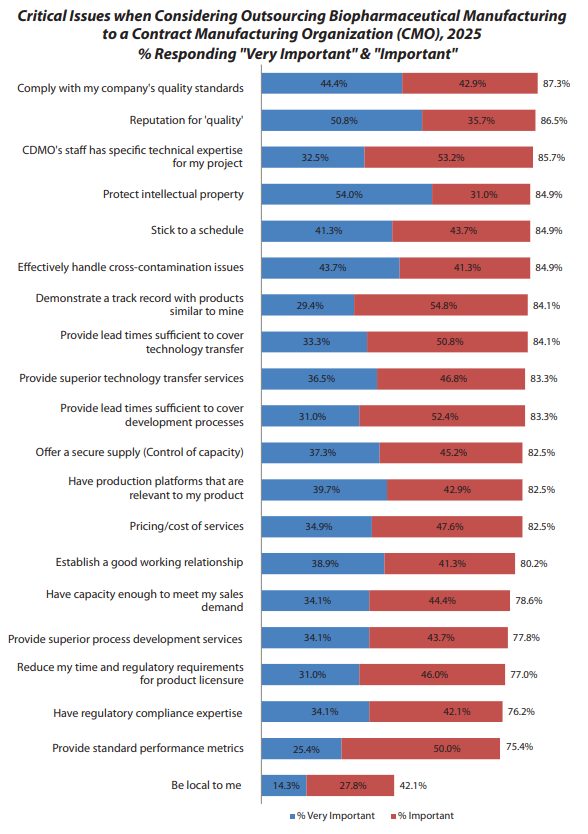

“Be local to me” has ranked last in CMO selection criteria for 19 consecutive years in BioPlan’s survey, despite extensive industry discussion about nearshoring post-COVID (fig. 1). This apparent contradiction reveals sophisticated decision-making dynamics.

The United States captured nearly 75% of outsourcing intentions in BioPlan’s most recent study. The highest level ever recorded. Eric explains, “there’s a difference between outsourcing and offshoring. That question centered on where the respondents, the VPs or directors of manufacturing, perceive a particular international country as a potential outsourcing destination. That would be offshoring.”

The 75% figure means US-based CDMOs are seen as relevant and viable outsourcing destinations by three-quarters of global manufacturers. “This is significantly higher than it was pre-COVID,” Eric notes. “I think part of the COVID factor played into some of this recognition and perception of where manufacturing could and should take place.”

However, Eric cautions that these preferences may shift. “There is, of course, a lot of uncertainty today around things like supply chains. There is a lot of uncertainty around tariffs and demand for international investment in local manufacturing.” He adds that some global investors have used phrases like “we will wait for more stability before making plans. That kind of wait and see may play into some of the decision making.”

Eric attributes the low priority of proximity to several factors: enhanced communication technology enabling effective remote collaboration, industry maturation reducing the need for on-site presence, and the internationalization of biopharmaceutical operations. Companies routinely conduct development in the EU, API production in Asia, and fill-finish operations in Turkey, demonstrating comfort with geographically distributed manufacturing networks.

While decision makers may prefer local partners for convenience, they prioritize expertise and capability over proximity. When critical competencies reside internationally, organizations accept the logistical complexities of time zone coordination and international travel.

Quality and Compliance: The Entry Requirement

Eric emphasizes that quality isn’t a competitive advantage in biopharmaceutical manufacturing. It’s the minimum requirement to participate.

BioPlan’s research shows 87.3% of respondents prioritize quality and compliance as the most critical factor in CMO selection, significantly outweighing cost considerations (fig. 1). Eric characterizes quality as “the ante to be in the game.” The remaining 13% likely consider quality a fundamental prerequisite rather than a selection criterion.

“If you can’t demonstrate international quality standards, nobody is going to take a chance on a million-dollar batch to save a few dollars on their manufacturing. It just won’t happen,” Eric explains. Organizations cannot afford quality compromises regardless of potential cost savings.

Talent Shortage: The Compounding Crisis

Eric identifies talent acquisition and retention as perhaps the most critical constraint facing the industry today.

BioPlan’s data reveals that 34% of the industry struggles with hiring in process development roles, representing a critical capacity constraint. Eric explains, “to keep up with the 12% annual growth in biologics demand, which equates to a doubling of the market for the biologics and therapeutics every five years, even with an industry that’s competent to train, that kind of growth requires more trained staff than the industry right now is effectively capable of training.”

Process engineers, process development specialists, and upstream and downstream processing experts have been particularly challenging positions to fill. Eric emphasizes that organizations face hiring difficulties for existing operations before considering expansion, creating a compounding staffing crisis.

“If you decide that you’re going to expand, you’d better have not just a hiring strategy in place, but also a retention strategy. Your neighbor is having the same challenge, and being able to retain those really good employees that you’ve meticulously trained for five or ten years—when somebody decides they can’t manufacture unless they have that expertise, price will be no object,” Eric warns.

This talent dynamic creates bidding wars for experienced personnel, particularly in emerging modalities like gene therapy where specialized expertise commands premium compensation. Organizations must develop comprehensive retention strategies extending beyond competitive salaries to career development, work environment, and professional fulfillment.

Technology Adoption

Eric addresses a persistent gap between interest in new technologies and actual implementation rates.

BioPlan’s research consistently reveals significant gaps between stated adoption intentions for technologies like continuous bioprocessing and automation versus actual implementation rates. Eric characterizes this phenomenon as reflecting genuine scientific curiosity rather than empty promises.

Biopharmaceutical scientists maintain authentic interest in potentially enabling technologies. However, the regulated manufacturing environment demands extensive evaluation preceding adoption. Testing can require literally hundreds of thousands of dollars in consumables and staff time, consuming weeks or months for continuous processes.

When researchers probe implementation timelines and resource requirements, enthusiasm tempers as stakeholders confront practical evaluation challenges. “If you don’t have an effective way to measure the parameters in a process, automation will continue to be aspirational and you will still be talking about this five years from now,” Eric emphasizes. To address this gap, BioPlan has developed methodologies for testing technology viability.

Eric identifies artificial intelligence as potentially the most overestimated trend in current industry discourse. BioPlan is launching comprehensive AI benchmarking research to measure actual implementation versus aspiration.

He stresses that AI-enabled automation requires robust measurement infrastructure, specifically multi-parameter and single-use sensors. Without effective parameter measurement capabilities, automation remains aspirational regardless of AI sophistication.